The volume of consumer lending in the UK in April rose sharply after a period of weakness in March.

The data published on Thursday pointed to the strongest growth in unsecured consumer lending for almost 18 months. Unsecured consumer lending jumped to 1.8 billion pounds in April after falling to 400 million British pounds in March.

This signal can affect the Bank of England and convince in the need to raise the key interest rate in the coming months.

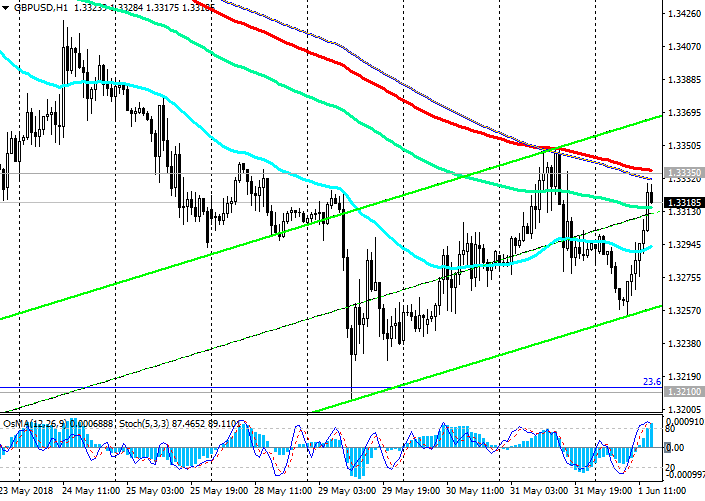

On Friday, the pound gained additional support after the index of supply managers (PMI) for the UK manufacturing sector, which in May exceeded the forecast of 53.5, to 54.4, was published at the beginning of the European session.

The production growth accelerated to the highest level in the last year of the current year against the backdrop of the strongest growth in inventories over the entire 26-year history of observations and a sharp reduction in outstanding orders.

After the publication of the data, the pound strengthened, and the GBP / USD pair increased by 30 points relative to the opening price of today.

Meanwhile, the US dollar is trading almost unchanged, while investors are preparing to the publishing of important economic report at the end of the week.

The dollar index DXY, reflecting its value against the other 6 major currencies, today declined slightly at the beginning of the European session, to 93.95, after it reached its next annual maximum of 94.98 on Tuesday.

At 12:30 (GMT), the US Department of Labor will report on the most important indicators of the labor market in the US in May (Average hourly wage / Number of new jobs created outside the agricultural sector / Unemployment rate). Forecast: + 0.2% (against + 0.1% in April) / 188 000 (against 164 000 in April) / 3.9% (against 3.9% in April), respectively.

In general, the indicators can be called strong. If they coincide with the forecast or come out better, then this will have a positive effect on the USD.

Strong data will strengthen the likelihood of four Fed rate increases this year. In this case, the investment attractiveness of the dollar will grow.

According to some leaders of the Fed, "it is advisable to continue to tighten monetary and credit policy in order to avoid increasing risks for macroeconomic stability".

Thus, the different focus of the monetary policy of central banks in the UK and the US, as well as the uncertainty about Brexit, will further reduce the GBP / USD.

However, if the data prove to be worse than the forecast or market participants find the report on the labor market weak, then the dollar will inevitably fall.

In any case, it is often difficult to predict the market reaction to the publication of indicators. Often, a strong move to the one side should be followed by an equally strong rollback to the other side, since the data published earlier is often revised.

Probably the most successful trading position today will be to stay out of the market, at least, in this period of time.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

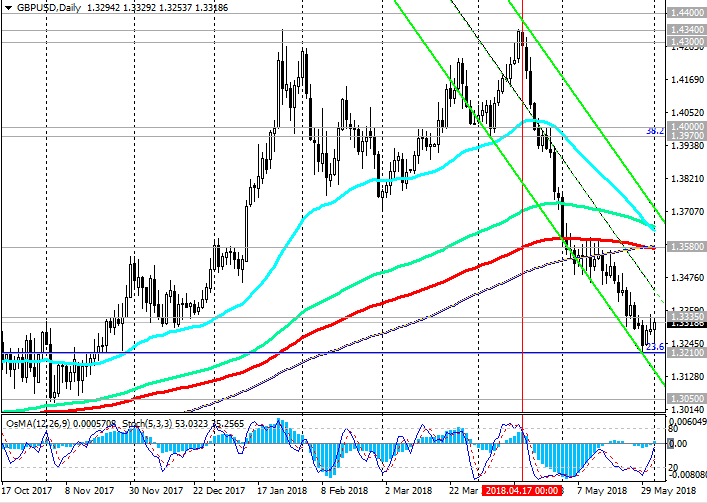

Support levels: 1.3300, 1.3210, 1.3050

Resistance levels: 1.3390, 1.3460, 1.3580, 1.3650, 1.3800, 1.3970, 1.4000

Trading Scenarios

Sell Stop 1.3290. Stop-Loss 1.3350. Take-Profit 1.3210, 1.3100, 1.3050

Buy Stop 1.3350. Stop-Loss 1.3290. Take-Profit 1.3390, 1.3460, 1.3580, 1.3620

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com