Market Condition Evaluation based on standard indicators in Metatrader 5 - page 162

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

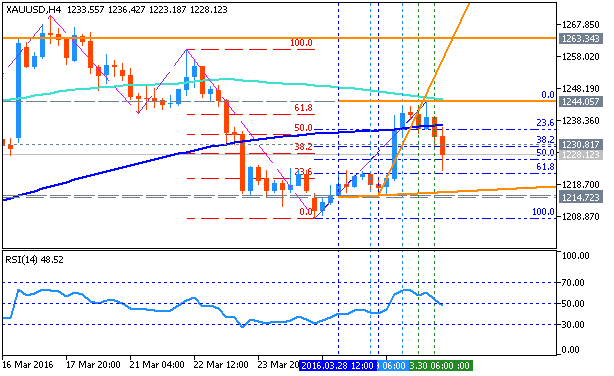

Forecast for Q1'16 - levels for GOLD (XAU/USD)

Sergey Golubev, 2016.03.29 16:52

GOLD (XAU/USD) Intra-Day Technical Analysis Ahead Of Yellen Speech

H4 price is on primary bearish market condition: the price is located below Ichimoku cloud and below Senkou Span line which is the virtual border between the primary bearish and the primary bullish trend on the chart.

If H4 price will break 1207.86 support level on close H4 bar so the primary bearish trend will be continuing.

If H4 price will break 1223.08 resistance level on close bar so the local uptrend as the secondary rally within the primary bearish trend will be started.

If H4 price will break 1260.21 resistance level on close bar so the intra-day price will be reversed to the bullish market condition.

If not so the price will be ranging within the levels.

SUMMARY : bearish

TREND : rallyForum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.03.29 21:17

"The FOMC left the target range for the federal funds rate unchanged in January and March, in large part reflecting the changes in baseline conditions that I noted earlier. In particular, developments abroad imply that meeting our objectives for employment and inflation will likely require a somewhat lower path for the federal funds rate than was anticipated in December.

Given the risks to the outlook, I consider it appropriate for the Committee to proceed cautiously in adjusting policy. This caution is especially warranted because, with the federal funds rate so low, the FOMC's ability to use conventional monetary policy to respond to economic disturbances is asymmetric. If economic conditions were to strengthen considerably more than currently expected, the FOMC could readily raise its target range for the federal funds rate to stabilize the economy. By contrast, if the expansion was to falter or if inflation was to remain stubbornly low, the FOMC would be able to provide only a modest degree of additional stimulus by cutting the federal funds rate back to near zero.9

One must be careful, however, not to overstate the asymmetries affecting monetary policy at the moment. Even if the federal funds rate were to return to near zero, the FOMC would still have considerable scope to provide additional accommodation. In particular, we could use the approaches that we and other central banks successfully employed in the wake of the financial crisis to put additional downward pressure on long-term interest rates and so support the economy--specifically, forward guidance about the future path of the federal funds rate and increases in the size or duration of our holdings of long-term securities. While these tools may entail some risks and costs that do not apply to the federal funds rate, we used them effectively to strengthen the recovery from the Great Recession, and we would do so again if needed."======

14 pips price movement for EURUSD was immediate effect after Fed Chair Yellen Speech. The medium term situation related to this Speech after publishing it on Federal Reserve website are the following:

1. EURUSD M5: 82 pips price movement by Fed Chair Yellen Speech news event :

2. GBPUSD M5: 106 pips price movement by Fed Chair Yellen Speech news event :

3. USDJPY M5: 55 pips price movement by Fed Chair Yellen Speech news event :

4. GOLD (XAU/USD) M5: 1,406 pips price movement by Fed Chair Yellen Speech news event :

Quick Technical Overview for EUR/USD: bullish breakout with 1.1342 as the target

EUR/USD: bullish breakout. Intra-day H4 price is on bullish breakout located to be above Ichimoku cloud: price is breaking 1.1302 resistance level to above for the breakout to be continuing with 1.1342 as the next bullish nearest target.

There are the following news events which will be affected on EUR/USD price movement for the week:

Quick Technical Overview for GBP/USD: breakout with 1.4514 bullish target tto re-enter

GBP/USD: bullish breakout. Intra-day H4 price is on breakout located above Ichimoku cloud and Senkou Span line which is the virtual border between the primary bearish and the primary bullish trend on the chart. The price is breaking 1.4403 resistance level to above for the breakout to be continuing with 1.4514 as a target to re-enter.

There are the following news events which will be affected on GBP/USD price movement for the week:

Forecast for Tomorrow - levels for EUR/USD and GOLD (XAU/USD)

EUR/USD: ranging below 50.0% Fibo support level. This pair on intra-day H4 price is located to be above 100/200 period SMA for the bullish market condition. The price was on bullish breakout, and it is started to be ranging within Fibo resistance level at 1.1364 and 50.0% Fibo support level at 1.1254.

GOLD (XAU/USD): ranging on reversal. Intra-day H4 price is located near and below 100/200 SMA ranging area waiting for direction: price is ranging within the following key reversal s/r levels:

RSI indicator is estinating the bearish trend to be started.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.03.31 08:45

Trading the News: Euro-Zone Consumer Price Index (CPI) (based on the article)What’s Expected:

Why Is This Event Important:

Signs of sticky price growth may encourage the ECB to endorse a wait-and-see approach at April 21 interest rate decision, and President Mario Draghi may adopt a less-dovish tone over the coming month as the series of non-standard measures work their way through the real economy.

However, waning confidence accompanied by subdued factor-gate prices may drag on the CPI, and a softer-than-expected reading may generate a near-term pullback in EUR/USD as it fuels bets for a more accommodative policy stance.

