Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.06 14:33

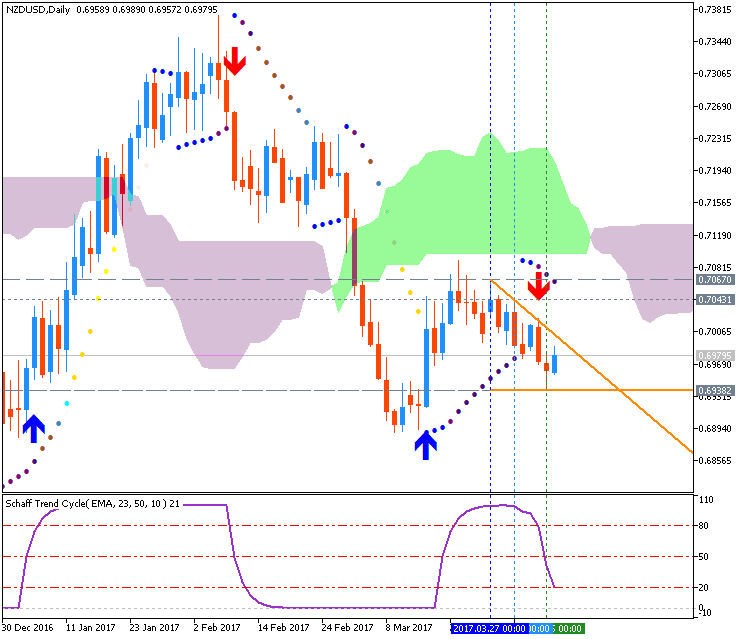

NZD/USD - bearish signal with descending triangle pattern; 0.6938 is the key (based on the article)

Daily price is located below Ichimoku cloud in the bearish area of the chart. The price is on testing 0.6938 support level together with descending triangle pattern to below for the bearish trend to be resumed.

- "The New Zealand Dollar may be preparing to re-accelerate downward for a challenge of lows established in early March against its US counterpart. Prices appear to have cleared the bottom of their near-term digestion range, paving the way for resumption of the downtrend begun in early February."

- "Partial profit was taken on a NZDUSD position activated at 0.7205. The next leg lower may now be getting underway and the trade has been scaled back up to full size at 0.6974, bringing the cumulative cost basis to 0.7090. Exposure will be cut in half again upon hitting the next downside target at 0.6905. A stop-loss on the full trade will be activated on a daily close above 0.7005."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.11 07:22

Intra-Day Fundamentals - EUR/USD, NZD/USD and Hang Seng Index (HSI): Fed Chair Yellen Speaks

2017-04-10 21:10 GMT | [USD - Fed Chair Yellen Speaks]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[USD - Fed Chair Yellen Speaks] = The speech at the University of Michigan.

==========

From wsj article - "Federal Reserve Chairwoman Janet Yellen Sees Monetary Policy Shifting":

- "Federal Reserve Chairwoman Janet Yellen indicated Monday that the era of extremely stimulative monetary policy was coming to an end."

==========

EUR/USD M5: range price movement by Fed Chair Yellen Speaks news events

==========

NZD/USD M5: range price movement by Fed Chair Yellen Speaks news events

==========

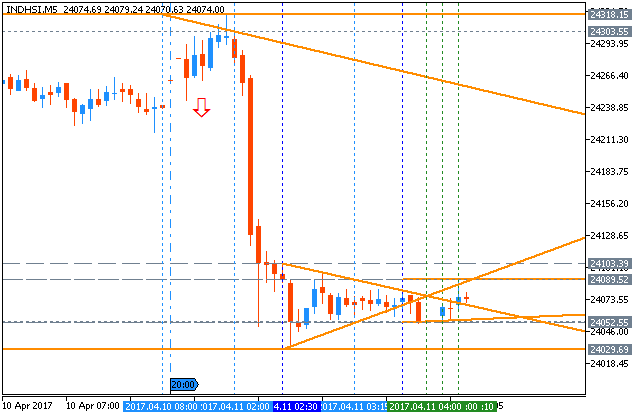

Hang Seng Index M5: range price movement by Fed Chair Yellen Speaks news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.15 09:34

Weekly Outlook: 2017, April 16 - April 23 (based on the article)

The dollar lost ground in the lead up to the long Easter weekend. Will it continue? A mix of figures from all over the world awaits us now.

- Haruhiko Kuroda speaks: Monday, 7:15. BOE Governor Haruhiko Kuroda will speak in Tokyo.

