You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

EUR/USD Intra-Day Fundamentals: German Unemployment Change and 10 pips price movement

2016-03-31 08:55 GMT | [EUR - German Unemployment Change]

if actual > forecast (or previous one) = good for currency (for EUR in our case)

[EUR - German Unemployment Change] = Change in the number of unemployed people during the previous month.

==========

EURUSD M5: 10 pips price movement by German Unemployment Change news event :

GBP/USD Intra-Day Fundamentals: U.K. Current Account and 24 pips price movement

2016-03-31 09:30 GMT | [GBP - Current Account]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Current Account] > Difference in value between imported and exported goods, services, income flows, and unilateral transfers during the previous quarter.

==========

"The United Kingdom’s (UK) current account deficit was £32.7 billion in Quarter 4 (October to December) 2015, up from a revised deficit of £20.1 billion in Quarter 3 (July to September) 2015. The deficit in Quarter 4 (October to December) 2015 equated to 7.0% of gross domestic product (GDP) at current market prices, the largest proportion since quarterly records began in 1955, up from 4.3% in Quarter 3 (July to September) 2015."

==========

GBPUSD M5: 24 pips price movement by U.K. Current Account news event :

USD/CAD Intra-Day Fundamentals: Canada's Gross Domestic Product and 51 pips price movement

2016-03-31 13:30 GMT | [CAD - GDP]

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

==========

USDCAD M5: 51 pips price movement by Canada's Gross Domestic Product news event :

Ahead of NFP: Fundamental Forecasts by Bank of America Merrill Lynch, Nordea Bank AB and Skandinaviska Enskilda Banken (adapted from the article)

2016-04-01 08:55 GMT | [USD - Non-Farm Employment Change]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

==========

EUR/USD M5: bullish reversal. Intra-day M5 price broke 100/200 period SMA for the bullish market condition: the price is breaking 1.1390 resistance level to above for the bullish trend to be contin uing with 1.1411 level as the nearest bullish target. On the other hand, if the price breaks 1.1376 support level so the bearish reversal will be started with 1.1366 level as the nearest bearish target in this case.

GBP/USD M5: ranging within 100/200 SMA area for direction. Intra-day M5 price is located to be within 100/200 period SMA for the secondary ranging market condition. If the price breaks 1.4366 resistance to above so the bullish reversal will be started with 1.4373 target to re-enter. Alternatively, if the price breaks 1.4337 suport so the primary intra-day bearish trend will be continuing with 1.4328 target.

GOLD (XAU/USD) M5: ranging bullish near reversal area. Intra-day price is located near and above 100/200 period SMA for the bullish market condition with the secondary ranging. if the price breaks 1235.24 resistance to above so the bullish trend will be continuing, otheerwise the price will be on secondary ranging with the possible bearish reversal by breaking 1231.65 support to below and 1229.24 target to re-enter.

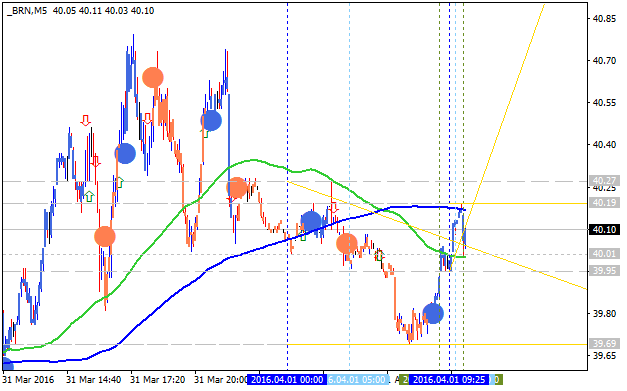

Crude Oil M5: intra-day ranging within narrow s/r levels waiting for direction. Intra-day price is located to be within 100 period SMA and 200 period SMA for the total ranging market condition within narrow s/r levels waiting for direction. If the price breaks 40.19 resistance on close candle so the reversal of the intra-day price movement from the ranging bearish to the primary bullish trend will be started with 40.27 target to re-enter. And if the price breaks 39.95 support level to below so the primary intra-day bearish trend will be continuing with 39.69 as the nearest target.

Another 205K expansion in Non-Farm Payrolls (NFP) may heighten the appeal of the greenback and spur a near-term pullback in EUR/USD as it puts increased pressure on the Federal Open Market Committee (FOMC) to further normalize monetary.

What’s Expected:

Why Is This Event Important:

Market participants may pay increased attention to Average Hourly Earnings as the U.S. economy approaches ‘full-employment,’ and the ongoing weakness in private-sector wages may push the committee to further delay the normalization cycle as central bank officials highlight the downward tilt in inflation expectations.

