The focus of traders today will be the publication (at 18:00 GMT) of the minutes from the March Fed meeting. At this meeting, the leaders of the Federal Reserve unanimously voted to increase the range of the key interest rate by a quarter of percentage points to 1.5% -1.75% and raised the forecast for the growth of the US economy for the next two years.

"The outlook for the economy has improved in recent months", the Fed said in an official statement following the meeting. The central bank expects GDP growth of 2.7% this year and 2.4% in 2019 against earlier forecasts of 2.5% and 2.1%, respectively, and predict annual inflation at 2,1% next year against 2% in the previous forecast. Investors were disappointed that the Fed confirmed the intention to raise another 2 times the rate this year. However, the new forecasts published after the meeting indicated that the Fed could accelerate the rate of rate hikes in order to cool down the economy after 2019. And this is now the main intrigue - how high is the probability that the Fed will make 4 rate increases this year, rather than 3, as it was planned earlier. In a statement by the Fed following the results of the March meeting, it was said that the risks appear to be approximately balanced.

Nevertheless, there was one significant negative factor. The leaders of the Federal Reserve took a cautious approach to the introduction of duties and other restrictions on trade with China. Investors now need to know how the Fed will react in the event of increased tensions.

It is likely that the number of supporters of a more balanced approach with regard to the rate of further rate increases may increase. It is characteristic that the president of the Federal Reserve Bank of Dallas Robert Kaplan said on Monday that this year he expects two more interest rate hikes. At the same time, he believes that in the coming years the rate of rate hikes will decrease due to a slowdown in the economy.

The aging of the population, the slow increase in labor resources, the slow growth of productivity, and the high level of public debt can become deterrents to GDP growth in the next few years, the president of the Fed-Dallas said. For this reason, the Fed should raise rates "gradually and patiently", he added.

On Monday, the Budget Office of the US Congress published its forecast, according to which the state budget deficit by 2020 will exceed the $ 1 trillion mark.

The recent tax cuts and the increase in budget expenditures create prerequisites for the growth of the federal budget deficit. In addition, the growing deficit of the US foreign trade balance, coupled with the trade conflict with China, makes investors cautious about buying dollars. The dollar remains under pressure, despite the Fed's rate hike.

Under normal conditions, tightening monetary policy of the Fed strengthens the dollar and leads to a decrease in gold quotations.

But at the moment, the dollar is getting cheaper, and gold is rising in price, as geopolitical risks, connected with the prospect of new trade wars, are brought to the forefront.

Perhaps, the trade conflict will not be aggravated, but it is too early to say about its completion. Volatility and negative dynamics of the stock market will continue, at least until the end of May, given the planned introduction of customs duties in the US. Against this background, the demand for gold will continue.

)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

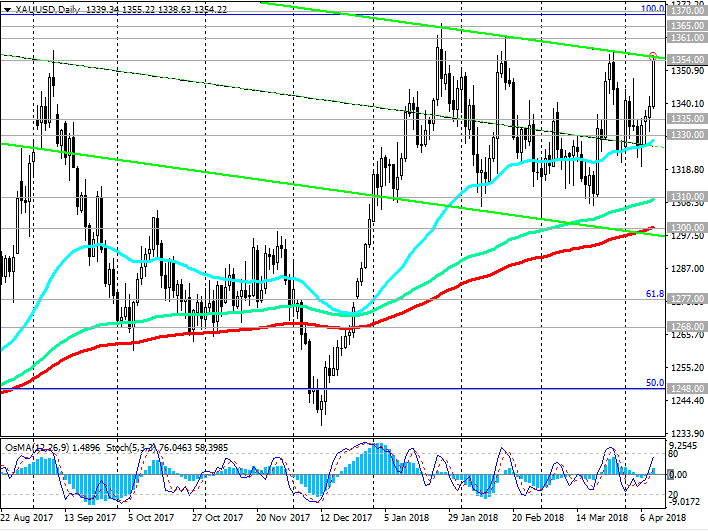

Support

levels: 1335.00, 1330.00, 1310.00, 1300.00, 1277.00, 1268.00

Resistance levels: 1354.00, 1361.00, 1365.00, 1370.00, 1390.00, 1425.00

Trade recommendations

Sell Stop 1339.00. Stop-Loss 1355.00. Take-Profit 1335.00, 1330.00, 1310.00, 1300.00

Buy Stop 1355.00. Stop-Loss 1339.00. Take-Profit 1361.00, 1365.00, 1370.00, 1390.00, 1425.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com