EUR/USD: ECB needs to take further action to contain inflation expectations

European Central Bank spokesman Joachim Nagel said yesterday that the ECB needs to take further action to contain inflationary expectations, i.e. continue to tighten their monetary policy.

As for today's economic calendar, at 13:00 (GMT) will be published a preliminary harmonized consumer price index HICP for Germany. The index (CPI) is published by the EU Statistics Office, is an indicator for assessing inflation and is used by the Governing Council of the ECB to assess the level of price stability. Under normal economic conditions, rising prices force the country's central bank to raise interest rates in order to avoid excessive inflation (above the target level of the Central Bank). Therefore, the growth of the indicator is a positive factor for the national currency (in normal conditions), and the decline in the indicator (as expected, to 10.7% from 11.3% in November) is negative.

At the beginning of the American trading will be published revised index of business activity PMI in the US manufacturing sector (from S&P Global). The previous values of the PMI indicator in the manufacturing sector were 47.7, 50.4, 52.0, 51.5, 52.2, 57.0, 59.2. The forecast for December is 46.2 (preliminary estimate was 46.2), which indicates the ongoing slowdown in this sector of the American economy and this is a negative factor for the dollar.

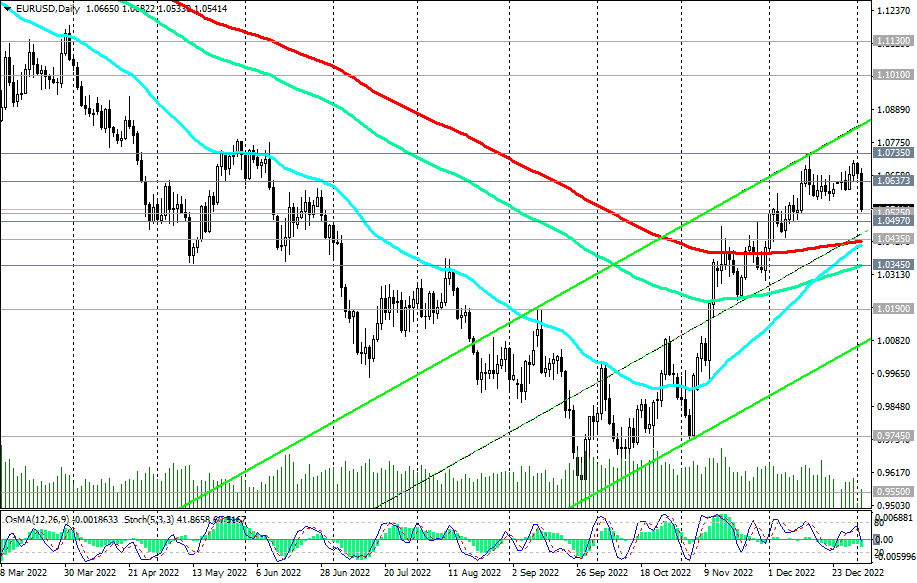

In an alternative scenario, EUR/USD will reach a key support level 1.0435. But most likely - this is a story for 2-3 days. On Friday (at 10:00 GMT) Eurostat will publish data on retail sales and consumer inflation in the Eurozone, and at 13:30 the US Department of Labor will publish a monthly report with key data on the US labor market for December.

Is it worth reminding once again how strong the movement in EUR/USD is expected this Friday? The level of 1.0435 in this situation will act as a kind of watershed separating the long-term bullish trend of the pair from the bearish one.

*) for important events of the week, see the Most Important Economic Events of the Week 01/02/2023 - 01/08/2023, as well as in our yesterday's review "Dollar: important publications in the first days of the new year".

Support levels: 1.0525, 1.0497, 1.0435, 1.0345, 1.0300, 1.0190, 1.0000, 0.9745, 0.9700, 0.9600, 0.9550, 0.9500

Resistance levels: 1.0557, 1.0600, 1.0637, 0.0700, 1.0735

- details - https://www.instaforex.com/ru/forex_analysis/331379/?x=PKEZZ

- or https://www.instaforex.com/forex_analysis/331379/?x=PKEZZ

- signals -> https://www.mql5.com/en/signals/author/edayprofit

- link to third party Live-monitoring –> myfxbook.com/members/FxForward

- see also “Technical analysis and trading recommendations” -> https://t.me/fxrealtrading