What is ICT Series about?

Well ICT series is focused on using all the different tools that ICT have taught, simplified for the use of everyone. This way we can see the market from a different view and ease our decision-making process. Of course, there is too many concepts to use, so in this specific article we will focus on the ones I believe are most important:

- Trading Sessions

- Power of 3

- Liquidity

Let’s go to the charts.

Let’s start by the trading sessions, why is it so important? Well as we all know the markets are composed by buyers and sellers which exchange an asset between them. As logic it is this transaction occurs in a specific time. Now, why are the session timing the important ones. Well, the banks, funds, governments, and companies that exchange certain assets will most likely do it in their working times, since they must be present during the transaction. For this reason, it makes sense that all the action and moves happen during the bank times of the countries where the currency is from.

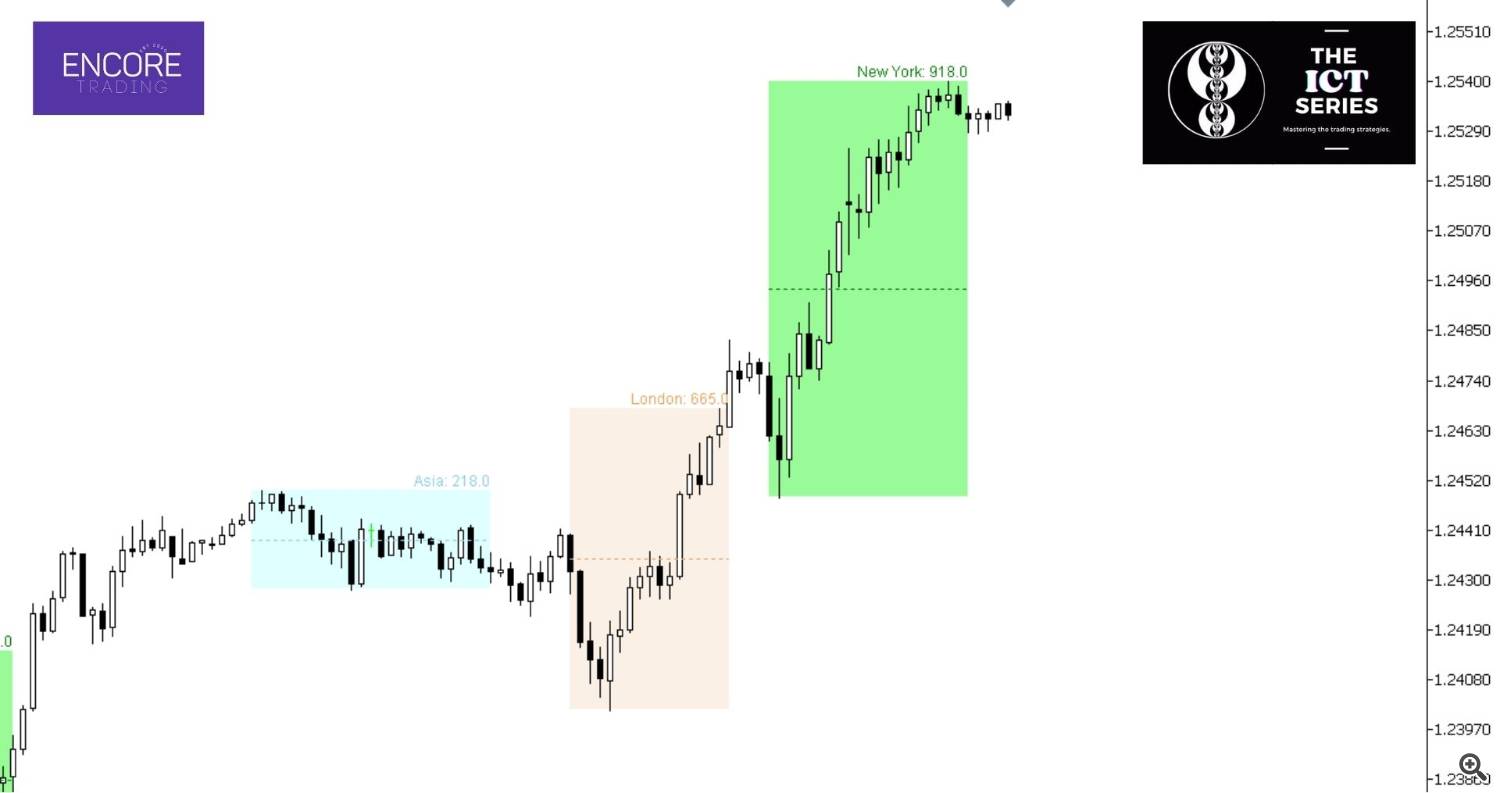

As we can see in the picture, during London and New York we see the biggest displacements of EURUSD, and during Asia is rather slow.

We possibly all knew that, if not, I am happy you learned it here, this is the simplest explanation you will ever get. The session indicator tells us at what time to trade, as well it tells us how much the market moved in previous days, that way we have an expectation of what could be the move of today, and it show us the middle point to know where out cheap and expensive levels during that session are. Additionally, it has alarms, so we don’t have to sit on the computer to wait for the session to start or set the alarms ourselves. The indicator does it for you.

But now… What are good entry areas for us? Well, here is where your technical analysis and the power of 3 come in handy.

