Macro Economy

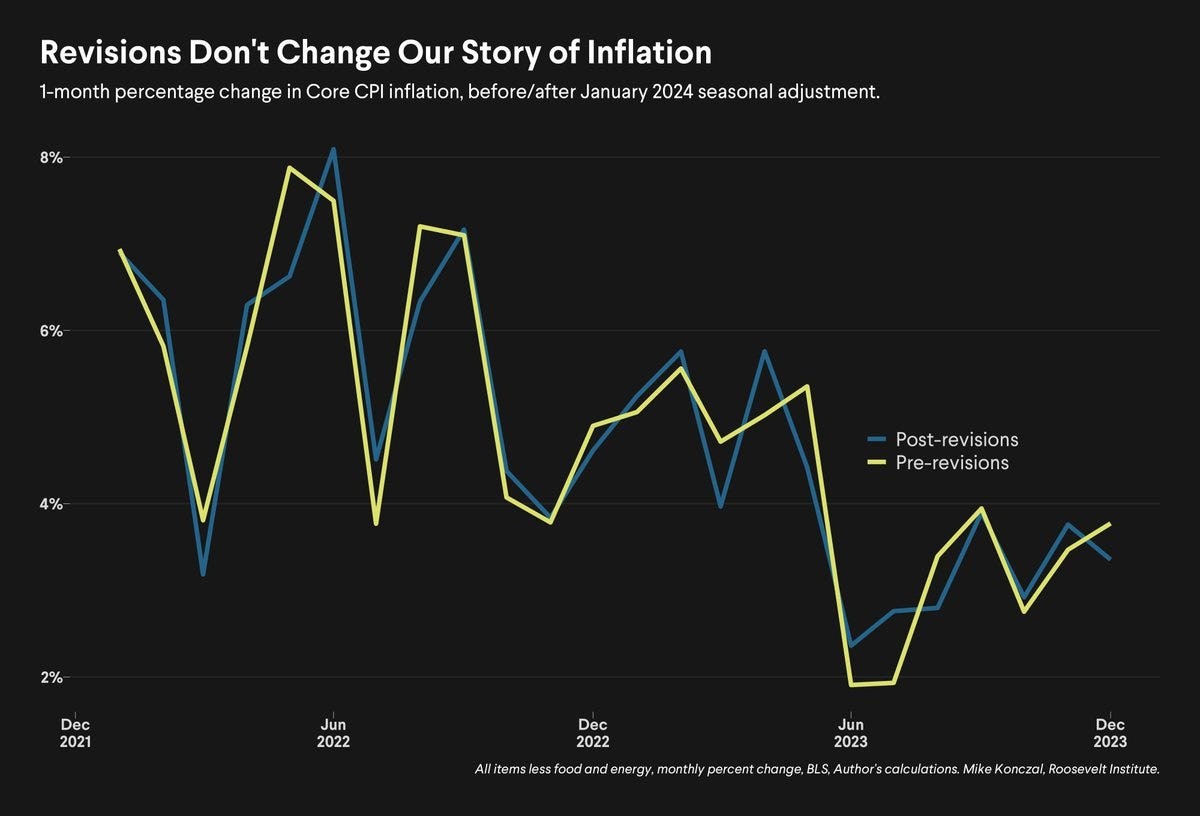

The consumer price index data was seasonally adjusted, but the revision did not greatly affect the overall picture; the core CPI is still at +0.3% m/m, which is in line with expectations:

