As reported by the Australian Bureau of Statistics on Thursday, the unemployment rate in April was 5.6% after 5.5% in March (the forecast was 5.5%). Nevertheless, other articles of the report were more positive, and the Australian currency strengthened. Thus, the number of jobs increased by 22,600 against the expected 20,000, the number of full-time jobs increased in April by 32,700, and the number of part-time jobs dropped by 10,000. Meanwhile, the proportion of economically active population in Australia in April was 65.6% after 65.5% in March and compared with the forecast of 65.5%.

Published on Wednesday, data showed that the growth rate of wages in Australia remained near the record low in the first three months of this year. Wage growth in Australia in the first quarter of 2018 was + 2.1% (in annual terms). The Reserve Bank of Australia pays much attention to this indicator when deciding on the interest rate. Low wage growth rates may prompt the Reserve Bank of Australia to not change interest rates for a longer period of time.

Since mid-2016, the RBA's key rate is at a record low of 1.5%.

Deputy Governor of the RBA Debell said that interest rates will not be raised until consumers' incomes rise. Economists believe that the first increase will take place only in 2019. However, interest rates may remain unchanged for an even longer time, given the weak wage growth and the slowdown in the Australian economy.

"The Board does not see any weighty arguments in favor of adjusting the key interest rate in the short term", - said in one of the latest statements of the RBA.

Economists also warn that due to the weakness of the housing market and the continuing weakening of housing prices in major cities, the RBA will not change rates until 2020.

If pressure on housing prices increases, it will undermine consumer confidence and lead to a slowdown in economic growth. And this, in turn, suggests a possibility of a decrease, rather than an increase in interest rates.

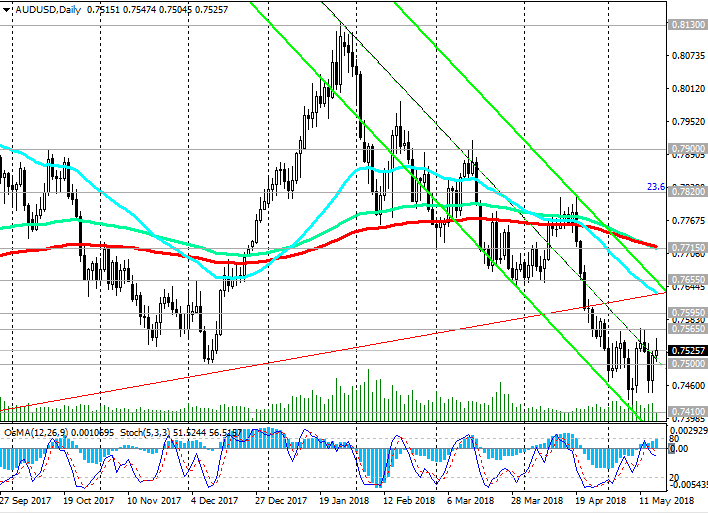

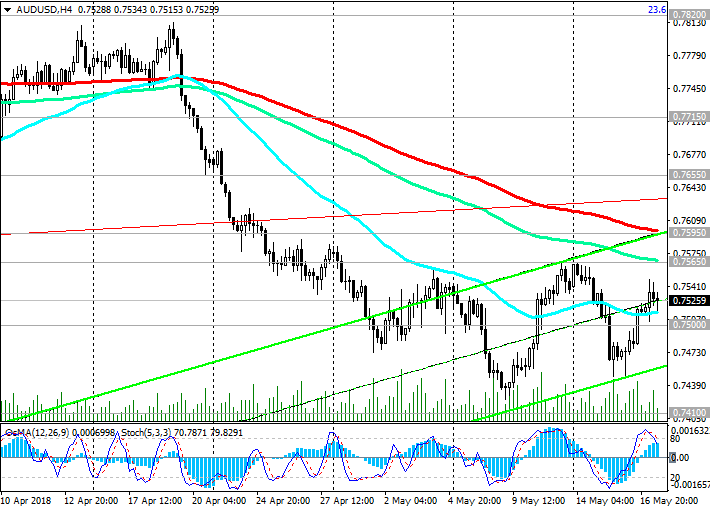

In general, the negative dynamics of the AUD / USD pair remains. The US dollar receives support from the growing yield of 10-year US government bonds, which reached a new high of 3.122% on Thursday.

The different focus of monetary policy of central banks in the US and Australia will be the main most important long-term factor in favor of weakening the AUD / USD pair.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support levels: 0.7500, 0.7410, 0.7330, 0.7155

Resistance levels: 0.7565, 0.7595, 0.7655, 0.7715, 0.7820, 0.7900, 0.8000

Trading Scenarios

Sell on the market. Stop-Loss 0.7570. Take-Profit 0.7500, 0.7410, 0.7330, 0.7155

Buy Stop 0.7570. Stop-Loss 0.7490. Take-Profit 0.7600, 0.7655, 0.7690, 0.7715, 0.7820, 0.7900, 0.8000

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com