Forex Forecast and Cryptocurrencies Forecast for February 15 - 19, 2021

First, a review of last week’s events:

- EUR/USD. It often happens that monthly forecasts come true faster than weekly ones. That was what happened this time as well. Recall that only 30% of experts expected the EUR/USD pair to grow in the weekly perspective. In the transition to the monthly forecast, those were in majority already, 60%.

We started talking about the paradoxes of the relationship between stock indices and the dollar seven days ago. With the outbreak of the pandemic at the end of last February, an inverse correlation was clearly visible between them: thanks to fiscal stimulus (QE), lower interest rates and pumping the US economy with cheap money, the S&P500, Dow Jones and Nasdaq stock indices went up, and the DXY dollar index - way down. And that was logical.

And here came 2021, and everything turned upside down. Against the backdrop of good economic data and expectations of a new injection of financial "vaccine" for almost $2 trillion, the growth of risk sentiment and stock indices continued. But in parallel, the yield of long-term US Treasury bonds and the dollar grew.

But the surprises with overturns did not end there. Based on the same fiscal incentives and rapid vaccination in the United States, Wall Street Journal experts are raising their forecasts for US GDP for 2021 from 4.3% to 4.9%. In Europe, the opposite is true: there are a lot of delays with vaccination, the EU countries, one after another, are tightening anti-covid measures once again, there is no end in sight to lockdowns. As a result, the European Commission lowers its forecast for the Eurozone economy to 3.9%. But at the same time, the euro is growing, and the American currency is falling.

According to a number of experts, it's all about the long-term policy of the US Fed, which is not going to wind down the QE program until the end of 2021 and will not raise interest rates on the dollar earlier than 2023. This should lead to the recovery of not only the American but also the global economy, including the EU, making the euro a reasonably attractive currency for some, primarily Chinese, investors. China's interests in Europe are great, and appetites are constantly growing, which supports the demand for a pan-European currency.

As a result, having started at 1.2050, the EUR/USD pair rose by 100 pips and reached a weekly high at 1.2150 on Thursday, February 11. This was followed by a correction and a finish at 1.2120;

- GBP/USD. The released macro statistics looks quite contradictory. Due to the coronavirus pandemic, investment cuts and Brexit problems, UK GDP contracted 9.9% which is a record drop in more than 300 years. At the same time, monthly and quarterly GDP were better than expectations. GDP growth in Q4 2020 amounted to +1%. Industrial production figures were lower than forecasted, but the trade balance report pleased investors.

Solid monetary policy of the Bank of England, positive interest rate, and the first in Europe and third in the world (after Israel and the UAE) in terms of vaccination rates also played on the side of the pound. At the time of writing this review, 20.67% of the country's population was already vaccinated (the figure in the USA is 14.02%).

Recall that the majority of analysts (65%) also sided with the British currency. The main forecast assumed that the pair would succeed, having broken through the resistance at 1.3750, to rise to the height of 1.3800, and possibly 25-50 points higher. And so it all happened: the high of the week was fixed at 1.3865, and the last chord of the GBP/USD pair set at 1.3850.

- USD/JPY. The movement of this pair in most cases depends on what is happening not in Japan, but in the United States, on where stock indices, as well as the yield of American state bonds and the DXY dollar index are moving. This happened last week as well.

DXY climbed to 91.21, USD/JPY grew to 105.66 on February 8. On February 10, the dollar index dropped to 90.26, followed by a bottom at 104.40. On February 12, we see an increase in the DXY to 90.71 and an increase in USD/JPY to 105.17, then a slight drop: in the index to 90.39, in the pair to 104.95. So, if anyone wants to try the DXY as a leading indicator for this pair, they can try it;

- cryptocurrencies. At the end of 2020, Forbes compiled a list of the wealthiest representatives of the cryptocurrency business with capitals of over $1 billion. The top three included Coinbase CEO Brian Armstrong with $6.5 billion, FTX head Sam Bankman-Fried with $4.5 billion and Ripple co-founder Chris Larsen with $2.9 billion. In total, Forbes counted 11 billionaires, although, given the rise in the price of digital assets in January-February, there may have already been more of them. Suffice it to say that the total cryptocurrency market capitalization increased by 87% in less than a month and a half in 2021, from $776 billion to $1,452 billion.

The past week was one of the most successful this year. The rally began with the news that Tesla bought $1.5 billion of bitcoins. At the same time, its head, Elon Musk, said that he plans to sell cars of this brand for cryptocurrency in the near future. Bitcoin went up in price by 23% on this news, on February 8.

But this did not end there. Global payments giant MasterCard has announced that it plans to provide merchants with the ability to receive payments in cryptocurrency starting later this year. As a result, bitcoin once again renewed all-time highs, reaching $48,930 in the afternoon of Friday, February 12. The capitalization of BTC has risen to $885 billion at the moment and exceeded the volume of the money supply of such a large country as Russia, for the first time.

The Crypto Fear & Greed Index has reached 92 (it was 81 a week ago) and is in the overbought zone. At the same time, the BTC Dominance Index has decreased from 70.36% to 61.06% since the year started. But, according to many experts, this does not indicate a deterioration in investor attitudes towards bitcoin, but an improvement in their attitude towards altcoins.

