Hidden Truth: A Guide to Evaluating Expert Advisors in Today's Market

The world of trading is flooded with a myriad of promising Expert Advisors (EAs) vying for attention. Each one touts its exceptional qualities and strives to present itself in the best possible light. Yet, for buyers seeking a reliable and profitable EA, the task of comparing and making an informed decision has become increasingly challenging.

The real challenge lies in the concealed nature of an EA's true reliability, as vendors often keep vital information under wraps. However, fear not, a breakthrough method has emerged to uncover the genuine trustworthiness of each EA - an analysis focused solely on its live trading signals.

In this article, we will delve into the perils of relying on martingale strategies and the dangers associated with adding new positions while prices continue to plummet. Many traders, after testing various EAs and strategies, have come to a resounding conclusion: this approach is highly dangerous and inevitably leads to blown accounts over time.

To compound matters, EA authors have mastered the art of deception by cleverly disguising their strategies. They swiftly delete blown signals and replace them with new ones. As long as the new account remains intact - be it for a month or even a year - they shamelessly market the EA, leaving unsuspecting buyers in the dark about its true risks.

But how can we detect if an EA genuinely employs martingale and averaging techniques? And if it does, how dangerous is its configuration? In this comprehensive guide, we will unravel these mysteries and equip you with two indispensable tricks to accurately evaluate the true nature of an EA.

Prepare to uncover the hidden truth as we embark on a journey to decode the intricacies of Expert Advisors and empower you to make informed decisions in today's complex trading landscape.

Secret 1: The Many-At-Once-Close Pattern

The closing times of positions provide valuable insights that can be found under the "Trading History" section of a signal. When multiple positions are closed simultaneously, and some of them result in losses, it should serve as a red alert.

This scenario indicates that the EA is employing a dangerous tactic of adding funds to a losing position as long as there are available resources. However, it is crucial to recognize that this strategy holds a significant risk. Extensive research conducted by numerous scientists over time has led to a unanimous conclusion: if an EA utilizes such a strategy, it is inevitable that one day, a novel market movement will emerge, ultimately leading to the depletion of your invested funds.

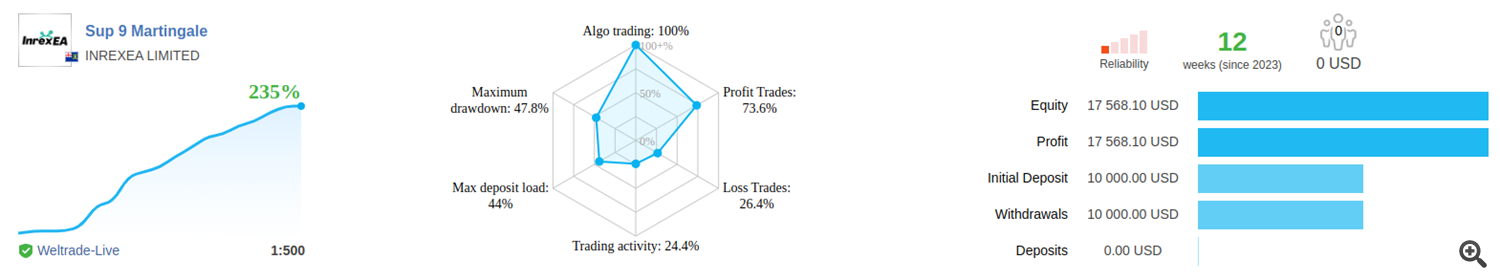

Example: Sum 9 Martingale EA

You can find this EA here and buy it for 3250$.

Upon initial examination, this EA appears to be highly profitable and capable based on its performance. However, to gain a more comprehensive understanding, let's delve deeper into its details.

