User Guide: StoplossHunt Filter User Guide — Filtering "SL Sweep" Signals

Mirage Trading System | Buy Trading Indicator for MetaTrader 5

This functionality is available in the trading system

Main Manual : Mirage Trading System - Trading Systems - 5 February 2026 - Traders' Blogs

1. Introduction

StoplossHunt Filter is an intelligent tool that helps you identify trading signals with higher win probability by checking whether price "swept stoploss" before forming a pattern.

What is StoplossHunt Filter?

This is an automated filter that checks:

- For BUY signals (bullish): Did price touch below the previous bottom? (sweeping buyers' stoploss)

- For SELL signals (bearish): Did price touch above the previous top? (sweeping sellers' stoploss)

If price did not sweep stoploss → signal is rejected (weak, high risk) If price already swept stoploss → signal is accepted (strong, high probability)

Why should you use it?

When this filter is enabled, you will:

- Only trade signals where "Smart Money" has already acted (swept the crowd's SL)

- Avoid mid-air signals (no clear momentum)

- Increase win rate because you enter AFTER the market has purged weak liquidity

- Better understand market structure — know which levels have been swept

-

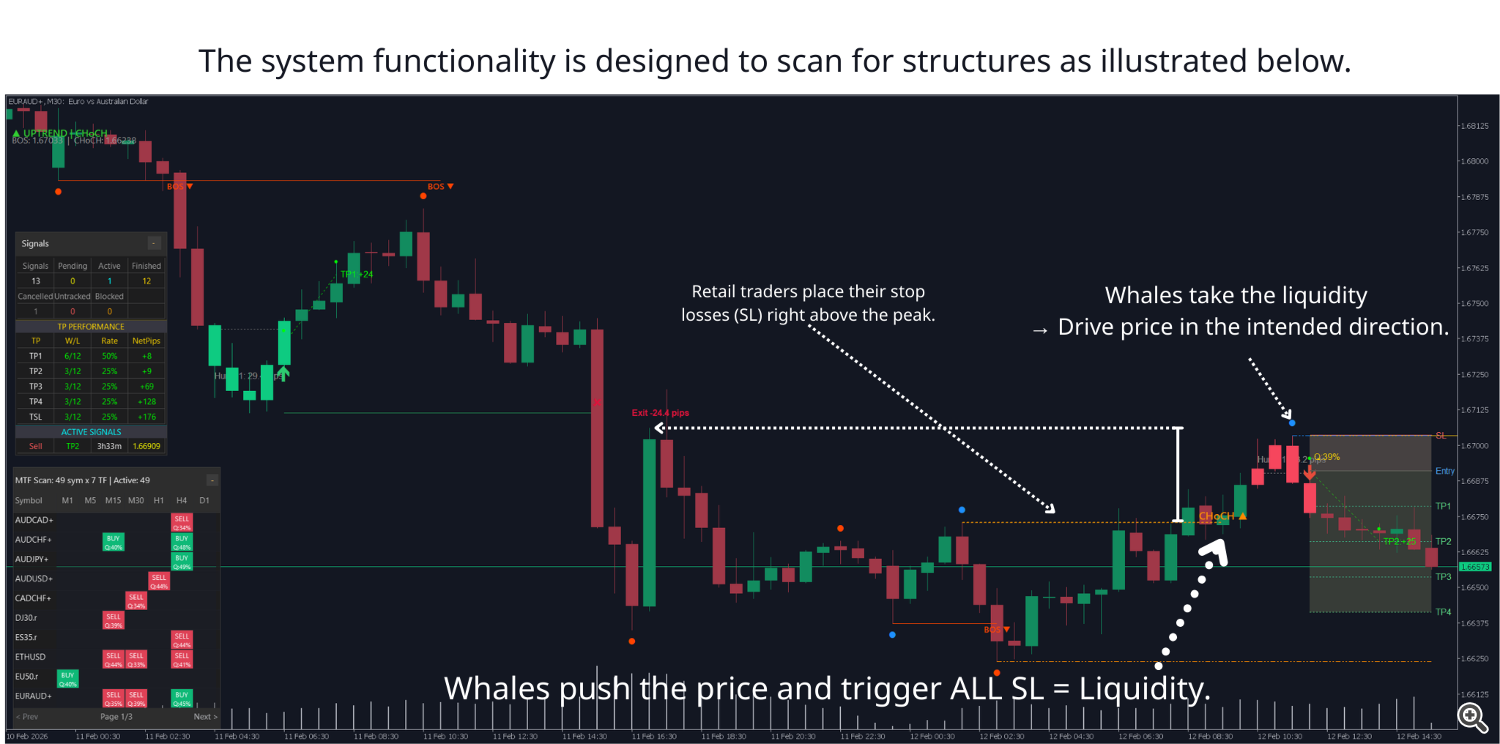

2. Why do you need StoplossHunt Filter?

How "sharks" (Smart Money) operate

Step 1: Market creates tops/bottoms → many traders sell/buy Step 2: SL orders cluster just below/above those tops/bottoms Step 3: Sharks push price past the top/bottom slightly → trigger all SL (massive liquidity) Step 4: Sharks absorb all that liquidity at a good price → then push price in the real direction

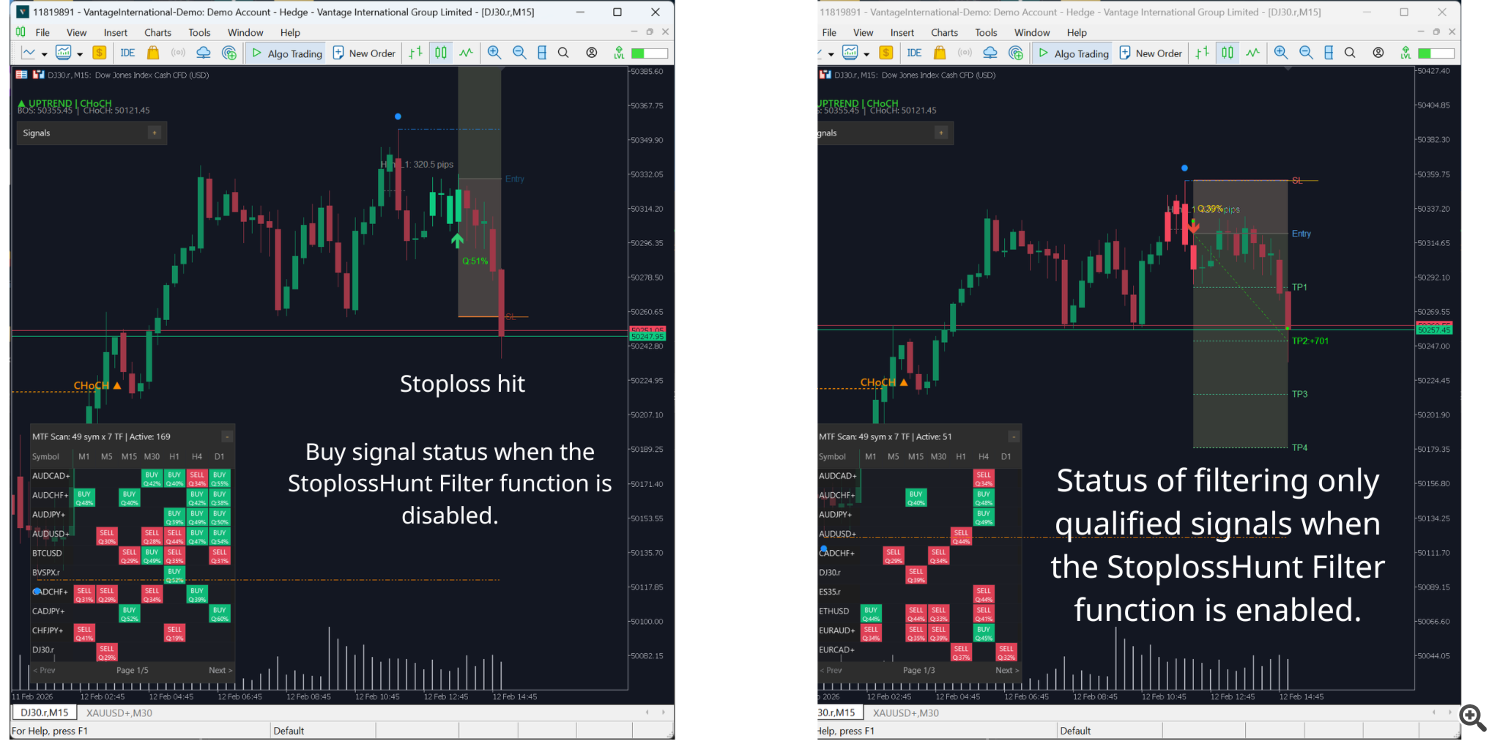

Without vs With the Filter

WITHOUT StoplossHunt Filter: You enter at "random" patterns mid-air, don't know if sharks have acted yet, easy to fall into traps.

WITH StoplossHunt Filter: You ONLY enter AFTER sharks have finished sweeping, you move IN THE SAME DIRECTION as the big money flow. Fewer signals but much higher quality.

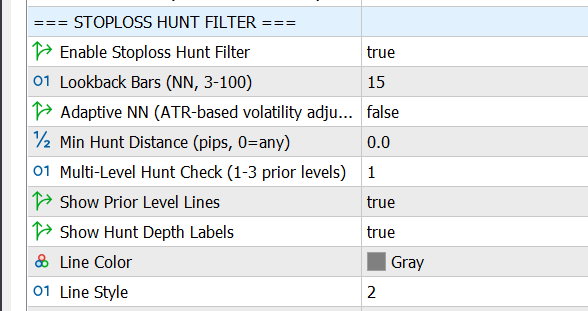

3. Step-by-step Parameter Setup Guide

When you load the indicator onto a chart, you'll see 9 settings related to StoplossHunt Filter.

3.1. Enable Stoploss Hunt Filter (On/Off)

| Parameter name | InpSH_Enable |

|---|---|

| Data type | true/false |

| Default value | false (OFF) |

- false : All signals are accepted (no filtering)

- true : ONLY accept signals with stoploss sweep

Enable when: Trading Gold, major Forex pairs, Smart Money / ICT style, want quality over quantity. Disable when: Testing new strategy, trading erratic small coins, already using many other filters.

3.2. Lookback Bars (Number of candles to look back)

| Parameter name | InpSH_LookbackBars |

|---|---|

| Data type | Integer (3-100) |

| Default value | 15 candles |

| Recommendation | Small TF → 10-20, Large TF → 30-50 |

The filter scans backwards this many candles to find previous tops/bottoms.

- Increasing (e.g. 15 → 50): Finds more/older tops/bottoms, easier to pass filter, but may find levels no longer important

- Decreasing (e.g. 15 → 5): Only recent tops/bottoms, stricter, but may miss important levels

Recommended Lookback by Timeframe:

| Timeframe | Lookback Bars | Notes |

|---|---|---|

| M5 | 8-15 | Scalping, nearby bottoms/tops only |

| M15 | 15-25 | Intraday, balanced |

| H1 | 20-35 | Swing, look further |

| H4 | 30-50 | Position, wide scan |

General rule: High volatility products (indices, crypto) → increase 30-50% from the table above.

3.3. Adaptive NN (Automatic adjustment based on volatility)

| Parameter name | InpSH_AdaptiveNN |

|---|---|

| Data type | true/false |

| Default value | false |

When ENABLED, the filter automatically adjusts Lookback Bars based on market volatility (ATR):

- Strong volatility (high ATR) → Automatically INCREASE lookback

- Weak volatility (low ATR) → Automatically DECREASE lookback

Example: You set Lookback = 20, Adaptive = true. US session (strong vol) → system adjusts to ~30. Asian session (weak vol) → system adjusts to ~14.

Enable when: Trading across sessions, trading Gold, want auto-adjustment. Disable when: Only trade one fixed session, backtesting (need fixed parameters).

3.4. Min Hunt Distance (Minimum sweep distance)

| Parameter name | InpSH_MinHuntPips |

|---|---|

| Data type | Decimal (pips) |

| Default value | 0.0 (accept any) |

Price must sweep at least this many pips past the previous top/bottom to count as a "hunt". This filters out market noise (spread, slippage touches of 0.1-0.2 pips).

