Big news came up on Sep 1st 2023. MFF - My Forex Fund - was shut down and was accused for fraud. Many of us have been wondering:

I thought they were nice and lovely bros helping everyone making tons of moneys in the Forex market?

Remember my earlier post about the Forex Game rules? 🙈

Let's have a look at the official CFTC charges stated in this document. There are quite a few interesting points in there.

CFTC charge 1: False promise

They assured customers that “your success is our business,” and “we only make money when you do.” But, in reality, Traders Global—not a third-party “liquidity provider”—is the counterparty to substantially all customer trades.

This means, that they told us that they help us but in reality they played us. Ok, I thought. Someone misinterpreted the vision statement of the company maybe? 😄

CFTC charge 2: AI and Automation to Play the Customers

Take a deep breath and read through this slowly:

Traders Global actively minimizes the likelihood that customers trade profitably by using pretexts to terminate customer accounts, misleadingly assessing commissions that reduce customer account equity, secretly using specialized software to cause customer orders to be executed at worse prices than appeared to the customer at the time an order was sent, and handicapping the extremely small number of successful customers to decrease customer profits and increase customer losses.

What can I say? It feels like the image below.

(Image: Bender is wearing X-Ray glasses, can see all the cards and wins all Poker rounds)

3. Money collected at Scale

135,000 customers have signed up for their trading program since November 2021, paying at last $310 million in fees.

That is $2296 per client in average. I am not sure if the payouts are already part of it. It won't be much with max 5% of successful traders.

Court Documents from New Jersey

The document is getting into more details. You need to see this! I will just place a few screenshots from the document and let you enjoy the read.

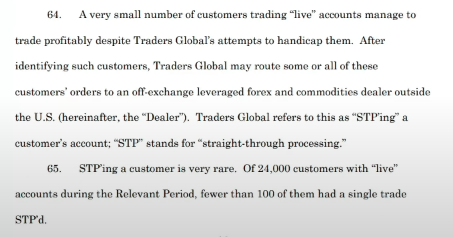

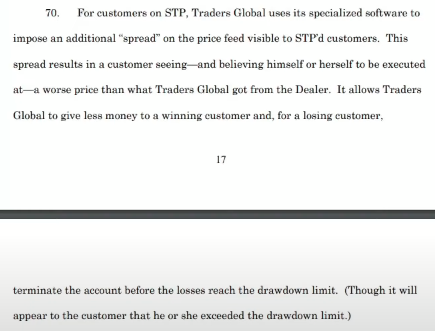

And one more interesting quote:

Customers whose trading generates consistent profits, however, are subjected to longer delays and increased slippage, implemented by Traders Global.

In 100 of 24000 funded accounts, MFF really routed the trades to the real "Dealer". But MFF changed the prices which appeared to the customer on MetaTrader. So they always cut a slice from the "real trades" between the customer and the Dealer (real broker).

Consequences

I hope many Prop Firms will wake up now and eventually disable their "virtual delay and slippage" parameters. I also assume that some prop firms will move further away from US or EU regulations where doing nasty stuff is less painful. So at the end, it is very hard do measure if the prop firm is adding slippage of delay to your trades and the rules of the Forex trading game remain the same.

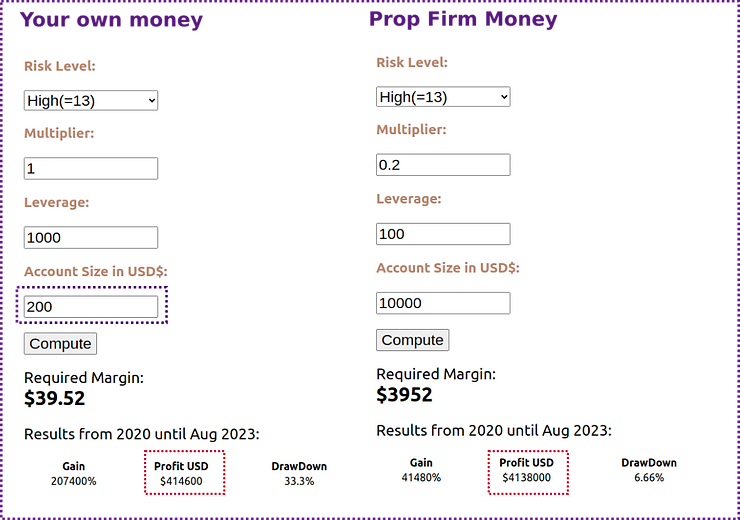

If you really like to trade with high leverage, consider to trade with a 1:1000 leverage some brokers offer.

From the AI for Gold Documentation, I used the interactive calculator to estimate what is better: Trading Prop Firms or trading own money? I compared tha case when trading your own money $200 with 1:1000 leverage against buying a $10000 account for $200 at some prop firm:

The final profit in USD is $414,600 with own money and $413,00 with propfirm. Where the fee of 10% or more is not removed yet. And of course, past performance does not guarantee future results. But in our case Ai for Gold was holding its promises since March 2023.

Discover AI for Gold now and lean back while the EA grows your small account for a year or two without hussle or stress.