- US Building Permits: Tuesday, 13:30. The number of permits is expected to rise to 1.25 million this time.

- US Crude Oil Inventories: Wednesday, 15:30.

- New Zealand inflation data: Wednesday, 23:45. CPI is expected to rise 0.8% in the first quarter of 2017.

- US Philly Fed Manufacturing Index: Thursday, 13:30. The manufacturing index is expected to decline to 25.6 in April.

- US Unemployment Claims: Thursday, 13:30. The number of new claims is expected to reach 241,000 this week.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.20 07:16

NZD/USD Intra-Day Fundamentals: NZ Consumer Price Index and 41 pips range price movement

2017-04-19 23:45 GMT | [NZD - CPI]

- past data is 0.4%

- forecast data is 0.8%

- actual data is 1.0% according to the latest press release

if actual > forecast (or previous one) = good for currency (for NZD in our case)

[NZD - CPI] = Change in the price of goods and services purchased by consumers.

==========

From official report:

- "The consumers price index (CPI) rose 1.0 percent (up 1.0 percent with seasonal adjustment)."

- "From the March 2016 quarter to the March 2017 quarter: The CPI inflation rate increased 2.2 percent."

==========

NZD/USD M5: 41 pips range price movement by NZ Consumer Price Index news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.21 19:15

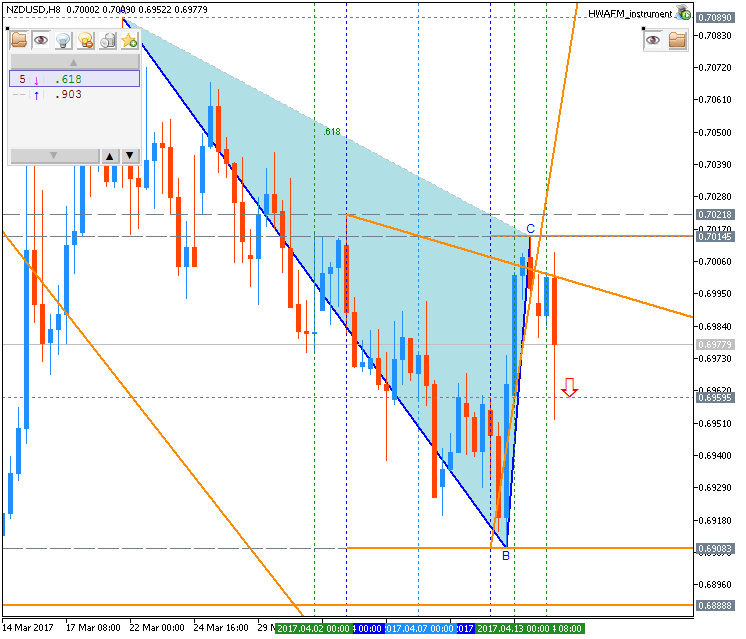

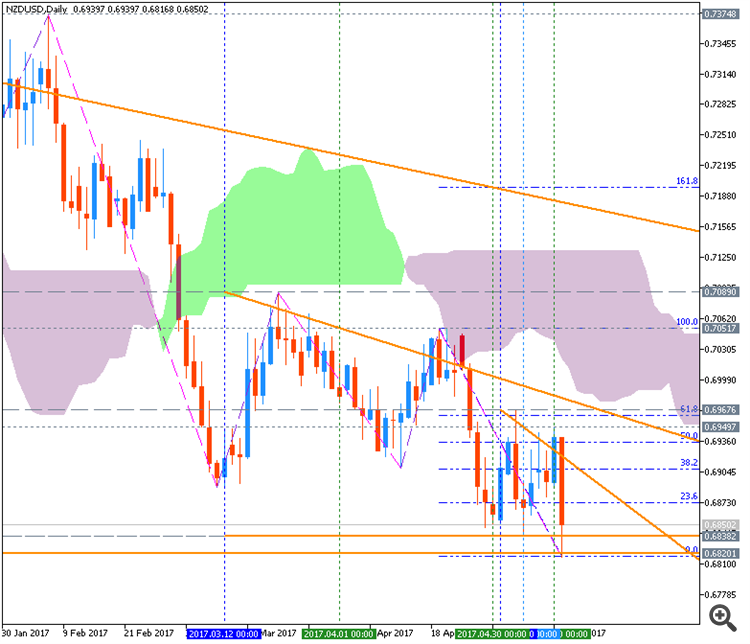

NZD/USD - ranging bearish near 200-day SMA reversal level (based on the article)

Daily price is below 200 SMA for the ranging within the following support/resistance levels:

- 0.6888 support level located on the beginning of the bearish trend to be resumed, and

- 0.7145 resistance level located in the beginning of the bullish reversal to be started.