So, the Chicago Mercantile Exchange (CME) launched trading in Ethereum futures on Monday, February 08. The turnover reached $30 million on the very first day, and the open interest - $ 20 million, which indicates the stable interest of investors in this token. The capitalization of ETH has increased by 32% since the year started and amounts to more than $203 billion as of February 12.

Another top coin that we have already paid attention to in the previous review is Litecoin. Over the past three months, aggregate open interest in LTC futures has grown by 285% to $584 million. And, although the share of Litecoin in the total cryptocurrency market capitalization is quite small (8th place with 0.85%), it now occupies an honorable 3rd place among derivatives after bitcoin and Ethereum.

***

As for the forecast for the coming week, summarizing the views of a number of experts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

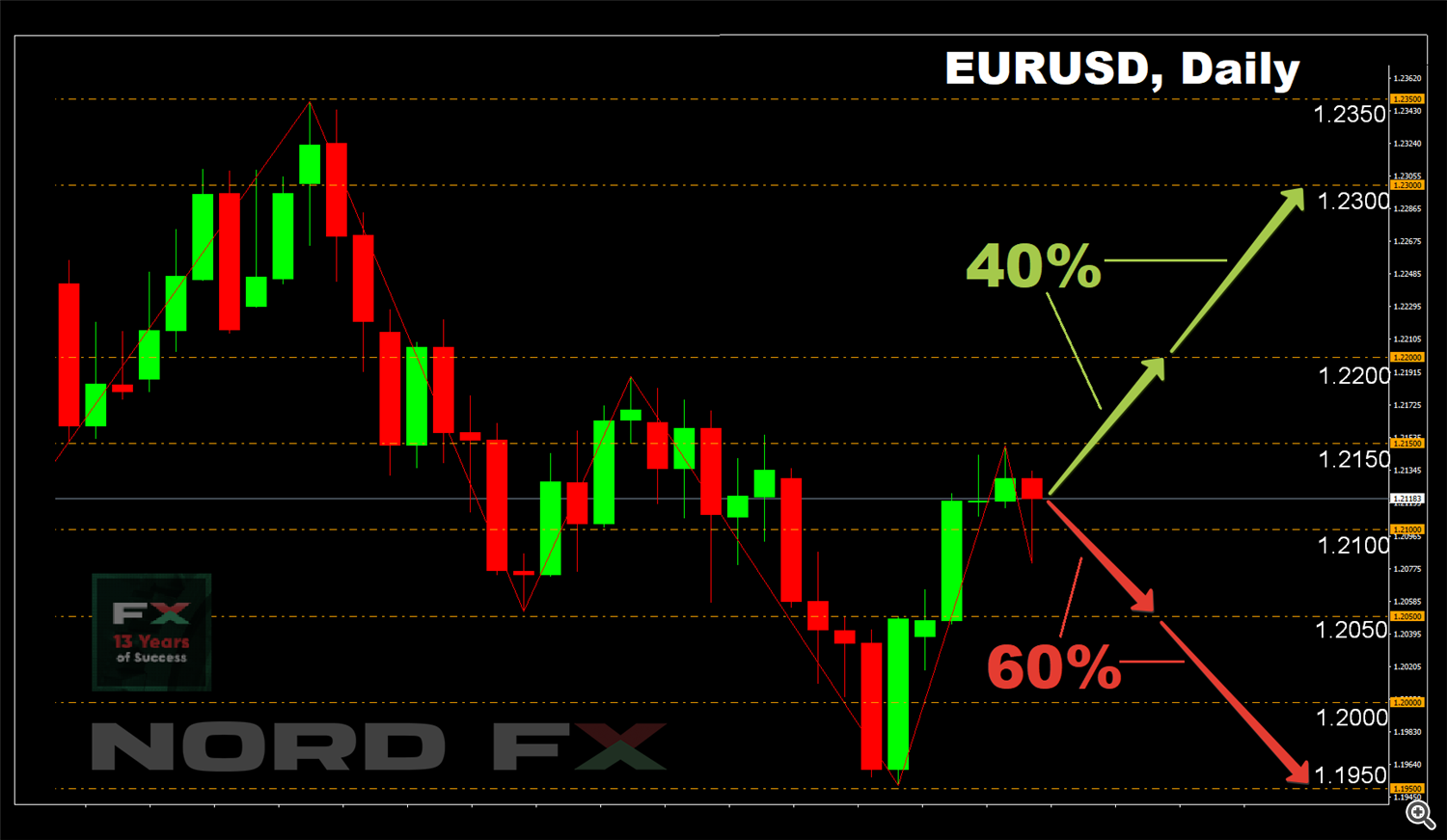

- EUR/USD. Throughout the coming week, China is celebrating the New Year, which will cause a significant portion of trade volumes to leave the global markets. However, this does not at all promise a calm or a decrease in volatility. Although right now, investors are at a crossroads. US stock indices, after a powerful upward leap in January, have gradually moved to consolidation and look overbought. No surprises are expected from the Fed any time soon, and the report of the Open Market Committee meeting on Thursday February 18 is likely to be boring enough. On the same day, the report on the ECB meeting on monetary policy will be released, but it will be highly likely filled mostly with general streamlined phrases. Therefore, the main drivers for the EUR/USD pair will again be news about the successes in the fight against the Covid-19 pandemic on both sides of the Atlantic Ocean.