Recommended MinHuntPips:

| Product type | MinHuntPips | Notes |

|---|---|---|

| Low volatility (Forex majors) | 0.5 - 2.0 | Small spread, slow moves |

| Medium volatility (Gold, Forex cross) | 2.0 - 5.0 | Filter noise more clearly |

| High volatility (Indices, Crypto) | 5.0 - 50.0 | Depends on average ATR |

Tip: Start with MinHuntPips = 0 → observe → gradually increase until noise is filtered but real hunts are kept. Large broker spread → increase MinHuntPips.

3.5. Multi-Level Hunt Check

| Parameter name | InpSH_MultiLevel |

|---|---|

| Data type | 1, 2, or 3 |

| Default value | 1 (only check 1 level) |

| Recommendation | 2 (balanced), 3 (sideways market) |

The filter checks this many levels of previous tops/bottoms:

- Level 1: ONLY checks the nearest top/bottom → strictest

- Level 2: Checks 2 levels → balanced (recommended)

- Level 3: Checks 3 levels → easiest to pass, more opportunities

When to use: Level 1 for strong trending market. Level 2 for most cases. Level 3 for sideways market with many alternating tops/bottoms.

3.6. Show Prior Level Lines

| Parameter name | InpSH_ShowLines |

|---|---|

| Data type | true/false |

| Default value | true (SHOW) |

Displays horizontal lines on chart marking swept tops/bottoms. Enable during learning phase, disable for cleaner chart in live trading.

3.7. Show Hunt Depth Labels

| Parameter name | InpSH_ShowLabels |

|---|---|

| Data type | true/false |

| Default value | true (SHOW) |

Displays text label on chart, e.g.: "Hunt L1: 3.5 pips" showing which level was swept and how deep.

Reading hunt depth:

- Shallow (1-3 pips): Light hunt, may just be testing level

- Deep (5-10 pips): STRONG hunt, many SL triggered → very good signal

- Extremely deep (>15 pips): May be structure change, need caution

Recommendation: Keep ENABLED — helps assess signal quality quickly.

3.8. Line Color

| Parameter name | InpSH_LineColor |

|---|---|

| Default value | clrGray (gray) |

| Parameter name | InpSH_LineColor |

|---|---|

| Default value | clrGray (gray) |

Color of horizontal lines. Suggestions: clrGray (neutral), clrDimGray (dark background), clrSilver (softer). Avoid red/green (confuses with candle colors).

3.9. Line Style

| Parameter name | InpSH_LineStyle | |

|---|---|---|

| Default value | STYLE_DOT (dotted) | |

| Value | Name | Appearance |

| 0 | STYLE_SOLID | __________ (solid) |

| 1 | STYLE_DASH | - - - - - - (dashed) |

| 2 | STYLE_DOT | . . . . . . . (dotted) |

| 3 | STYLE_DASHDOT | -.-.-.-.-(dash-dot) |

| 4 | STYLE_DASHDOTDOT | -..-..-..-(dash-dot-dot) |

Recommendation: STYLE_DOT — easy to distinguish from other chart lines.

4. How to Read Signals on Chart

4.1. BULLISH (BUY) Signal with Hunt

When you see: (1) Gray dotted horizontal line below candle pattern, (2) Label "Hunt L1: X pips", (3) Reversal candle (e.g.: Fakey, Pin Bar) forms AFTER touching the line.

Reading: Line = previous bottom. Price touched past this line = swept buyers' SL. Price reversed up = sharks finished feeding. → CONSIDER BUY (if other filters also PASS).

4.2. BEARISH (SELL) Signal with Hunt

Same logic reversed: horizontal line above candle = previous top. Price touched past it = swept sellers' SL. Price dropped = sharks pushing down. → CONSIDER SELL.

4.3. No Line = No Hunt = FILTERED OUT

Beautiful candle pattern but no horizontal line and no "Hunt" label → signal FILTERED OUT → SKIP (low probability "random" pattern).

4.4. Reading Hunt Depth

| Hunt Depth | Meaning | Action |

|---|---|---|

| 0.5 - 2 pips | Light hunt | Cautious, wait for confirmation |

| 3 - 7 pips | Moderate hunt | Can enter trade |

| 8 - 15 pips | STRONG hunt | High priority |

5. 7 Practical Tips

Tip 1: Don't Enter IMMEDIATELY When Seeing Hunt

WRONG: See "Hunt" → enter immediately. RIGHT: See "Hunt" → wait for candle CLOSE → check other filters → enter.

