Join our fan page

- Views:

- 28422

- Rating:

- Published:

- Updated:

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

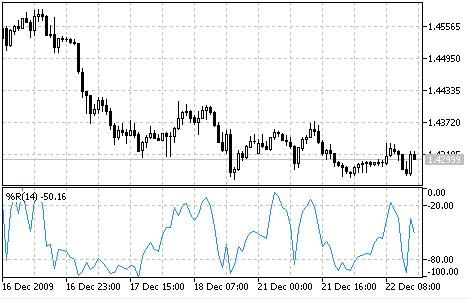

Williams’ Percent Range technical indicator (%R) is a dynamic technical indicator, which determines whether the market is overbought/oversold. Williams’ %R is very similar to Stochastic Oscillator. The only difference is that %R has an upside down scale and the Stochastic Oscillator has internal smoothing.

To show the indicator in this upside down fashion, one places a minus symbol before the Williams Percent Range values (for example -30%). One should ignore the minus symbol when conducting the analysis.

Indicator values ranging between 80 and 100% indicate that the market is oversold. Indicator values ranging between 0 and 20% indicate that the market is overbought.

As with all overbought/oversold indicators, it is best to wait for the security’s price to change direction before placing your trades. For example, if an overbought/oversold indicator is showing an overbought condition, it is wise to wait for the security’s price to turn down before selling the security.

An interesting phenomenon of the Williams Percent Range indicator is its uncanny ability to anticipate a reversal in the underlying security’s price. The indicator almost always forms a peak and turns down a few days before the security’s price peaks and turns down. Likewise, Williams Percent Range usually creates a trough and turns up a few days before the security’s price turns up.

Williams’ Percent Range indicator

Calculation:

Below is the formula of the %R indicator calculation, which is very similar to the Stochastic Oscillator formula:

%R = (HIGH(i-n)-CLOSE)/(HIGH(i-n)-LOW(i-n))*100

where:

- CLOSE - today’s closing price;

- HIGH(i-n) - the highest high over a number (n) of previous periods;

- LOW(i-n) - the lowest low over a number (n) of previous periods.

Translated from Russian by MetaQuotes Ltd.

Original code: https://www.mql5.com/ru/code/55

Williams'Accumulation/Distribution (W_A/D)

Williams'Accumulation/Distribution (W_A/D)

The Williams' A/D indicator is the accumulated sum of positive "accumulational" and negative "distributional" price movements. Divergences between the indicator and the price are a signals.

Volume Rate of Change (VROC)

Volume Rate of Change (VROC)

The Volume Rate of Change (VROC) is an indicator of the direction where the volume trend moves.

ZigZag

ZigZag

The Zigzag indicator is a series of sections connecting significant tops and bottoms at the price plot.

ZigZagColor

ZigZagColor

This is a modified version of ZigZag indicator that draws lines with different colors depending on the price movement direction.