Revised Core Consumer Price Index Data

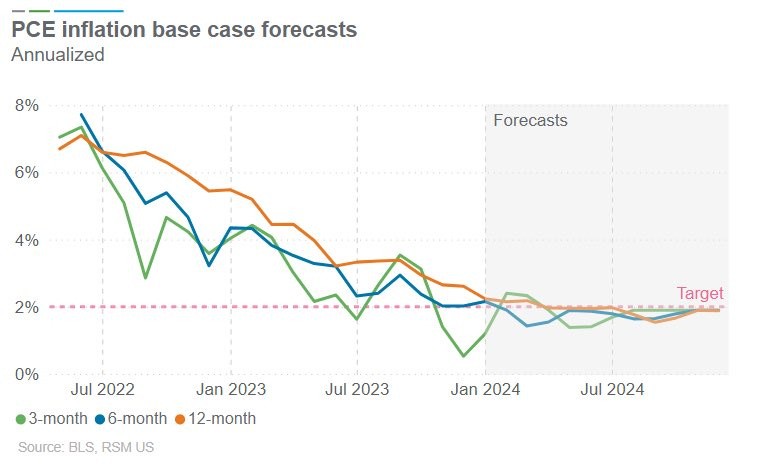

The market's updated forecast for inflation is that it will exceed the 2% target in the near term and then end the year at or near:

