Silver Just Broke $100. Here’s Why You Should Be Terrified (And Excited).

If you’ve been watching the charts this week, you saw history happen.

As of today, January 23, 2026, Silver (XAGUSD) has officially shattered the $100 per ounce psychological barrier. To put that in perspective: Silver is up over 40% just since New Year’s Day, following a massive 150% run in 2025.

For the "Gold Bugs" and "Silver Stackers," this is the moment they’ve been waiting for since the 1980s. But for us—retail traders trying to extract profit from the daily noise—this kind of parabolic move is a double-edged sword.

Here is what is driving this historic rally, what it means for the rest of 2026, and how you should respond if you want to make money rather than become "exit liquidity."

🚀 What on Earth is Driving This?

This isn't just a meme-stock squeeze. This is a perfect storm of fundamental shortages and monetary fear.

-

The Industrial Vacuum: The world is transitioning to green energy and AI at breakneck speed. Solar panels, EV batteries, and advanced semiconductors all require massive amounts of Silver. We are currently in our 5th consecutive year of supply deficits. The mines simply can't dig it up fast enough.

-

The "Fear" Trade: With geopolitical tensions rising and inflation numbers looking sticky again, big money is fleeing fiat currency. They are parking capital in hard assets. Gold broke $4,900, and Silver is drafting right behind it.

-

Retail FOMO: When an asset doubles in price, everyone wants in. Retail traders are flooding into ETFs and physical bullion, creating a feedback loop that pushes prices higher.

⚠️ The Trap for Retail Traders

This is the part no one likes to talk about.

Volatility kills unmanaged accounts.

When an asset goes parabolic, it doesn't just go up in a straight line. It thrashes. We are seeing daily swings of 5% to 10% in the price of Silver right now.

-

If you leverage up and buy the top, a standard 4% intraday pullback can wipe out your account equity before the price shoots back up.

-

If you try to "short the top," you risk getting run over by a freight train of momentum.

Manual traders are getting slaughtered right now because they are trading with emotion (Fear of Missing Out) rather than logic. They buy when it feels good (at the top) and sell when it hurts (at the bottom).

🛡️ How to "Make Something of Yourself" in This Market

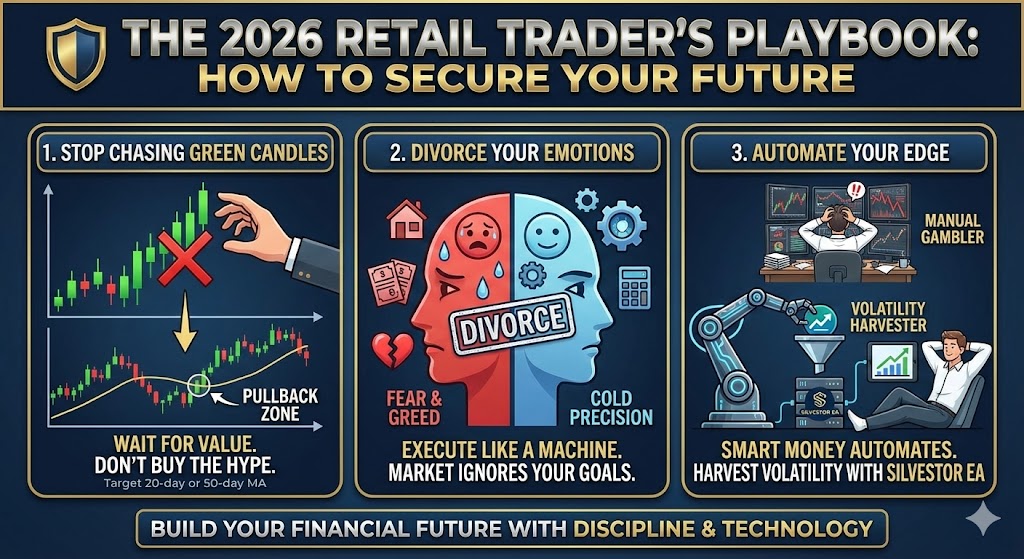

You asked how we, as retail traders, should respond to secure our financial future. Here is the playbook for 2026:

1. Stop Chasing Green Candles Never buy simply because the price is going up. Wait for the pullback. In a trend this strong, price will often return to the 20-day or 50-day moving average. That is your value zone.

2. Divorce Your Emotions The market does not care about your rent payment or your retirement goals. It only cares about liquidity. To win in 2026, you need to execute with the cold precision of a machine.

3. Automate Your Edge This is where the smart money separates from the gamblers. While the masses are glued to their screens, stressing over every tick, algorithmic traders are letting their systems harvest the volatility.

Tools like our Silvestor EA were built exactly for this environment. It doesn't get FOMO. It doesn't panic-sell. It uses the massive volatility of Silver to find high-probability entries, protecting your downside while capturing the upside.

The Outlook

Analysts are already calling for $120 and even $200+ silver by year-end. The trend is undeniable, but the ride will be violent.

You have a choice: You can try to tame this beast manually and risk your sanity, or you can equip yourself with the right tools to profit from the chaos.

Don't let the opportunity of a lifetime become a blown account.