How To Trade This Event Risk

Bullish EUR Trade: Core Rate of Inflation Edges Higher

- Need to see green, five-minute candle following the release to consider a long trade on EURUSD.

- If market reaction favors a bearish Euro trade, buy EURUSD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bearish EUR Trade: Euro-Zone CPI Report Misses Market Expectations- Need red, five-minute candle to favor a short EURUSD trade.

- Implement same setup as the bullish Euro trade, just in the opposite direction.

Potential Price Targets For The ReleaseEURUSD Daily

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.03.31 14:41

USD/CAD Intra-Day Fundamentals: Canada's Gross Domestic Product and 51 pips price movement

2016-03-31 13:30 GMT | [CAD - GDP]

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

==========

USDCAD M5: 51 pips price movement by Canada's Gross Domestic Product news event :

Forum on trading, automated trading systems and testing trading strategies

Forecast for Q2'16 - levels for USD/CAD

Sergey Golubev, 2016.03.31 15:26

USD/CAD Intra-Day Technical Analysis - deep bearish

H4 price is located below SMA with period 100 (100 SMA) and SMA with the period 200 (200 SMA) for the primary bearish market condition: price broke key support levels to below to be stopped by 1.2875 and 1.2831 support levels. For now, the price is on bearish ranging within 1.2831 bearish continuation support level and 1.3010 resistance level. RSI indicator is estimating the bearish trend to be continuing with the secondary ranging.

SUMMARY : ranging

TREND : bearishForum on trading, automated trading systems and testing trading strategies

Press review

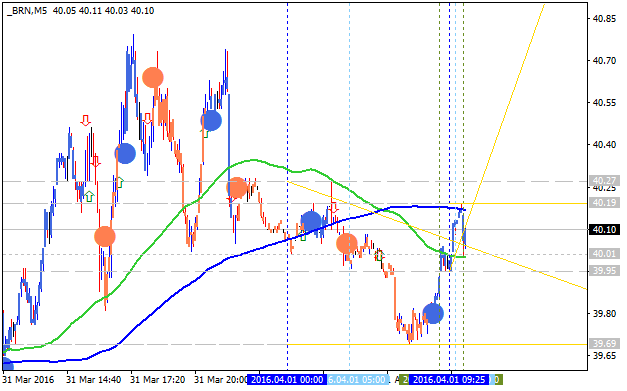

Sergey Golubev, 2016.04.01 09:07

Ahead of NFP: Fundamental Forecasts by Bank of America Merrill Lynch, Nordea Bank AB and Skandinaviska Enskilda Banken (adapted from the article)

2016-04-01 08:55 GMT | [USD - Non-Farm Employment Change]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

==========

EUR/USD M5: bullish reversal. Intra-day M5 price broke 100/200 period SMA for the bullish market condition: the price is breaking 1.1390 resistance level to above for the bullish trend to be contin uing with 1.1411 level as the nearest bullish target. On the other hand, if the price breaks 1.1376 support level so the bearish reversal will be started with 1.1366 level as the nearest bearish target in this case.

GBP/USD M5: ranging within 100/200 SMA area for direction. Intra-day M5 price is located to be within 100/200 period SMA for the secondary ranging market condition. If the price breaks 1.4366 resistance to above so the bullish reversal will be started with 1.4373 target to re-enter. Alternatively, if the price breaks 1.4337 suport so the primary intra-day bearish trend will be continuing with 1.4328 target.

GOLD (XAU/USD) M5: ranging bullish near reversal area. Intra-day price is located near and above 100/200 period SMA for the bullish market condition with the secondary ranging. if the price breaks 1235.24 resistance to above so the bullish trend will be continuing, otheerwise the price will be on secondary ranging with the possible bearish reversal by breaking 1231.65 support to below and 1229.24 target to re-enter.

Crude Oil M5: intra-day ranging within narrow s/r levels waiting for direction. Intra-day price is located to be within 100 period SMA and 200 period SMA for the total ranging market condition within narrow s/r levels waiting for direction. If the price breaks 40.19 resistance on close candle so the reversal of the intra-day price movement from the ranging bearish to the primary bullish trend will be started with 40.27 target to re-enter. And if the price breaks 39.95 support level to below so the primary intra-day bearish trend will be continuing with 39.69 as the nearest target.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.04.01 11:36

Trading News Events: U.S. Non-Farm Employment Change (based on the article)Another 205K expansion in Non-Farm Payrolls (NFP) may heighten the appeal of the greenback and spur a near-term pullback in EUR/USD as it puts increased pressure on the Federal Open Market Committee (FOMC) to further normalize monetary.

What’s Expected:

Why Is This Event Important:

Market participants may pay increased attention to Average Hourly Earnings as the U.S. economy approaches ‘full-employment,’ and the ongoing weakness in private-sector wages may push the committee to further delay the normalization cycle as central bank officials highlight the downward tilt in inflation expectations.

Nevertheless, waning business confidence paired with the rise in planned job-cuts may drag on labor market dynamics, and the dollar may face further losses over the near-term should the NFP report dampen the outlook for growth and inflation.

How To Trade This Event Risk

Bullish USD Trade: NFP Expands 205K+ Accompanied by Sticky Wage Growth

- Need red, five-minute candle following the NFP print to consider a short trade on EUR/USD.

- If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bearish USD Trade: U.S Labor Report Fails to Meet Market Expectations- Need green, five-minute candle to favor a long EUR/USD trade.

- Implement same setup as the bullish dollar trade, just in the opposite direction.

Potential Price Targets For The ReleaseEURUSD Daily