PCE Inflation Forecast

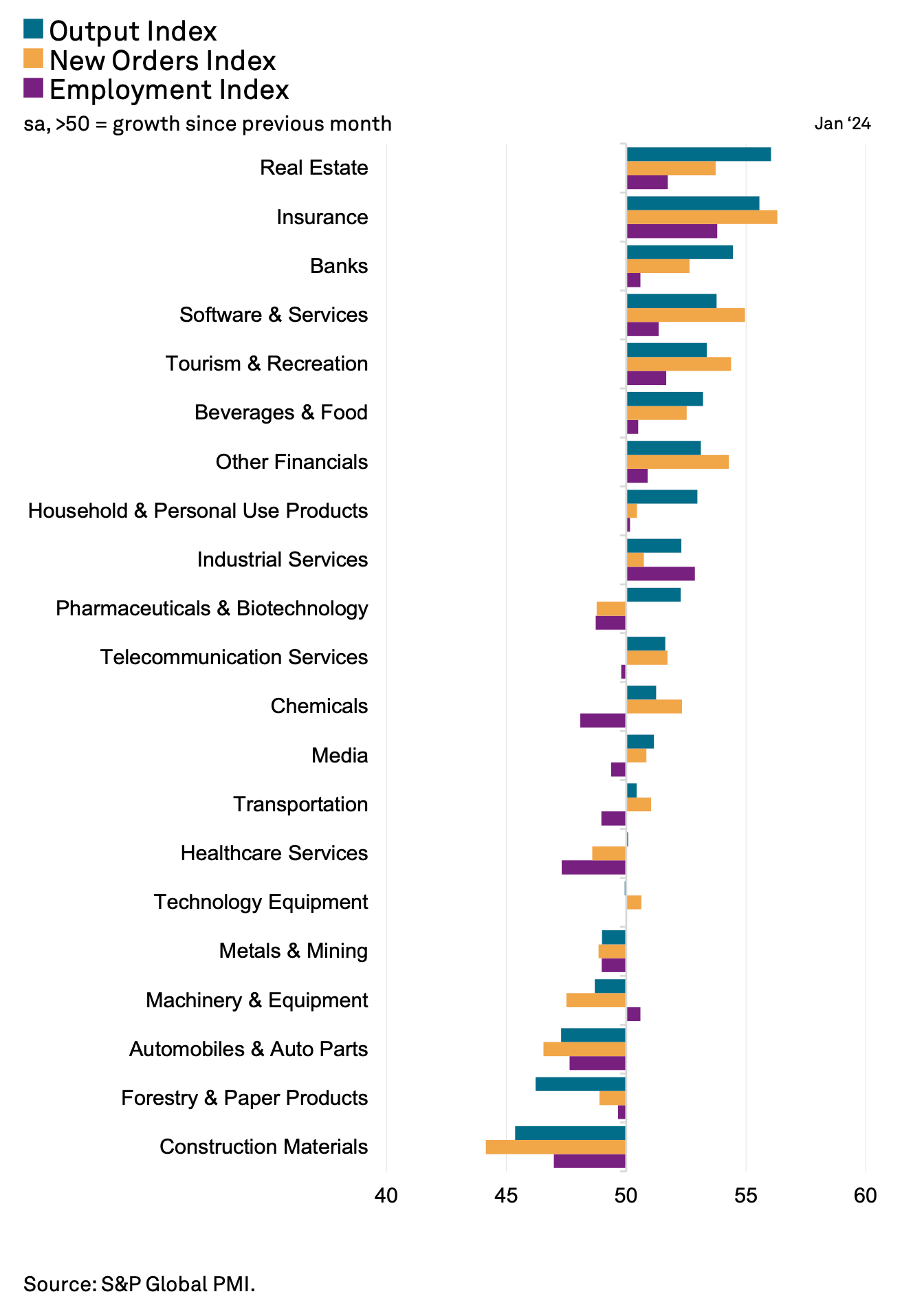

The latest PMI from S&P Global showed some signs of improvement in the global economy during the first month of 2024, with 15 of the 21 sectors tracked posting their strongest gains since June last year:

S&P Global PMI, sector indicators

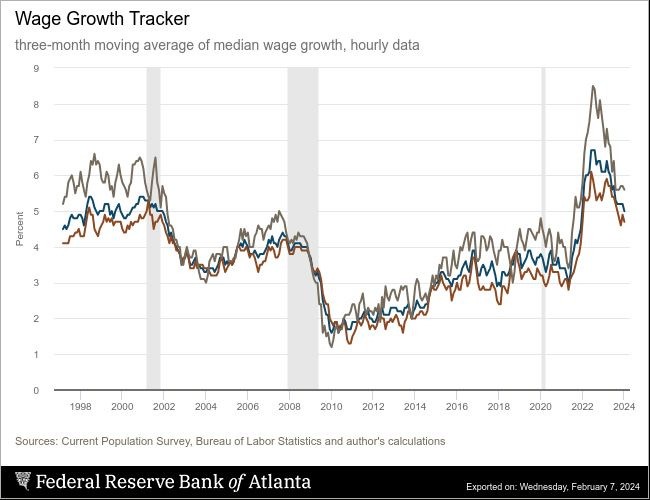

The Atlanta Fed's wage indicator fell from +5.2% to +5.0% in January (lowest in +2 years). Wage growth also slowed for those who remain at work (to +4.7% from +4.9%) and for those who change jobs (to +5.6% from +5.7%):

Atlanta Fed wage indicator

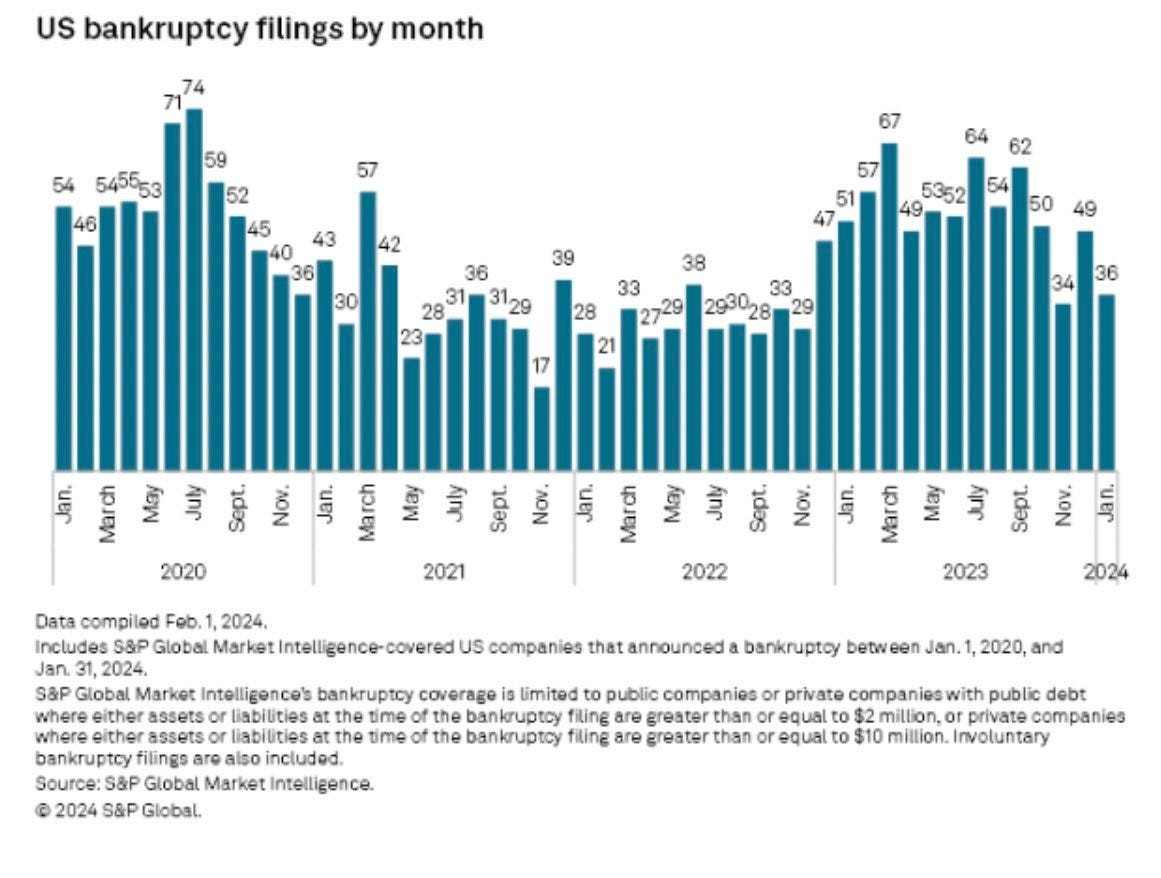

In January, the number of corporate bankruptcy filings in the United States slowed compared to the previous month:

Number of corporate bankruptcy filings in the United States

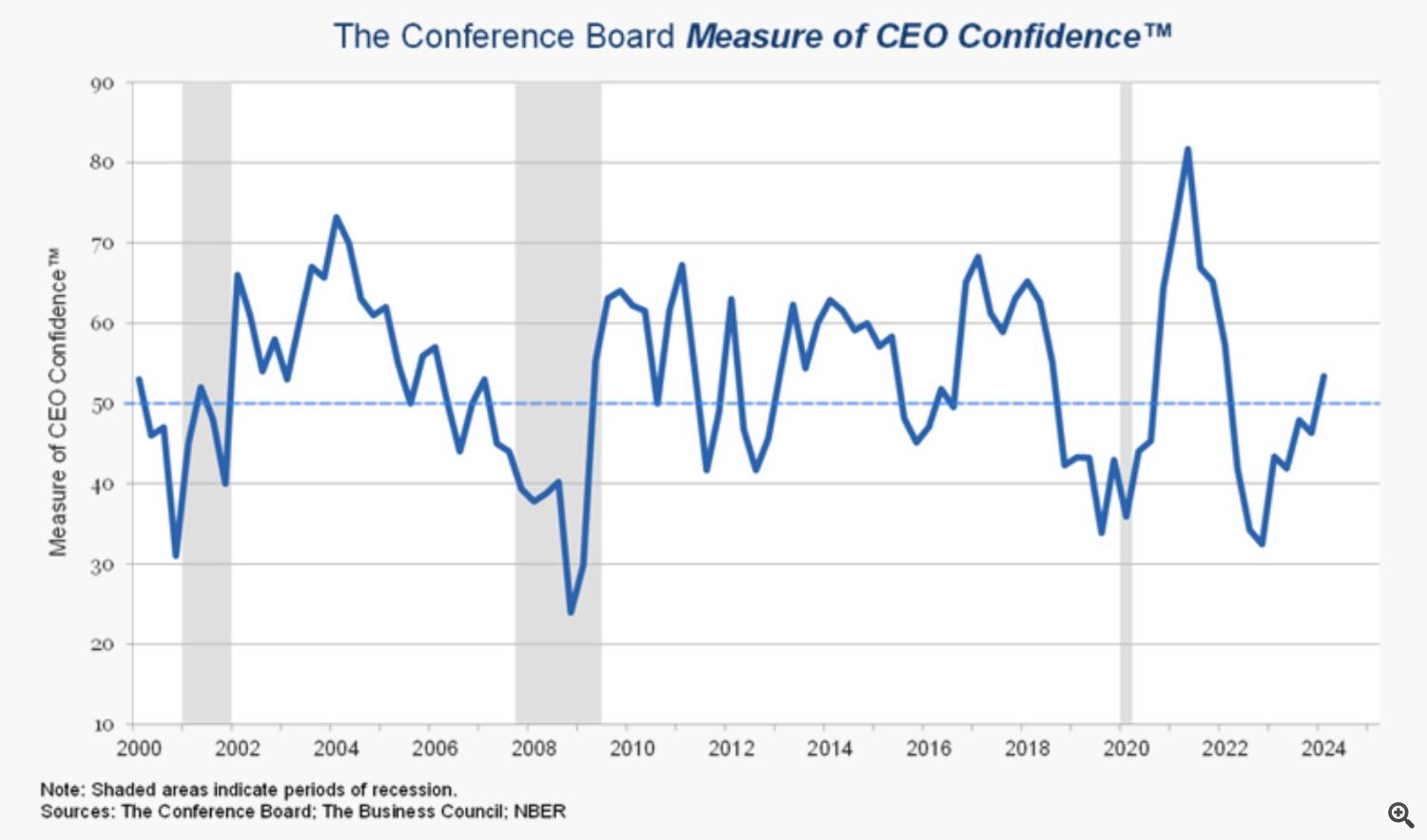

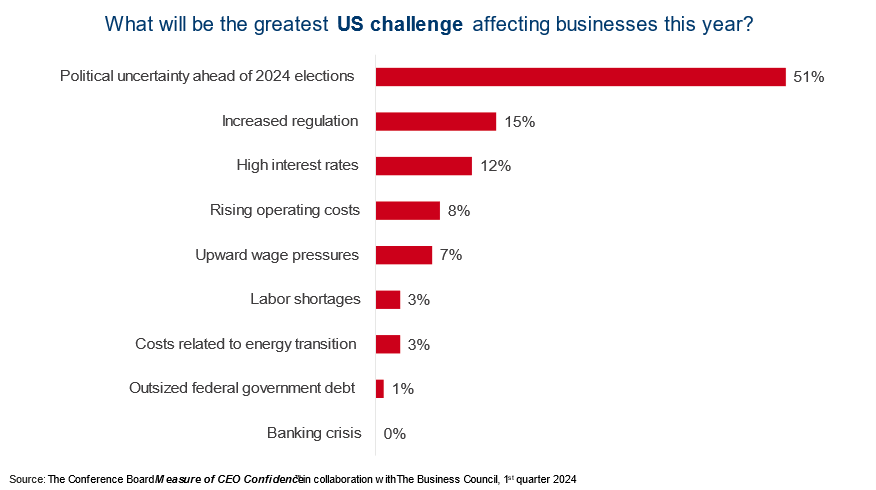

CEO confidence increased from 46 to 53 for the first quarter, marking the first optimistic reading (above 50) since Q1 2022. At the same time, executives consider political uncertainty the biggest challenge for business in the United States this year:

CEO Confidence Index

The biggest challenge for US business by 2024, according to CEOs

What are others doing?

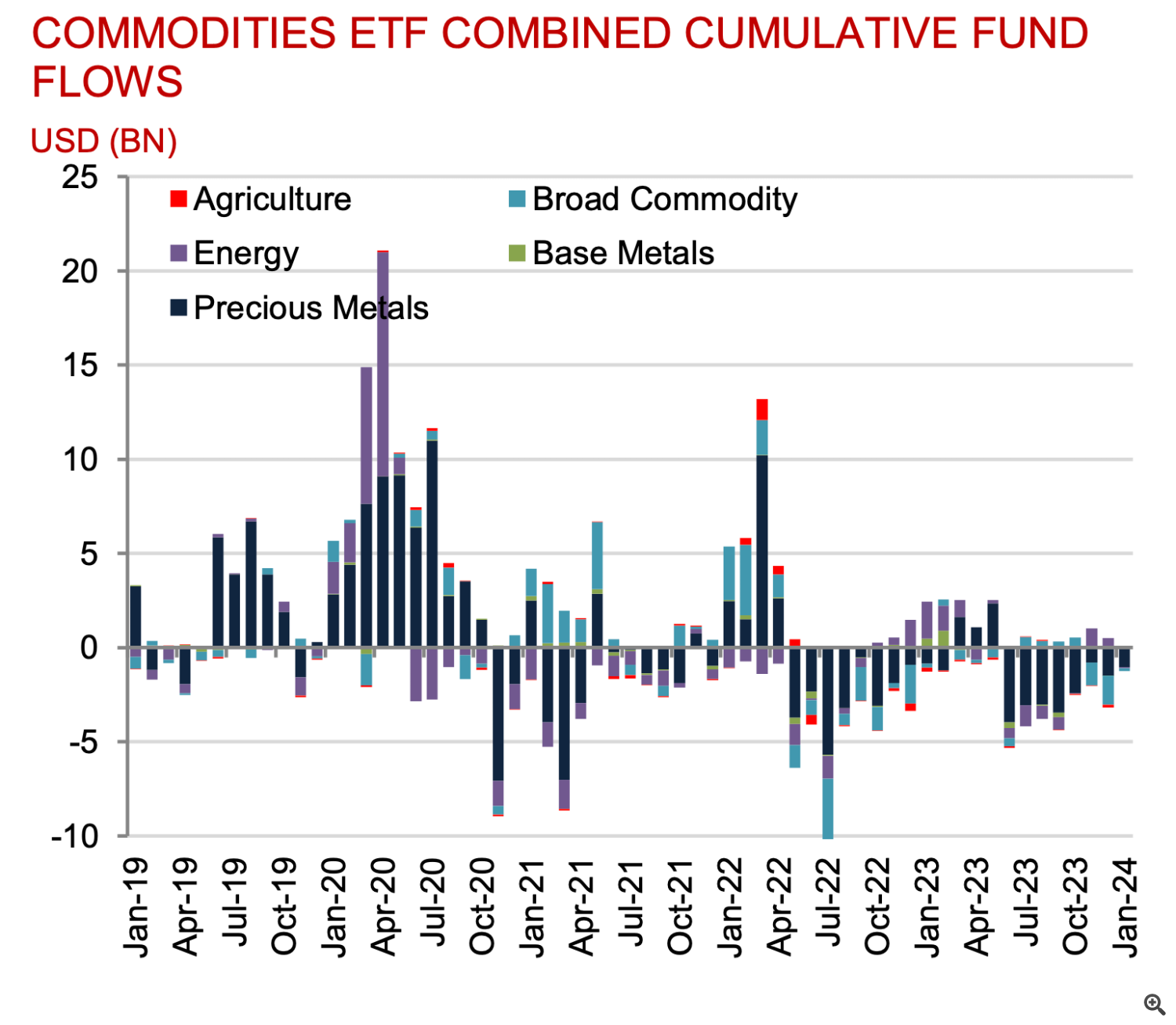

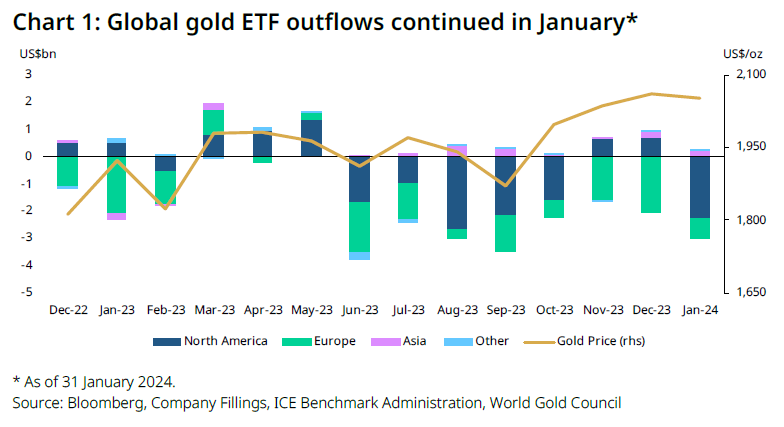

Net outflows from gold ETFs were -$2.8 billion (~51 tons) in January, marking the 8th consecutive month of outflows. As a result, total AUM decreased to USD 210 billion (-2% MoM):

