The tension in the trade relations between the US and China weakened, and the risk appetite for investors again increased. After this, stock markets grew, and commodity and oil prices strengthened. Rising commodity prices, as well as a general weakening of the dollar, contribute to the growth of quotations of commodity currencies against the US dollar.

Investors also took a positive view of the speech of Chinese President Xi Jinping at the Boao Asian Forum on Tuesday. Xi Jinping stressed Beijing's commitment to further liberalization of the economy and promised to give foreign companies more access to the financial and manufacturing sectors of China.

Investors considered Xi Jinping's speech as conciliatory with respect to the US, which gives hope for resolving the trade conflict between the two countries.

On Monday, the Bank of Canada published the results of a survey according to which the mood of the business community remains positive, which is supported by good sales forecasts due to strong demand from the US. The companies signaled a desire to increase capital expenditures in the next year and create new jobs.

The Canadian economy grew by 3% in 2017, which is the fastest rate among the G7 countries, and inflation in February increased to the highest level in the last three years.

The growth of the positive mood of business circles in Canada is also promoted by the expectations regarding the achievement of the NAFTA agreement. The US wants to reach an agreement on the NAFTA in the coming weeks.

In January, the central bank of Canada raised the rate, and left it unchanged in March, pointing to the uncertainty associated with US trade policy. In the second half of the year, the pace of economic growth has slowed significantly, and data point to a slight decrease in GDP in January.

"We all know that interest rates are low, and this suggests that in a more normal period they would be higher than today", said Bank of Canada Governor Stephen Poloz at a press conference in mid-March. "But the transition to this is a very gradual process", he added.

Nevertheless, a positive assessment of the state of the Canadian economy and the mood of the country's business circles is especially important on the eve of the meeting of the Bank of Canada, which will be held on April 18.

Probably, the Bank of Canada will keep the current interest rate at 1.25%. Investors will study the text of the accompanying statement of the Bank of Canada to understand the prospects for the monetary policy of the bank. If signals from the side of the Bank of Canada towards a rapid increase in the interest rate, the Canadian dollar will strengthen, including against the US dollar, which remains vulnerable against a growing deficit of foreign trade and the US federal budget.

On Monday, the Budget Office of the US Congress published its forecast, according to which the recent tax cuts and increased budget spending will make the state budget deficit exceed the $ 1 trillion mark by 2020.

"The increasing of public debt in the late stages of the business cycle is bad", commented Robert Kaplan, President of the Federal Reserve Bank of Dallas. The aging of the population, the slow increase in labor resources, the slow growth of productivity, and the high level of public debt can become deterrents for GDP growth in the next few years, Kaplan said. For this reason, the Fed should raise rates "gradually and patiently", he added. "In 2018, GDP growth will be relatively high", Kaplan said in an interview with Bloomberg TV. "In 2019-2020, I expect some slowdown in economic growth, so raising rates will also be less rapid", he said.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

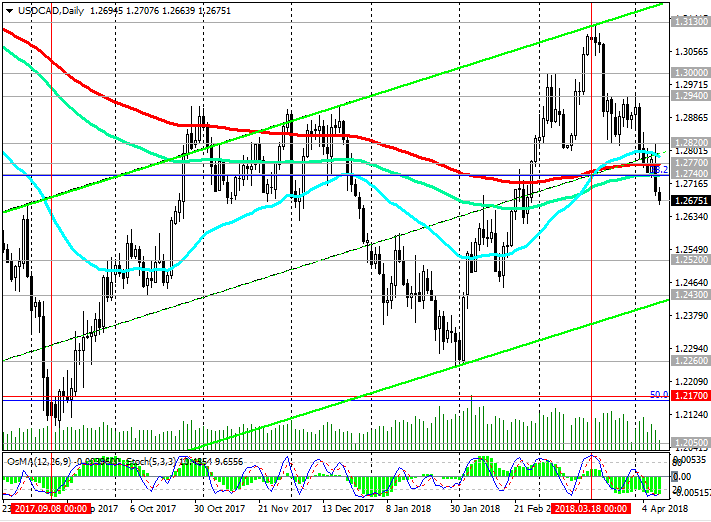

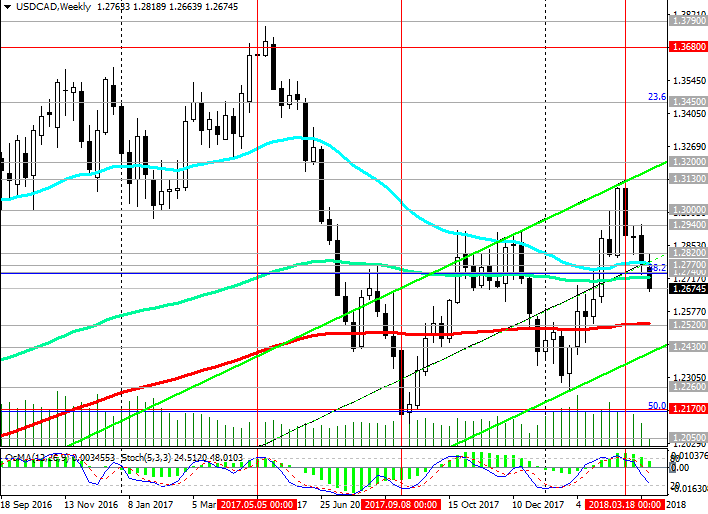

Support levels: 1.2600, 1.2520, 1.2430,

1.2360, 1.2260, 1.2170, 1.2100, 1.2050

Resistance levels: 1.2740, 1.2770, 1.2820, 1.2900, 1.2940, 1.3000, 1.3130, 1.3200

Trading Scenarios

Sell Stop 1.2670. Stop-Loss 1.2710. 1.2600, 1.2520, 1.2430, 1.2360, 1.2260, 1.2170

Buy Stop 1.2710. Stop-Loss 1.2670. Take-Profit 1.2740, 1.2770, 1.2820, 1.2900, 1.2940, 1.3000, 1.3130, 1.3200

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com