Join our fan page

- Views:

- 6582

- Rating:

- Published:

- Updated:

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

Original author:

Eva Ruft

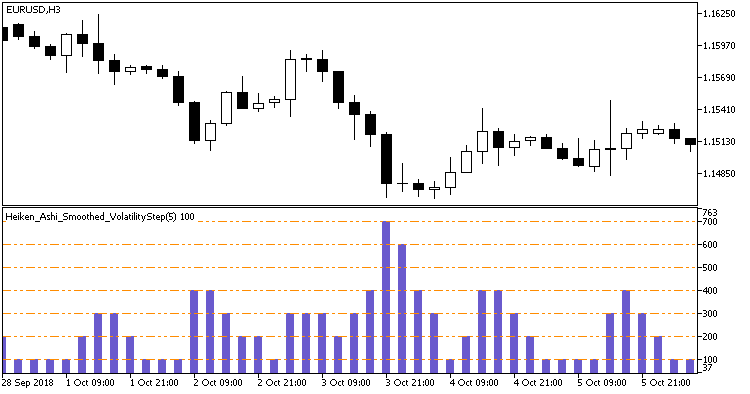

A simple indicator that calculates rounded volatility of a financial asset. Volatility is calculated in points based on the maximum and minimum prices of smoothed Heiken_Ashi candlesticks.

Volatility is calculated as High minus Low of Heiken_Ashi_Smoothed candlesticks. The resulting value is converted into points and rounded according to the coordinate grid step defined by the StartLevel and LevelsStep input values.

//+----------------------------------------------+ //| INDICATOR INPUT PARAMETERS | //+----------------------------------------------+ input Smooth_Method HMA_Method=MODE_JJMA; // Smoothing method input uint HLength=5; // Smoothing depth input int HPhase=100; // Smoothing parameter, 3//---- for JJMA within the range of -100 ... +100, it influences the quality of the transition process; //---- for VIDIA it is a CMO period, for AMA it is a slow average period input int Shift=0; // horizontal indicator shift in bars input uint LevelsTotal=20; // number of levels input uint StartLevel=100; // initial level input uint LevelsStep=100; // distance between levels input color LevelsColor=clrDarkOrange; // color of levels

The indicator uses SmoothAlgorithms.mqh library classes (copy it to terminal_data_folder\MQL5\Include). The use of the classes was thoroughly described in the article "Averaging Price Series for Intermediate Calculations Without Using Additional Buffers".

Fig.1. Volatility2Step indicator

Translated from Russian by MetaQuotes Ltd.

Original code: https://www.mql5.com/ru/code/23205

Exp_ColorMETRO_MMRec_Duplex

Exp_ColorMETRO_MMRec_Duplex

Two identical trading systems (for long and short deals) based on the ColorMETRO indicator signals that can be configured in different ways within a single EA with an ability to change the volume of a forthcoming trade depending on the results of the previous trades for this trading system.

Day Trading PAMXA

Day Trading PAMXA

The strategy is based on two indicators calculated on two timeframes: iAO (Awesome Oscillator, AO) on the D1 TF and iStochastic (Stochastic Oscillator, Stoh) on H1.

MACD No Sample

MACD No Sample

An Expert Advisor based on the iMA (Moving Average, MA) and iMACD (Moving Average Convergence/Divergence, MACD) indicators

Heiken_Ashi_Smoothed_VolatilityStep_Alerts

Heiken_Ashi_Smoothed_VolatilityStep_Alerts

The Heiken_Ashi_Smoothed_VolatilityStep indicator with the ability to send alerts, emails and push notifications when the indicator breaks through the trigger level specified in the inputs.