Flows into gold ETFs

Commodity ETF Fund Flows by Category

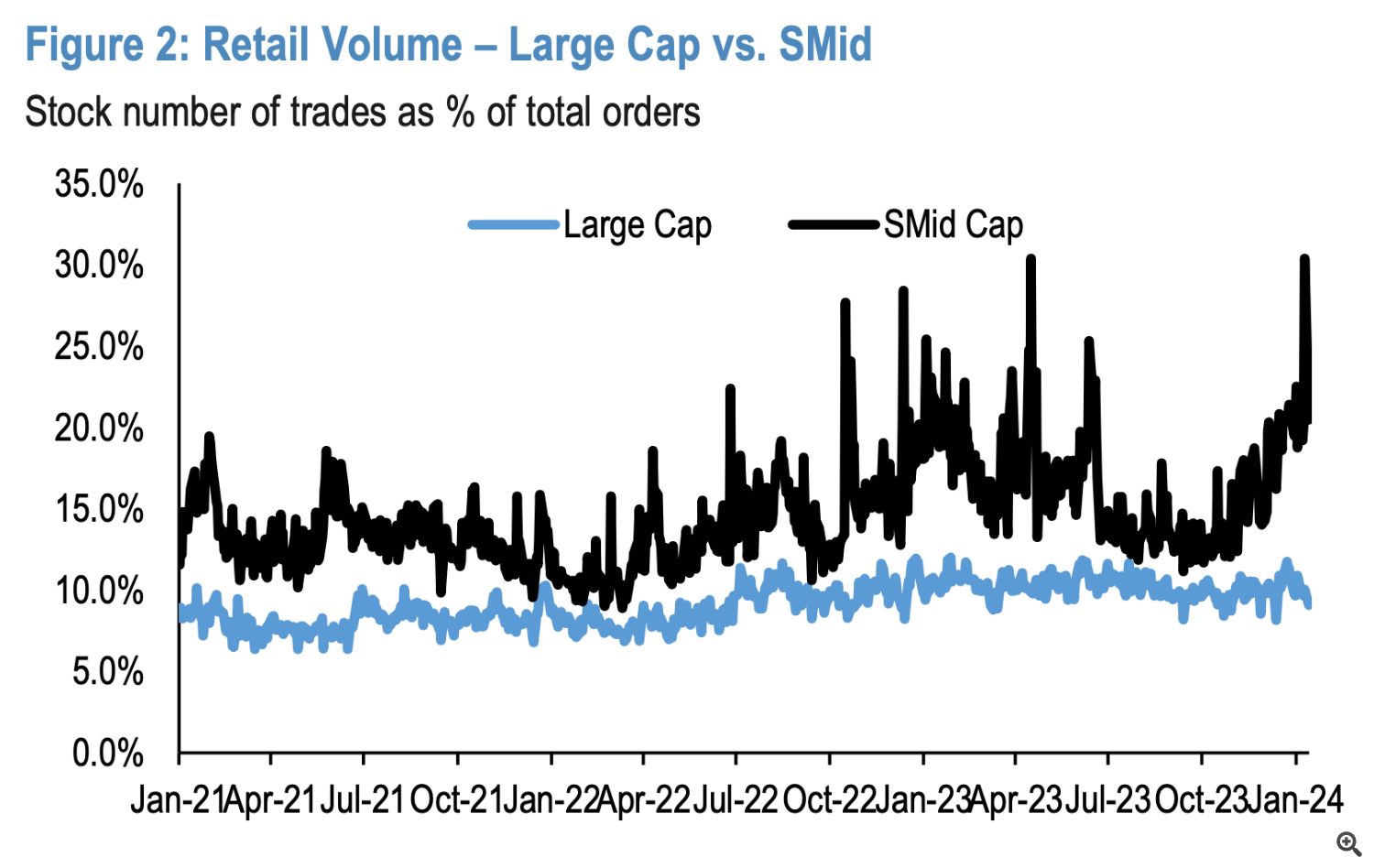

In recent months, retail traders' trading volumes have shifted heavily towards small and mid-cap stocks:

Share of shares from all transactions of retail traders by capitalization