GBP/USD: pound reacted positively to industrial production data

According to official data published on Wednesday, UK manufacturing production in November increased by 0.4% (forecast was + 0.3%) and by 3.5% in annual terms. Data for October were revised upwards (+ 0.3%, and not 0.1%, as previously thought). Despite the fact that industrial production accounts for about a fifth of the country's economy, with the largest contribution to the economy by the service sector and retail trade, the pound reacted positively to the data presented.

At the same time, data showed a slight increase in the UK trade deficit in November (to 12.2 billion pounds from 11.7 billion pounds in October, with a forecast of -10.7 billion pounds). Nevertheless, the pound continued to rise against the dollar after the release of the data.

The dollar is again falling today after growth in the beginning of the year.

On Tuesday, the Bank of Japan cut of 5% to 190 billion yen in buying some long-term government bonds. Market participants considered this a foreshadowing of the beginning of the curtailment of a large-scale program to stimulate the Japanese economy. Sales of the dollar against the yen against the backdrop of an increase in the yield of 10-year and 25-year Japanese government bonds provoked its decline against other currencies. By the beginning of today's European session, the dollar index DXY fell to 92.07 from the level of 92.2 on Tuesday.

In general, the positive dynamics of the GBP / USD pair remains. Nevertheless, traders who trade in the pound and GBP / USD pair are cautious ahead of the start of trade talks between the EU and the UK. Uncertainty in the prospects for economic relations between the UK and the European Union and the disagreements in the British government over Brexit put pressure on the pound. The British government still has no common opinion on further actions and future relations with the EU.

Back in November, UK Finance Minister Philip Hammond published negative forecasts for the growth of the British economy, and in December the IMF published a forecast that the GDP growth of the UK in 2018 will slow down to about 1.5% against the backdrop of declining consumer and company costs due to Brexit .

At 13:00 (GMT) the report NIESR (National Institute for Economic and Social Research of Great Britain) will be published with an estimate of GDP growth rates of the country. This indicator estimates the growth rate of the British economy during the last three months and is able to influence the monetary policy of the Bank of England. The high value of the indicator is a positive factor for GBP. Forecast: UK economic growth for the last three months was 0.5% (against + 0.5% in the previous 3-month period). If the data are confirmed, then you can expect a 2% increase in the UK economy in 2017. This is a very positive indicator, given the gloomy forecasts of economists regarding the British economy after the referendum on Brexit, held in June 2016.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

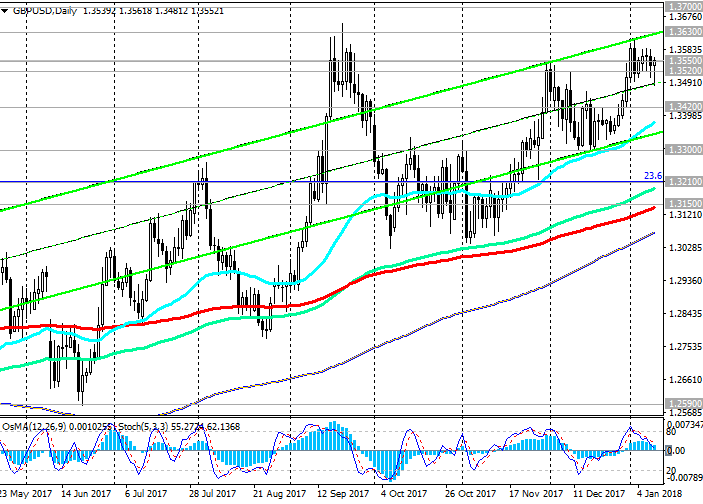

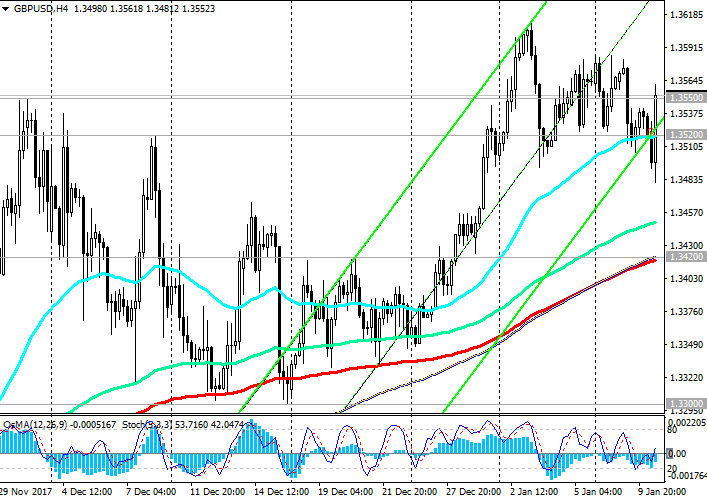

Short-term support level 1.3520 (EMA200 on 1-hour and EMA50 on 4-hour charts) kept GBP / USD from a deeper decline.

The pair GBP / USD remains positive dynamics, trading in the upward channels on the daily and weekly charts.

In case of consolidation above the local resistance level 1.3550, the GBP / USD growth will continue towards the resistance levels 1.3700 (EMA144), 1.3970 (Fibonacci level 38.2%), 1.4050 (EMA200 on the weekly chart).

The decline scenario will be related to the breakdown of the support level 1.3420 (EMA200 on the 4-hour chart) and the further decline of the GBP / USD to support levels of 1.3300 (the lows of December), 1.3210 (the Fibonacci level 23.6% of correction to the decline of the GBP / USD pair in the wave, which began in July 2014 near the level of 1.7200). The breakdown of the key support level 1.3150 (EMA200 on the daily chart, EMA50 on the weekly chart) will return GBP / USD in to the global downtrend began in July 2014.

Support levels: 1.3520, 1.3420, 1.3300, 1.3210, 1.3150

Resistance levels: 1.3550, 1.3630, 1.3700, 1.3970, 1.4050

Trading Scenarios

Sell Stop 1.3470. Stop-Loss 1.3590. Take-Profit 1.3420, 1.3300, 1.3210, 1.3150

Buy Stop 1.3590. Stop-Loss 1.3470. Take-Profit 1.3630, 1.3700, 1.3970, 1.4050

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com