Reason Over Hype: How Avalut X1 Balances AI Research with Rule-Based Trading

Avalut X1 — From thesis to a robust, institutionally tested Gold EA

In late 2022 we formed a simple thesis: the coming years would grant Gold (XAUUSD) unusually rich, tactical opportunities. The right response would not be a single “magic rule”, but a disciplined, multi-phase system that survives regime shifts.

How it started (2022): the thesis behind Avalut

Inflation waves, shifting rate cycles, and episodic risk-off behavior made volatility a structural feature rather than a bug. A one-pattern approach would either overfit the past or underperform in live trading. We therefore set a different goal: build a framework that can deliberately address trend, range, and volatility phases — with tight execution discipline and without dependence on any single signal.

From idea to design: robustness over “pretty curves”

Avalut X1 is a multi-strategy EA: four complementary logics share one framework so strengths in one regime can offset weaknesses in another. The execution layer is explicit and conservative: hard SL/TP on every trade, optional trailing, spread/slippage caps, and broker-time session handling. We developed on GMT+3 and added automatic broker-offset detection so the system aligns to server time reliably.

AI-assisted signal research — tool, not crutch

We use AI to accelerate research and improve diagnostics — not to replace rules with a black box:

- Feature discovery: systematic exploration of volatility states, session effects, and micro-regimes to generate testable hypotheses.

- Clustering & regime indication: recognizing when a given logic has a relative edge, helping the ensemble stay diversified across conditions.

- Bayesian / evolutionary hyperparameter search: guided exploration that favors stable regions over narrow peaks.

- Monitoring & drift checks: live telemetry flags distribution shifts; adjustments are considered only when diagnostics justify them.

Decision-making remains rule-based and auditable. AI speeds up research; it does not market “secret sauce.”

Test methodology (institutional style, bias-aware)

Rather than a single glossy backtest, we layer adversarial checks:

- Walk-Forward with out-of-sample confirmation: optimize → freeze → confirm on unseen data to reduce look-ahead bias.

- Monte Carlo resampling: permute return/trade paths to expose path risk, drawdown clustering, and recovery times.

- Stability & sensitivity maps: prefer parameter regions with broad resilience; avoid knife-edge peaks.

- Execution stress: spread/slippage stress, latency tolerance, and varied fill policies (FOK/IOC/RETURN).

- Data hygiene: sufficient warm-up, day rolls and holidays handled, clean session cut-offs, and timezone sanity checks.

Four strategies, one framework

The ensemble combines trend-following elements, mean-reversion components, breakout logic, and volatility conditioning. Each strategy follows the same risk and execution standards, and the interaction is tuned so they complement — not crowd out — one another.