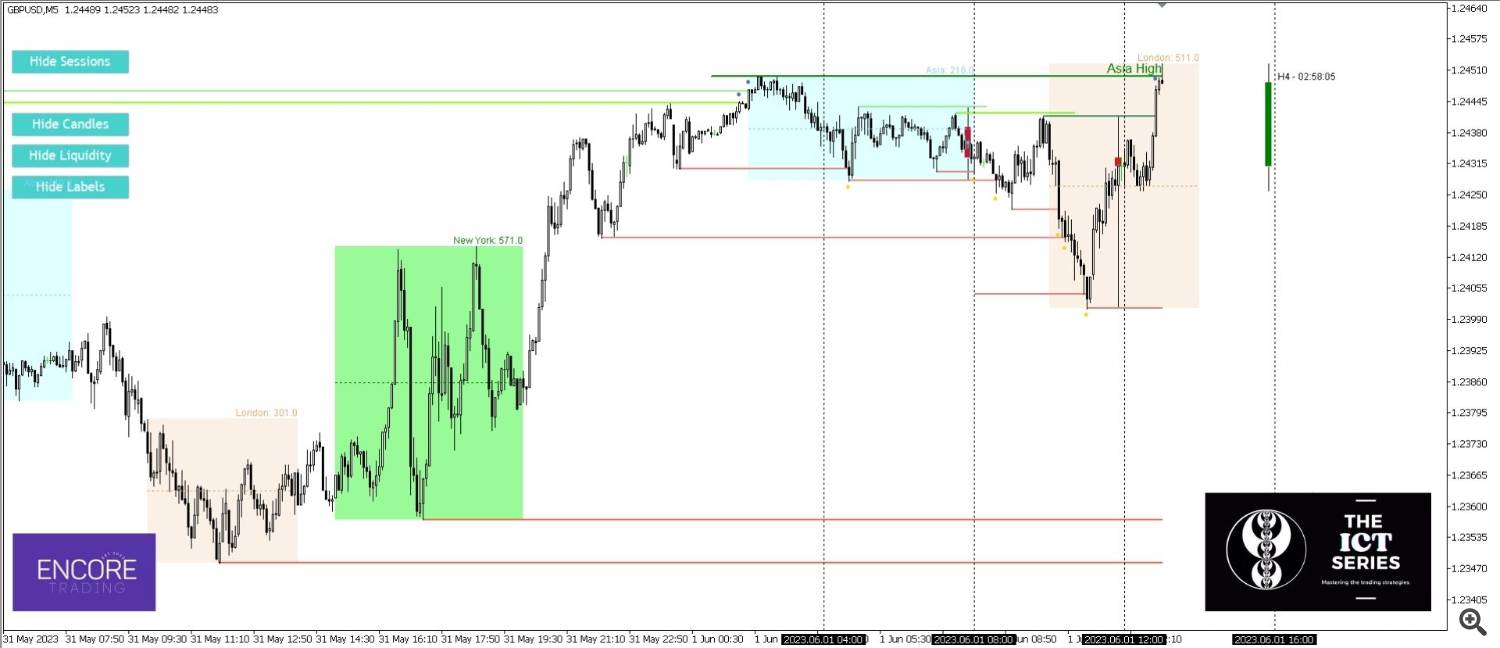

Like in the picture above, Analyzing the charts, we will be able to determine our expected direction based on previous days price moves (A tool to do this is being currently developed!) and we can determine what is the scenario which we like the most and which we will be looking to enter. Like in the above where we are clearly expecting a bear move after such a strong sell candle on HTF, and as expected we would have taken the right direction as we can see in the picture below.

The power of 3 would help us to keep an eye in the bigger timeframes and catch a good price based on our expected bias. As we know, every candle has wicks, and with the power of 3 we can have an idea of what is the expected range of a candle as well it will help us to catch the wick and get in the best price possible. As well the tool has a feature which shows us the most possible prediction for the current candle, which we can use with our own confluences to take a good trade.

We have now the times that we look for entries, the areas that we will be interested to trade from as well our ideal direction. And here is where our most important tool takes place, which is the liquidity indicator. This amazing tool displays for us the most possible reversal zones, which tapped on the right time with right HTF bias and momentum yields highly probable trades.

As you can see in the picture once the liquidity pool is tapped, we see a point under the candle which displays the potential reversal, aligned this with out entry model in LTF and incoming momentum we have a successful trade. And why is that? Well, the liquidity indicator displays what are prices which big players could fill their orders in and therefore cause the next expansion leg.

About the entry model there is multiple ways to enter depending on your risk and preference. We are currently developing an indicator to shows us some of the best entry patterns to ease us in the decision-making process, let us know if you would find this useful!.

Now all these ICT tools are great helps for trading, but the most important thing to always keep in mind is to use them together, because that’s where the key is. They’re tools to read the market but each one of those reads a different thing, so is important to align them all together.What is next?

Well, now is your time to try out the tools, all of them can be found in the following links as well in my profile, you can test the concepts and get trading the right ICT straight the way. This is just the start of the series and we have more helps and tools coming to helps us analyze the markets (as well EA’s which do what ICT proposes as the best strategies).

Please, if you like these concepts and have any tool or idea which you would like to see, let us know and we will try to make it a reality and test together the concept. Let’s get better at trading together.

As well any questions, feedbacks or just talk is welcomed. Leave us a message on the comment section and we will get back to you as soon as possible.