Price often sweeps and sweeps again. Waiting for close = confirming real reversal.

Tip 2: Deeper Hunt = Stronger Signal

Hunt < 3 pips → Weak, need more confirmation. Hunt 5-10 pips → Good signal. Hunt > 10 pips → Extremely strong, high priority. Note: High volatility products have higher thresholds. Hunt too deep vs normal volatility → may be real breakout.

Tip 3: Trade During Peak Hours

Strongest hunts: US session (20:00-02:00 VN / 13:00-19:00 UTC), European session (14:00-20:00 VN / 07:00-13:00 UTC), London open (14:00-15:00 VN). Weak hunts: Asian session (early morning VN) — low volume, rare/unclear. If trading M15/M5 → ONLY trade European-US session.

Tip 4: Combine with Risk Management

Stop Loss: Place SL past the hunt point (below/above lowest/highest sweep by 1-3 pips). Take Profit: Deep hunt (>10 pips) → larger TP (R:R 1:3 to 1:5). Shallow hunt (<5 pips) → smaller, safer TP.

Tip 5: Read Market Structure

Hunt at important support/resistance (H4, D1) → extremely strong signal (confluence). Hunt in middle of range → weaker signal.

Tip 6: Multi-Level Hunt = Super Signal

Label "Hunt L2: 15 pips" or "Hunt L3: 20 pips" = price swept deep, reaching level 2 or 3. Level 2-3 + hunt > 10 pips = great opportunity. Level 1 + hunt < 5 pips = weak signal.

Tip 7: Don't Trade Against Major Trend

No matter how strong the hunt, NEVER trade against H4/D1 trend. StoplossHunt Filter + Direction Filter (same trend) = Perfect combo.

6. Real-World Scenarios

Scenario 1: Bullish Hunt — US Session

Setup: M15, US session (~21:00-23:00 VN), H1 uptrend. What happened: Price created a bottom 12 candles ago → price touched past it by 2 pips → bullish Pin Bar formed → Label: "Hunt L1: 2.0 pips". Analysis: Hunt exists but shallow (2 pips). However: H1 uptrend + US session + Pin Bar = good confluence. Decision: ENTER BUY at 50% lot (shallow hunt → cautious). Result: TP1 (1:2) hit after ~35min, TP2 (1:4) hit after ~1.5h. Lesson: Shallow hunt + strong confluence = still profitable.

Scenario 2: Bearish Hunt — London Open

Setup: M15, London open (~14:00 VN), H4 downtrend. What happened: Price touched past old top by 3 pips → bearish engulfing → Label: "Hunt L1: 3.0 pips". Decision: ENTER SELL full lot (3 pip hunt + downtrend + London open + strong pattern). Result: TP1 (1:2) hit after ~20min. Lesson: Hunt at London Open + trend alignment = golden formula.

Scenario 3: When to SKIP

Setup: M15, 08:00 (weak Asian session), H1 sideways. What happened: Price touched past range bottom only 0.5 pips → Fakey pattern → Label: "Hunt L1: 0.5 pips". Decision: SKIP (hunt too shallow + Asian session + no trend). Result: Price reversed against → skip was correct. Lesson: Not every hunt should be traded. Must have context (time, trend, depth).

7. Combining with Other Features

StoplossHunt Filter is extremely powerful when combined with other filters.

7.1. Hunt + Direction Filter (Trend Alignment)

Direction Filter only allows signals in H1/H4 trend direction. When both PASS → signal with trend + with hunt = extremely high win probability.

| Filter | Setting |

|---|---|

| Direction Filter | ON, Timeframe = H1, Trend Period = 50 |

| StoplossHunt Filter | ON, Lookback = 20, MultiLevel = 2 |

7.2. Hunt + Quality Filter (High-Quality Only)

Quality Filter only accepts patterns with Quality Score > 0.7. When both PASS → beautiful pattern + hunt = golden signal.