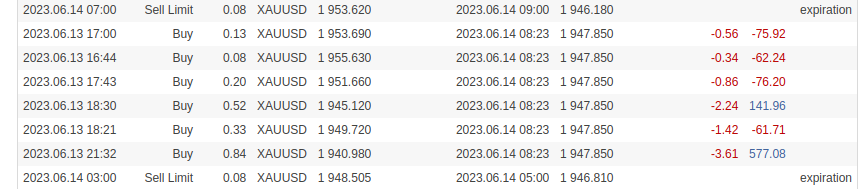

When we open the "Trading History" section, a noteworthy observation emerges - a series of positions exhibiting a recurring pattern known as Many-At-Once-Close.

Analyzing this block of data reveals that the EA commenced with a position size of 0.08 lots and gradually increased it to 0.84 lots. While this scaling may be acceptable for an account size of $17,000, it raises concerns for smaller accounts.

It is important to consider the implications of such position sizing, as it may not be suitable or viable for accounts with more limited capital. A prudent approach involves assessing the compatibility of an EA's trading strategy with your specific account size to avoid potential risks and account depletion.

Secret 2: Stop Loss to Take Profit Relation

When employing a strategy that aims to earn a mere $1 while tolerating a drawdown of up to -$100, a deceptive phenomenon occurs. Such a strategy will endlessly wait for positions to turn profitable, misleadingly maintaining an upward balance curve that never declines.

The question then arises: how can we uncover the true Stop Loss (SL) and Take Profit (TP) ratio of an EA? Fortunately, Live signals provide a valuable tool known as the Maximum Adverse Excursion (MAE) graph. Despite the lack of official documentation on its interpretation, it holds immense significance for MQL users like myself.

A bad EA would close a position with a profit only after it has endured significant drawdown. This results in the dots on the MAE graph appearing on the right side of the vertical axis, deeply descending into negative territory.

Conversely, a good EA exhibits a more favorable approach. It closes positions before they encounter substantial drawdown, ensuring that the profit exceeds the vertical distance from the horizontal axis.

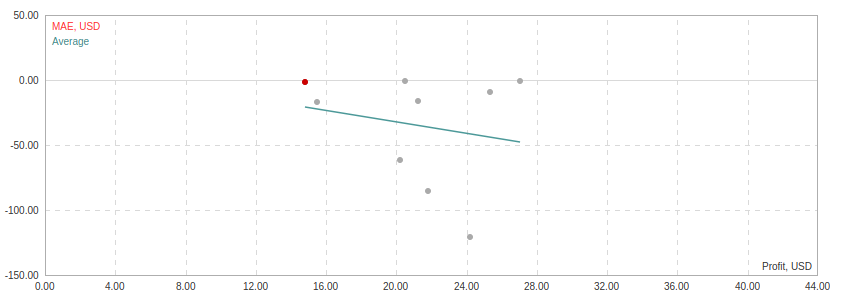

Example: Top Secret EA

You can find this EA here and buy it for 1250$

With an impressive track record of no losing trades over a span of 5 weeks, the EA certainly garners attention. However, it is crucial to delve deeper and examine its Maximum Adverse Excursion (MAE) graph to gain a comprehensive understanding of its risk profile. To access this information, we click on the "Risks" tab and scroll down for analysis.

Upon studying the MAE graph, a concerning revelation comes to light. In order to generate a profit of $24, the EA accepted a substantial drawdown of -$120. Considering the current account size, this drawdown represents approximately 30% of the entire account. Such a significant risk exposure raises valid concerns about the EA's long-term viability.

It becomes evident that there is a possibility, in the future, for the EA to either experience a catastrophic blowup or incur high losses exceeding 30% !. Additionally, there is a chance that the vendor may create a new signal to conceal such an event.

While these assumptions may be subject to interpretation, only time will truly reveal the validity of these concerns. It is crucial to remain vigilant and monitor the EA's performance closely to assess its ability to withstand market fluctuations and deliver consistent profitability.

By understanding and analyzing these contrasting variants, we can gain valuable insights into an EA's risk management capabilities and make informed decisions about its suitability for our trading endeavors.

Supercharge your trading reliability by subscribing to my articles and receiving automatic updates straight to your inbox.