By the way, if the price breaks 0.7051 resistance to above so the bullish reversal with 0.7145 resistance may be the next step with this situation for example.

- "The New Zealand Dollar is mired in a choppy congestion range below the 0.71 figure against its US cousin as prices struggle to find lasting directional momentum. Still, the broader longer-term trend bias appears to favor the downside."

- "Interim support is at 0.6975, the 23.6% Fibonacci expansion, with a daily close below that opening the door for a test of the 38.2% level at 0.6905. Alternatively, a push above the 38.2% Fib retracement at 0.7076 paves the way for a challenge of the 50% threshold at 0.7133."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.05.03 06:56

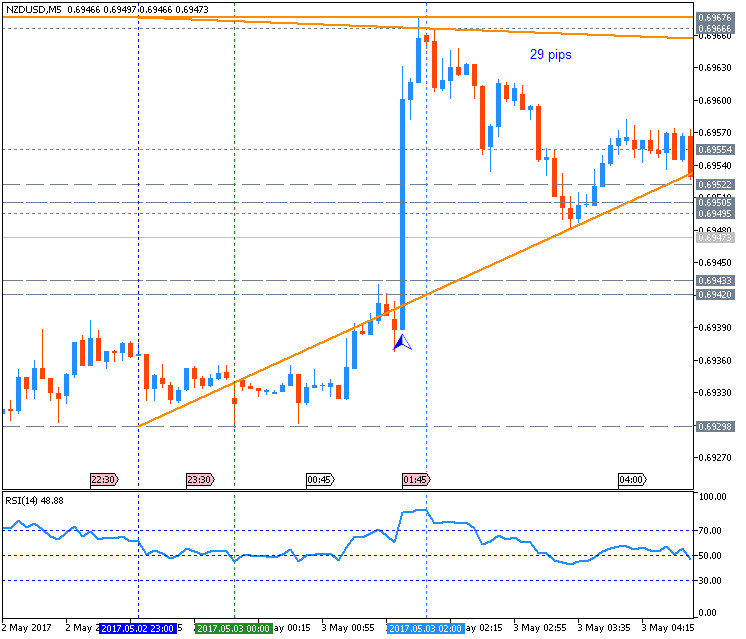

NZD/USD Intra-Day Fundamentals: NZ Employment Change and 29 pips range price movement

2017-05-02 23:45 GMT | [NZD - Employment Change]

- past data is 0.7%

- forecast data is 0.8%

- actual data is 1.2% according to the latest press release

if actual > forecast (or previous one) = good for currency (for NZD in our case)

[NZD - Employment Change] = Change in the number of employed people.

==========

From official report:

- "In the March 2017 quarter, the seasonally adjusted unemployment rate fell 0.3 percentage points to 4.9 percent. The fall reflected 6,000 fewer people being unemployed over the quarter."

- "In the March 2017 quarter, seasonally adjusted employment rose 1.2 percent, with 29,000 more people employed than in the December 2016 quarter. In that quarter, there was a 0.7 percent increase from the September 2016 quarter."

==========

NZD/USD M5: 29 pips range price movement by NZ Employment Change news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.05.05 08:12

NZD/USD Intra-Day Fundamentals: New Zealand Inflation Expectations and 20 pips range price movement

2017-05-05 04:00 GMT | [NZD - Inflation Expectations]

- past data is 1.9%

- forecast data is n/a

- actual data is 2.2% according to the latest press release

if actual > forecast (or previous one) = good for currency (for NZD in our case)

[NZD - Inflation Expectations] = Percentage that business managers expect the price of goods and services to change annually during the next 2 years.

==========

From official report:

- "One-year-ahead inflation expectations have increased to 1.92% from 1.56%. The median also increased to 2.00% from 1.50%. The two-year-ahead expectations had a 0.25 percentage point increase to 2.17% while the median increased to 2.20% from 2.00%."

