Mastering Your Entries and Exits:

Using Pending Orders in Forex Trading

Forex trading can be a thrilling yet demanding venture. While market orders allow you to jump into the trade immediately, pending orders offer more control over your entry and exit points, potentially leading to better trade execution. Let’s dive into the world of pending orders and how they can elevate your forex trading strategy.

What are Pending Orders?

Pending orders are instructions you give your forex broker to buy or sell a currency pair at a predetermined price level in the future, rather than at the current market price. Think of them as automated triggers waiting for the market to meet your specific conditions. Let’s delve into the different types of pending orders and how they can be used to your advantage:

Types of Pending Orders and Their Uses:

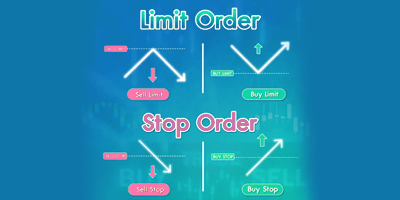

There are four main types of pending orders, divided into two categories, each with different trading scenarios:

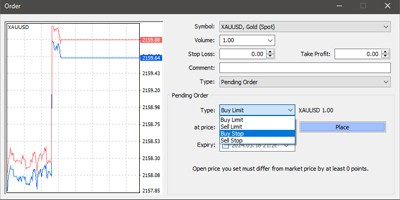

1. Buy Limit and Sell Limit Orders:

Use: Ideal for entering trades in the direction of a potential trend reversal.

- Buy Limit: Imagine you believe the EUR/USD is due for a rebound after a dip. You can set a buy limit order at a specific price below the current market price. If the price falls to your designated level (or even lower), the order is triggered, and you buy EUR/USD at your desired entry point.

- Sell Limit: Conversely, a sell limit order instructs your broker to sell a currency pair you already hold at a specific price above the current market price. This is useful if you anticipate a price reversal after a rally and want to lock in profits at your target price.

2. Buy Stop and Sell Stop Orders:

Use: Capture breakouts or breakdowns from support/resistance levels.

- Buy Stop: In contrast to buy limits, buy stop orders are placed above the current market price. This is used in breakout strategies where you believe the price will surge past a resistance level. If the price breaks above your stop price, a buy order is triggered, allowing you to capitalize on the potential upside.

- Sell Stop: A sell stop order is the opposite. You place it below the current market price, anticipating a price drop that breaches a support level. If the price falls below your stop price, a sell order is executed, potentially limiting your losses or locking in profits on a short position.

Other types of pending orders:

Absolutely, there are a few other types of pending orders you might encounter in forex trading, although they are less common than the ones we’ve already discussed. Here’s a quick rundown:

- Stop-Limit Orders: A stop-limit order combines elements of both stop and limit orders. You set a trigger price (like a stop order) and a limit price (like a limit order). If the market price reaches your trigger price, the order becomes a market order, but it will only be filled if the price can also reach your limit price or better.

- OCO Orders (One Cancels the Other): This is an advanced order type that involves placing two pending orders simultaneously. One order is a buy stop and the other is a sell stop. Whichever order is triggered first cancels the other. This can be useful for defining entry points in volatile markets or for hedging strategies.

- Trailing Stops: Trailing stops are not technically pending orders, but they are dynamic order types that can be very useful for managing existing positions. A trailing stop automatically adjusts its stop-loss price as the price moves in your favor. For example, with a long position (buying a currency pair), a trailing stop might be set at a fixed percentage below the current market price. If the price keeps rising, the trailing stop automatically rises as well, locking in profits if the price reverses.

Remember, using these less common order types requires a good understanding of how they work and careful consideration of potential risks and rewards. It’s always best to start by mastering the basic buy/sell stop and limit orders before venturing into more complex order types.

Why Use Pending Orders?

Effective use of pending orders:

- Trading Breakouts: Pending orders shine in breakout strategies. For instance, a buy stop order can capture a breakout to the upside, while a sell stop order can capitalize on a downside breakout.

- Price Reversals: If you believe the price will reverse after reaching a certain level, limit orders can be your weapon. A buy limit order anticipates a reversal after a price drop, while a sell limit order bets on a reversal after a price increase.

- Automated Trading: Pending orders allow you to automate your trading strategy. Set your entry and exit points based on technical analysis, and the orders will execute automatically when the market conditions are met, freeing you from constant monitoring.

Important points in using pending orders:

- Plan Your Strategy: Don’t just throw out random pending orders. Base them on technical analysis or a defined trading strategy.

- Consider Stop-Loss Orders: Always pair your pending orders with a stop-loss order to limit potential losses if the price moves against you.

- Be Realistic: Don’t set unrealistic price targets for your pending orders. Factor in market volatility and price action.

- Monitor Your Orders: Markets are dynamic. Keep an eye on your pending orders and adjust them as needed based on changing market conditions.

- Consider Market Volatility: In volatile markets, wide spreads (difference between buy and sell price) can affect execution price on pending orders, so factor that in.

- False Breakouts: Remember, pending stops can be triggered by false breakouts, leading to unexpected entries.

- Risk Management: Pending orders work hand-in-hand with stop-loss orders, which are crucial for limiting potential losses.

Remember:

Pending orders don’t guarantee execution. The price might not reach your trigger point.

Market volatility can affect pending orders. Sudden price swings might cause execution at a slightly different price than intended.

Always practice proper risk management techniques when using pending orders.

By effectively using pending orders, you can automate your entries and exits, take advantage of specific price movements, and potentially improve your overall trading discipline. However, remember, pending orders are a tool, and like any tool, mastering them requires practice and sound trading judgment.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor before making any investment decisions.

Happy trading

may the pips be ever in your favor!