How to choose the best time to launch an Automatic Trading System or subscribe to a Signal

When we plan to launch a trading system, the question always arises: How to choose the best time to start?

It's never pleasant to launch a trading system or subscribe to a trading signal and immediately find yourself in a huge drawdown! Sitting in the red is always unpleasant. Trading system drawdowns are difficult to predict. Therefore, the rule always applies: the larger the safety cushion, the more likely we are to survive the bad times and our trading system will lead us to a new account balance maximum. I've repeatedly observed how a trading strategy can increase its profitability severalfold after significantly increasing the drawdown.

Choosing the right entry point helps reduce drawdowns and start making profits faster. As a bonus, trading will be less stressful.

Let's move on to practice

The performance chart of successful trading systems that don't use martingale or averaging is similar to the chart of growing assets. Highs and lows alternate. Successful systems will have increasingly higher lows. Our goal is to initiate trading as close to these lows as possible (during drawdowns). Three possible outcomes follow.

- If, after our start at the moment of drawdown, the system produces a new maximum, we will earn very well.

- If the system fails (the minimum is followed by another, even lower one), we will still be forced to accept this loss. Unfortunately, there are no super-high profits without risks.

- We're unlucky, and the drawdown will continue. But thanks to the right starting point, we'll have enough reserves to ride it out, and we'll soon see a new high in our trading account balance.

How to determine the best starting point

When testing our own automated trading system, it's always logical to first test it on a real account with a minimum lot size. Adding your account to the monitoring system is very easy and risk-free. Reliable automated trading systems sold on the MQL Market must also have monitoring (a live signal from a real account). Therefore, to analyze the best starting point, we will use the MQL5 "Signals" service interface.

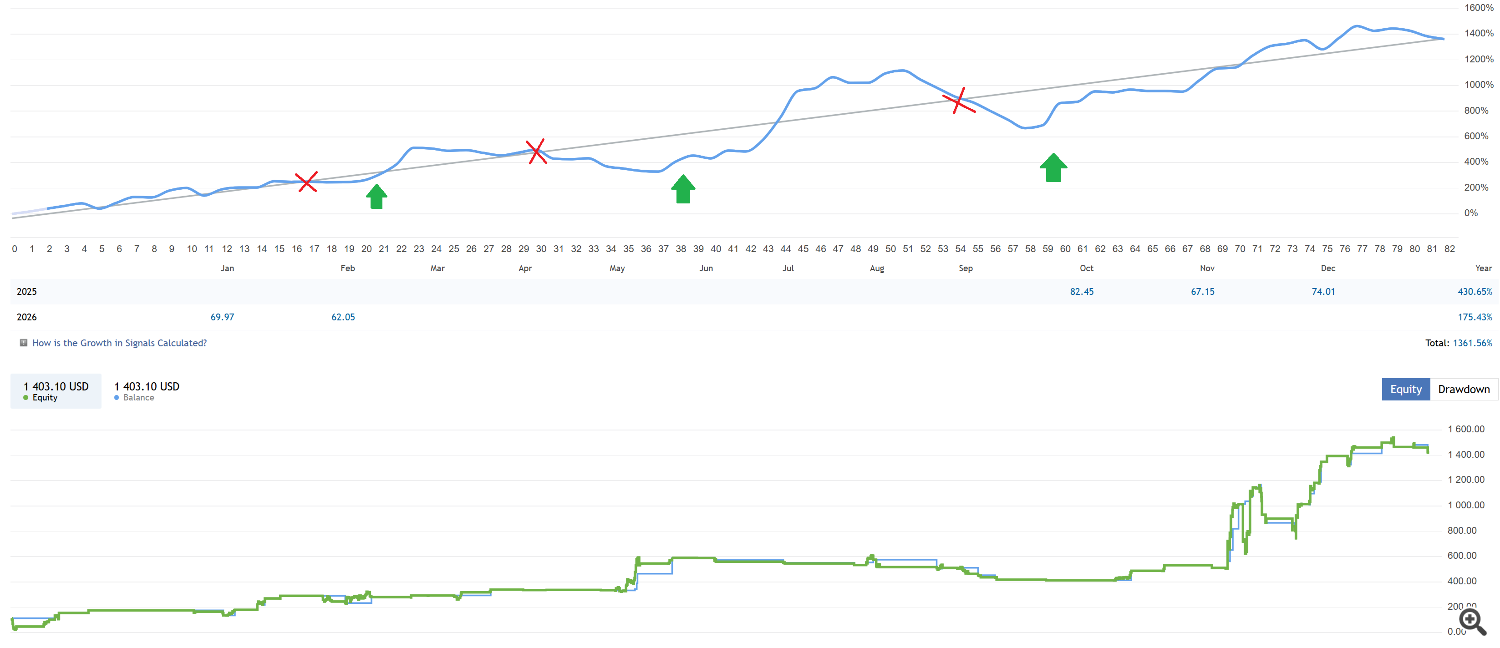

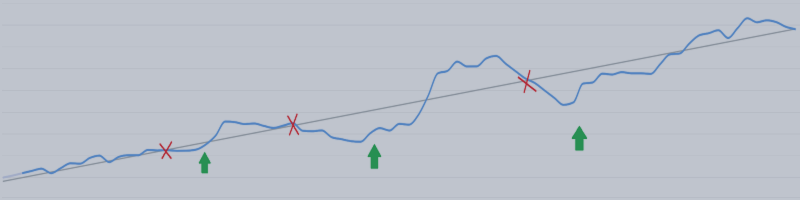

Let's look at an example of correct and incorrect places to start trading using the GoldBaron expert advisor. The screenshot is taken from this signal .

- Wait for the system to enter a drawdown phase. A good indicator would be a downward breakout of the average balance line.

- Wait until the system starts earning again. Only then should you begin trading.

How else can this concept be used?

- Increase trading volume only during the next drawdown

- Build a trading system based on an existing one. Execute trades only when the indicator system is in a drawdown.

Conclusions

Choosing a starting point isn't about guessing the future or "getting in at the bottom." It's about managing psychological capital and mathematical expectation.

The main mistake most traders make is impulsively starting at the peak of profitability. These points look attractive on the monitoring chart, but statistically, they represent the areas with the highest risk of a rapid drawdown.

The main principle we have established is:

A successful trading system doesn't require a "perfect entry." It requires confirmation of recovery after the drawdown.

A practical algorithm to get started:

-

Don't enter on high. If the system has just updated its balance maximum, skip the trade. This is the exhaustion zone.

-

Expect a drawdown. The system must “exhale” and break through the middle balance line.

-

Wait for the first turn. The true entry point is not at the very bottom, but at the moment when the system began to rebound from the lows and showed the first upward impulse.

Bottom line: The best time to start isn't when "everyone is making money," but when most of those who have lost faith have ended up with losses, and the system has technically confirmed its readiness to grow again. At this point, you have the shortest distance to a new high and the greatest safety net.