==========

NZD/USD M5: 20 pips range price movement by New Zealand Inflation Expectations news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.05.06 13:28

Weekly Fundamental Forecast for NZD/USD (based on the article)

NZD/USD - "The central bank will almost certainly keep the official cash rate on hold at 1.75% at its policy meeting on Thursday May 11, though thanks to the stronger-than-anticipated first-quarter inflation figures, it may adjust its OCR forecasts in the accompanying Monetary Policy Statement."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.05.11 18:36

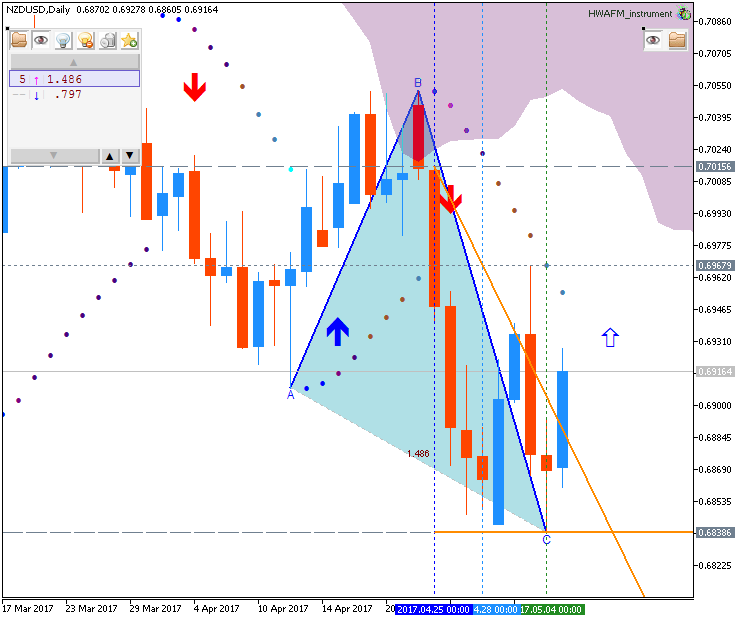

NZD/USD - bearish ranging; 0.6820 level is the key (based on the article)

Daily price is on ranging below Ichimoku cloud in the ebarish area of the chart: the price is testing 0.6820 support level to below for the bearish trend to be resumed.

- "The NZD/USD is trading off of new lows this morning, as the RBNZ (Reserve Bank of New Zealand) elected to keep key interest rates at 1.75%. While the decision to keep rates flat was not surprising, statements made by RBNZ’s Wheeler later in the session took a dovish stance. This news directly sent the NZD/USD to levels not seen since June of 2016."

- "Traders should note that the NZD/USD is now trading in a downtrend, with prices below both its 10 day EMA (exponential moving average) and 200 day MVA (simple moving average). Also the pair is set to close below .6862, which is the December 2016 swing low. A move to this point places the NZD/USD at new yearly lows, and suggests that the pair may fall further. In the event of a bullish reversal, traders should first look for prices to trade back above .6862, and then challenge the 10 day EMA found at .6888."

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

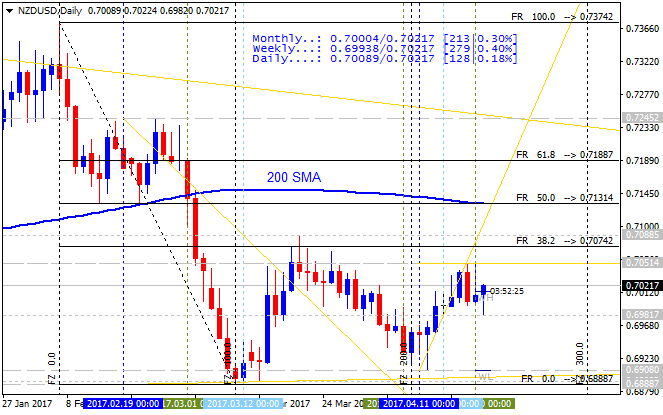

NZD/USD April-June 2017 Forecast: ranging within Ichimoku cloud for direction

W1 price is located inside Ichimoku cloud for the ranging market condition within the following support/resistance levels:

- 38.2% Fibo level at 0.7163 located in the beginning of the bullish trend to be resumed, and

- 0.6888 support level located in the beginning of the bearish trend to be started.

Chinkou Span line is below the price indicating the bearish ranging condition in the future, Trend Strength indicator is estimating the trend as a bearish reversal, and Absolute Strength indicator is evaluating the trend as a ranging. Non-lagging Tenkan-sen/Kijun-sen signal is for secondary ranging market condition for now and for very near future for example.Trend:

W1 - ranging