7.3. Hunt + Extreme Zone Filter (Overbought/Oversold)

Extreme Zone Filter accepts signals when RSI is in extreme zone. When both PASS → extreme + hunt = strong reversal.

| Filter | Setting |

|---|---|

| Extreme Zone Filter | RSI < 30 or > 70 |

| StoplossHunt Filter | ON, MinHuntPips = 5.0 |

7.4. 3-Filter Stack (Hunt + Quality + Direction)

Most powerful combo for medium/long-term traders:

| Filter | Setting | Role |

|---|---|---|

| Direction Filter | H4 trend | Major trend alignment |

| Quality Filter | Min = 0.7 | Beautiful pattern |

| StoplossHunt Filter | MinHunt = 5, MultiLevel = 2 | Strong hunt |

Result: 1-3 signals/week, win rate 75-85%, R:R 1:3 to 1:5. Best for busy traders who want quality over quantity.

7.5. Strategy by Timeframe

M5 (Scalping): Direction=M15 trend, Hunt MinHunt=1.0 Lookback=10, Quality Min=0.6. Target: 5-15 pips/trade.

M15 (Intraday): Direction=H1 trend, Hunt MinHunt=3.0 Lookback=20 MultiLevel=2, Quality Min=0.7. Target: 20-50 pips/trade.

H1 (Swing): Direction=H4 trend, Hunt MinHunt=5.0 Lookback=30 MultiLevel=2, Quality Min=0.75, Extreme Zone RSI<35 or >65. Target: 80-150 pips/trade.

H4 (Position): Direction=D1 trend, Hunt MinHunt=10.0 Lookback=50 MultiLevel=3, Quality Min=0.8. Target: 200-500 pips/trade.

8. FAQ

Q1: Enabled filter but no signals?

Try: (1) Increase Lookback to 25-30, (2) Set MinHuntPips = 0.0, (3) Increase MultiLevel to 3, (4) Disable other filters temporarily. If still nothing → check indicator is running correctly.

Q2: What hunt depth is "good enough"?

Hunt depth > 2x your MinHuntPips = good. > 4x = very good. Higher volatility products have higher thresholds.

Q3: Trade EVERY signal with hunt?

NO. Hunt is necessary but not sufficient. Still need: trend alignment, quality pattern, good trading hours, reasonable context.

Q4: Is Adaptive NN useful?

Yes if trading across sessions or Gold. Not needed if only one session or backtesting. Rule: ENABLE for live, DISABLE for backtesting.

Q5: Why do signals with hunt still lose?

Possible: "fake hunt" (trap), news/events, hunt too shallow (<2 pips), no confirmation. Solutions: Only trade deep enough hunts, avoid major news, wait for candle close + 1 confirmation candle.

Q6: MultiLevel = 1, 2, or 3?

Level 1 = strictest. Level 2 = recommended for most. Level 3 = sideways market. Start with 2, adjust based on signal count.

Q7: Works for crypto?

Yes with adjustments: increase MinHuntPips (based on ATR), increase Lookback, Adaptive = true (required). Note: crypto has "wash trading" → combine with Quality + Volume filter.

Q8: How to know settings are good?

Backtest 1 month (20+ trading days). Target: Win rate >60%, 1-5 signals/day (M15/H1), avg R:R >1:2. Too low win rate → settings too loose. Too few signals → too strict. Too many → too loose.

Q9: Show Lines and Labels?

Learning (1-3 months): ENABLE both. Proficient: disable Lines, keep Labels. Live trading: Labels ON for quick decisions.

Q10: Compatible with SMC (Smart Money Concepts)?

Absolutely! StoplossHunt Filter automates Liquidity Sweep / Stop Hunt. Combine with Order Block, FVG, BOS for a powerful automated SMC system.

SMC + Hunt workflow: (1) Identify Order Block on H1/H4 → (2) Wait for price to return → (3) Hunt + reversal pattern at OB → ENTER.

9. Conclusion

StoplossHunt Filter helps you filter out 70-80% of junk signals, only trade when Smart Money has acted, and increase win rate by 15-25%.

Remember: Hunt is necessary but not sufficient. Combine with other filters, maintain strict risk management, and don't FOMO.

Next steps:

- Load indicator onto chart

- Set according to recommendation table (section 8)

- Observe 1 week (no trades, just watch)

- Demo backtest 2 weeks

- Live trade with small lots

Wishing you successful trading!

Author: Ich Khiem Nguyen Version: 1.0 Last updated: 2026-02-11