Live operation (since 2023) and an illustration

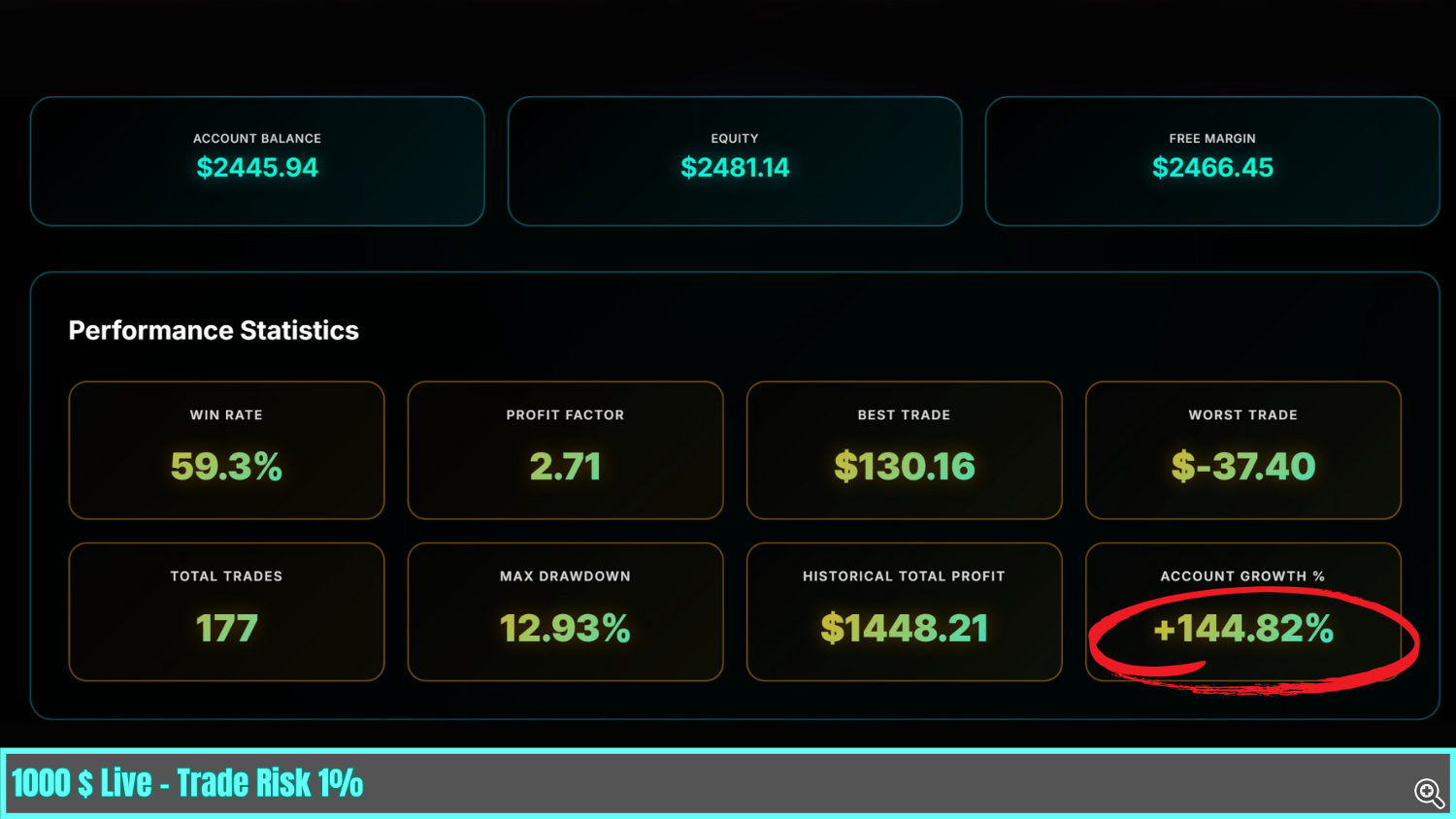

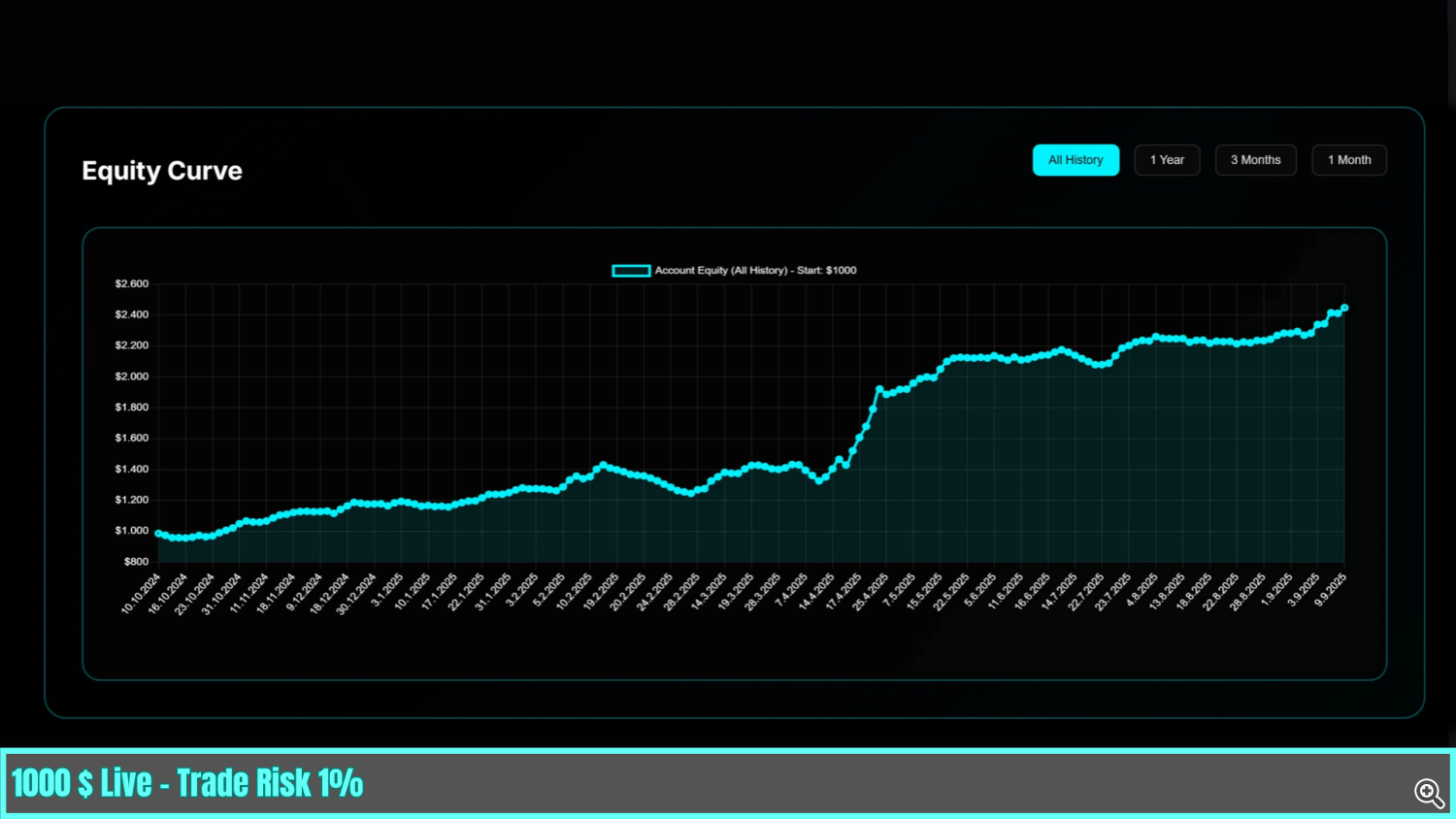

We have operated Avalut X1 on multiple live accounts (internal and client) since September 2023. Our philosophy is minimal change: in this period, one optimization was required. The following images illustrate one example track: starting balance EUR 1,000 (October 2024), currently about +144% with roughly 13% maximum drawdown. These figures are illustrative, not promises; results vary.

A sober contrast: how to spot over-engineered traps

There is a class of systems optimized to look perfect on paper: narrow parameter peaks, hindsight filters, “AI-washed” marketing, high-risk money management to smooth backtest curves, and review manipulation. Logic gaps are hidden by leverage until live friction arrives. Typical outcomes are delayed stops, equity cliffs, or slow bleed with occasional blow-ups.

- Tell-tales: curve “magic” that disappears out of sample, unstable parameters, reliance on extreme compounding, and explanations that change post-hoc.

- Our stance: transparent rules, adversarial validation, conservative sizing, and changes only when diagnostics justify them — not when marketing cadence demands them.

Independent references

For readers who prefer third-party reference points, we maintain a track record on an independently hosted live brokerage account. Additional context, background, and documentation are available on our website (link below). External resources are optional; everything essential is contained here.

Conclusion: sense over spectacle

Markets are competitive and, after costs and slippage, behave close to a zero-sum game. Durable results come from method, discipline, and clarity — not from louder narratives or AI buzz. Avalut X1 reflects that view: multiple complementary strategies, traceable tests, and restrained adjustments. If you value systems built with reason, not spectacle, this is the kind of engineering we practice.

Risk notice: Trading involves risk. Do not invest capital you cannot afford to lose. Past performance does not guarantee future results. Always test in a demo environment before live trading.

More information: https://www.edgezone.consulting/

Buy Avalut X1 on MQL5 Market: https://www.mql5.com/de/market/product/105080