Nevertheless, waning business confidence paired with the rise in planned job-cuts may drag on labor market dynamics, and the dollar may face further losses over the near-term should the NFP report dampen the outlook for growth and inflation.

How To Trade This Event Risk

Bullish USD Trade: NFP Expands 205K+ Accompanied by Sticky Wage Growth

- Need red, five-minute candle following the NFP print to consider a short trade on EUR/USD.

- If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bearish USD Trade: U.S Labor Report Fails to Meet Market Expectations- Need green, five-minute candle to favor a long EUR/USD trade.

- Implement same setup as the bullish dollar trade, just in the opposite direction.

Potential Price Targets For The ReleaseEURUSD Daily

EUR/USD Intra-Day Fundamentals: Non-Farm Employment Change and 49 pips range price movement

2016-04-01 13:30 GMT | [USD - Non-Farm Employment Change]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

"Total nonfarm payroll employment rose by 215,000 in March, and the unemployment rate was little changed at 5.0 percent, the U.S. Bureau of Labor Statistics reported today. Employment increased in retail trade, construction, and health care. Job losses occurred in manufacturing and mining."

==========

EURUSD M5: 49 pips range price movement by Non-Farm Employment Change news event :

EUR/USD Intra-Day Fundamentals: U.S. ISM Manufacturing PMI and 49 pips range price movement

2016-04-01 15:00 GMT | [USD - ISM Manufacturing PMI]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - ISM Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry.

==========

"Manufacturing expanded in March as the PMI® registered 51.8 percent, an increase of 2.3 percentage points from the February reading of 49.5 percent, indicating growth in manufacturing for the first time since August 2015 when the PMI® registered 51.0 percent. A reading above 50 percent indicates that the manufacturing economy is generally expanding; below 50 percent indicates that it is generally contracting."

==========

EURUSD M5: 49 pips range price movement by U.S. ISM Manufacturing PMI news event :

Fundamental Weekly Forecasts for GBPUSD, USDJPY, AUDUSD, USDCAD and GOLD (based on the article)

GBP/USD - "GBP/USD may enjoy a relief rally during the first full-week of April as market participants continue to gauge the outlook for monetary policy, and a further commitment by Fed officials to ‘gradually’ remove the accommodative policy stance may produce near-term headwinds for the greenback as it dampens bets for a rate-hike in the first-half of 2016. In turn, GBP/USD may work its way back towards the top of its current range as the pair remains off of the March low (1.3903) and holds above the 1.4000 handle."

USD/JPY - "We may continue to see capital flow out of Japan which itself will keep pressure on the JPY exchange rate. The USD/JPY in particular seems likely to test near-term lows, but that is just as easily a function of US Dollar weakness instead of Yen strength. It would take a fairly significant shift in Bank of Japan policy to improve outlook for the domestic currency."

AUD/USD - "Monetary policy considerations are front and center for the Australian Dollar in the week ahead, with key event risk on tap on the domestic and the external fronts. First, the RBA will deliver its monthly policy announcement. Then, minutes from the March meeting of the Federal Reserve’s rate-setting FOMC committee will give insight on policymakers’ thinking about on-coming rate hike prospects."

USD/CAD - "Next week, Canada will announce employment data which has been volatile this year. In February, the rate was 7.3% with a drop in employment of 2.3 thousand jobs. Another critical component will be housing starts, which will help traders to see if the economy is weathering the year-over-year drop in oil price. Stability or improvement in these measures could further support the price of the Canadian Dollar, and the critical 1.2836 level could soon break."

GOLD (XAU/USD) - "Gold is trading at some tricky levels as the pair struggles to solidify a break above a parallel extending off the 2015 October high as momentum continues to hold below the 70-threshold. The risk remains for a pullback in price with interim support eyed at 1246/50 backed by soft support at 1225 & our bullish invalidation level at 1194. We’ll be looking for move lower towards these levels to offer favorable long-entries with a breach of the highs targeting the 2015 high-week close backed at 1294 closely by the 2015 high-day close at 1301. Subsequent topside targets are eyed at the 2014 high week reversal close at 1293."

Forex Weekly Outlook April 4-8 (based on the article)

The US dollar was hit hard by Yelle’s dovish tone and the recovery was limited. Yellen has another opportunity to move the greenback in the upcoming week. In addition, a rate decision in Australia, the US Non-Manufacturing PMI and the FOMC meeting minutes stand out. These are the highlights of this week.

AUD/USD Intra-Day Fundamentals: Australian Retail Sales and 34 pips price movement

2016-04-04 02:30 GMT | [AUD - Retail Sales]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Retail Sales] = Change in the total value of sales at the retail level.

==========

==========

AUD/USD M5: 34 pips price movement by Australian Retail Sales news event :