As for experts, 60% of them, together with graphical analysis for H4 and D1, expect the pair to decline, at least, to support 1.2050. In case of a breakout, the next target for the bears will be the February 05 low at 1.1950. The nearest support is in the 1.2100 zone.

40% of analysts adhere to the opposite scenario. However, when moving from weekly to monthly forecast, the number of bulls' supporters increases to 60%. 85% of trend indicators on H4 and D1 are also painted green. But the readings of the oscillators on both timeframes cannot be analyzed: there is complete chaos of red, green and neutral gray colors there. The nearest resistance level is 1.2150. The bulls' targets are first a return of the pair to the 1.2200-1.2300 zone, and then the January high at 1.2350.

As for the economic calendar of the week, in addition to the already mentioned meetings of the Fed and the ECB, we are waiting for: on Tuesday, February 16 - data on GDP of the Eurozone, on Wednesday, February 17 - data on retail sales in the United States (a noticeable increase from -0.7% to + 0.7% is expected), and at the end of the working week, on Friday, February 19, statistics on business activity of Markit in Germany and the EU will be published (here, although not so noticeable, but still growth is predicted);

- GBP/USD. A quarterly GDP growth of 1% means that the country has every chance of getting out of the recession. The high rates of vaccination will also contribute to this (although there are concerns about new strains of coronavirus). Prime Minister Boris Johnson plans to unveil a plan to exit the quarantine towards the end of the month, or rather February 22, which should clarify the prospects for the recovery of the UK economy.

In the meantime, analysts' votes have been distributed as follows: the pound has reached 34-month highs, and 45% of experts believe that it would be time for it to stop and play back a little down. 20% vote for the continued growth of the pair, while the remaining 35% take a neutral position. 100% of trend indicators and 75% of oscillators on H4 and D1, together with graphical analysis on H4, point north, targets are 1.3900 and 1.3950. The remaining 25% of the oscillators give signals that the pair is overbought.

As for the graphical analysis on D1, it shows a rebound from the resistance of 1.3865 and the decline first to support in the zone 1.3700, then 1.3630 and 1.3575.

As for economic statistics, one should pay attention to data on the UK consumer market, which will be released on Wednesday February 17, and business activity in the service sector on Friday February 19;

- USD/JPY. Graphical analysis on D1 predicts the movement of the pair in the channel along the Pivot Point 104.85 during the month. Moreover, it will first rise to the upper border of the channel at 105.75, and then descend to its lower border at 104.40. On H4, the oscillation amplitude is naturally less, from 104.85 to 105.30.

Apart from the green colored 75% of the trend indicators on D1, the readings of the other indicators and oscillators look quite confusing. It is also difficult to draw any conclusions from the opinions of experts, who are divided almost equally: 40% for the growth of the pair, 30% for its fall and the same amount for the sideways movement.

The GDP data for the IV quarter of 2020, which the Japanese Cabinet of Ministers will publish on Monday February 15, may somehow influence the formation of the short-term trend of the USD/JPY pair, especially if this indicator differs greatly from the forecasted +2.3%;

- cryptocurrencies. We wrote about bitcoin's readiness to storm the $50,000 high two weeks ago. And its rise to $48,930 on February 12 is a clear confirmation of the correctness of this forecast, which is supported by 80% of experts in a monthly perspective.

The growth of bitcoin and other top coins pulls up the entire crypto market. Its members look forward to following the example of Tesla and MasterCard and other S& P500 companies listed on the NYSE to announce their readiness to work with digital assets. As, for example, did the Bank of New York Mellon, which said it would allow digital currencies to pass through the same financial network that it uses for traditional financial assets.

The fact that every company in America will soon follow the example of Tesla, was mentioned by the founder of the crypto bank Galaxy Digital Mike Novogratz in an interview with Bloomberg. According to the billionaire, this will help bitcoin grow to $100,000 by the end of this year.

In the longer term, the BTC/USD pair may rise even to $600,000. At least, this is the opinion of specialists of the financial and investment company Guggenheim Partners. According to the company's investment director, Scott Minerd, everything will depend on the number of coins in the public domain. “Cryptocurrency can rise to very high values. It is possible that we are talking about 400 or even $600,000 per coin... Bitcoin used to be unjustified for institutional investors, but now everything has changed,” Minerd said.

According to the specialist, the concern is caused by the rapid growth of the asset in the past few weeks. It is possible that we are talking about speculation in which institutional investors are involved, capable to manage the value of the coin with the help of large investments. So far, bitcoin is in a difficult situation, as the departure of large depositors will lead to a return of the negative trend. This development of events is unlikely, says the director of Guggenheim Partners, but it should definitely be taken into account.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

#eurusd #gbpusd #usdjpy #Forex #forex_forecast #signals_forex #cryptocurrency #bitcoin