Best kept secret in the Forex game - your broker does not want you to know!

When trading forex, we speculate on the future direction of currencies, opting for either a long ("buy") or short ("sell") position based on our belief in whether a currency pair's exchange rate will rise or fall.

Price movements in the forex market are triggered by currencies either strengthening (price appreciation) or weakening (price depreciation).

Our ability to open AND close trades is limited to the prices that our forex broker offers, as there is no other market for these trades.

So now the question is...

Where do the Forex prices actually originate from?

Is it possible that the forex broker simply invents them?

While this is a remote possibility, it's highly unlikely.

You might be taken aback and wonder, "Wait, is it really possible?"

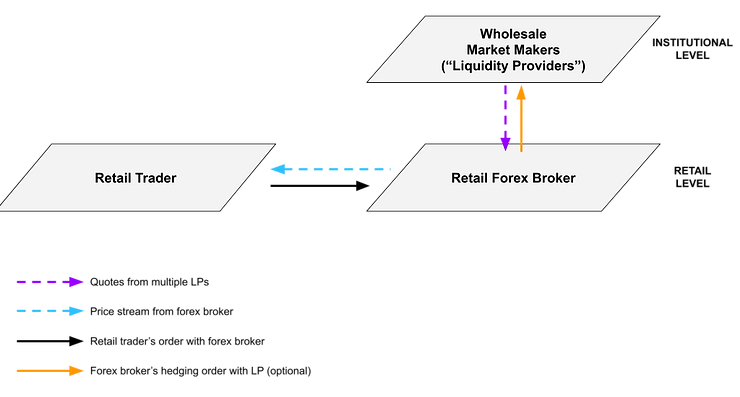

Here's something you might not know: as a retail trader, you are unable to participate in the institutional or "interbank" FX market. Due to being considered "uncreditworthy" or "too poor," you need to seek out a retail forex broker if you wish to speculate on currency exchange rates.

To facilitate your trades, the forex broker creates a forex market for you, usually in the form of CFDs (if you're outside the U.S.) or rolling spot FX contracts (if you're in the U.S.), collectively known as retail "FX contracts."

What does it all mean?

-

In Forex trading, brokers can choose their own prices, and regulations might not protect you from this.

-

You don't know for sure if your broker is changing the prices and how they do it, which can be worrying.

-

However, it's important to understand that the overall mid-term trend should align with the market. If not, brokers could face significant risks, especially if the arbitrage opportunities become too high.

These contracts involve only two parties: you and the forex broker.

Since these contracts are designed and provided by the forex broker, it technically has the flexibility to quote bid and ask prices as it sees fit, and it's up to you to decide whether to trade at those prices.

How and from where a forex broker sources its prices is entirely at their discretion.

On its trading platform, the broker may display prices derived from external sources, or it may not.

This implies that the prices offered by your forex broker may or may not align with prices available elsewhere, such as from another forex broker.

You might wonder why this is the case. Shouldn't the prices quoted by the forex broker be identical to the prices in the underlying (institutional) FX market?

Herein lies the issue.

In the FX market, each currency pair does not have a single "market price."

The FX market operates as an "over-the-counter" or OTC market.

In an OTC market, there is no centralized "location" where all market participants gather and have access to the same uniform market price.

How Retail Forex Brokers Source Their Prices

Reputable and larger forex brokers will base their price on the prices of other FX participants, usually banks and other non-bank financial institutions (NBFIs) from the institutional FX market.

These market participants are known as liquidity providers (LPs).

A group of liquidity providers (LPs) is known as a liquidity pool.

It is these prices that the forex broker uses as a REFERENCE price of an underlying currency pair. Or at least, should be using.

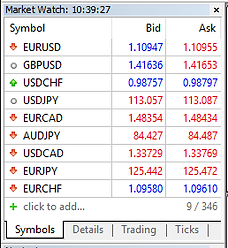

As mentioned earlier, a forex broker will quote you two different prices for a currency pair: the bid and ask price.

You see these quotes on your trading platform (or “customer terminal”). These quotes arriving are known as a “price stream”.

The price that YOU see is based on prices that your broker obtains from these liquidity providers.

The broker has a pool of multiple LPs from which it receives pricing for the various currency pair it offers.

The forex broker aggregates or collects these prices in real-time to find the best available bid and ask price.

Both prices do not necessarily have to come from the same LP. For example, the best available bid price may come from one LP, while the best avaiable ask price may come from another LP.

The aggregated prices are fed into a “pricing engine” which streams prices (your “price stream“) to your trading platform.

Just because two traders use the same broker, it doesn’t automatically mean they both see the same bid and ask prices in their price stream. Different customers may be quoted different prices. It depends on how brokers profile their customers and if the price engine is configured to vary pricing by profile. This is konwn as “price discrimination“. Ask your broker if it price discriminates between customers.

What does it all mean?

-

In Forex trading, brokers can choose their own prices, and regulations might not protect you from this.

-

You don't know for sure if your broker is changing the prices and how they do it, which can be worrying.

-

However, it's important to understand that the overall mid-term trend should align with the market. If not, brokers could face significant risks, especially if the arbitrage opportunities become too high.

What can we do about it?

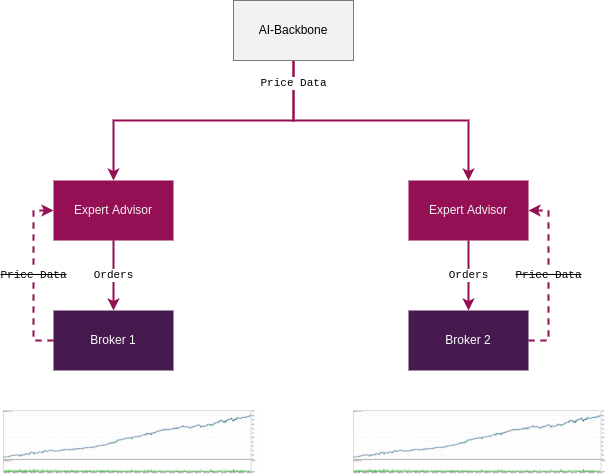

First of all, do not expect a regular Expert Advisor trading bot to perform same on all brokers! They don't and they can't. This is where MQL is rather on the side of the broker providing them with tools to minimize the risk (for the broker) of too successful EAs. There is no possibility for developers to optimize the over different accounts (brokers).

But there is hope😊

Imagine an Expert Advisor is not using the price data from the broker but from an external source to make decision upon. Some source, which is not affiliated with the broker interests. And imagine, an Expert Advisor would open and hold positions over a few hours - a time span where the broker is not able to deviate from the overall market.

Wouldn't that be a beautiful solution for us traders? Yesss.

This is exactly what I introduced in the latest release of AI for Gold. You can now apply it to any broker, any prop firm expecting 99% same results.

So while the previous versions of AI for Gold were optimized to work as robust as possible with different brokers, some brokers won anyway. For example RoboForex set thet size of one Poiint to 0.001 instead of 0.01 which breaks the AI model and all learned price statistics.

In this next phase, AI for Gold is becoming a predator. We are now above the brokers and we now really control our trading decisions without them meshing around in our "AI-Brains". 🧘

Get similar articles automatically to your inbox: