XAU/USD: The dollar is stable against the backdrop of new signs of strengthening the labor market

The dollar continues to bargain with the rise after it rose on Wednesday amid new signs of strengthening the labor market in the US. The ADP report, based on data from private companies, as well as on government data, pointed to a 190,000 increase in jobs in the private sector in the United States (the forecast was +175,000).

Hopes for signing the law on tax reform also support the US dollar. Earlier it became known that on Saturday the Senate passed a bill providing for lowering the tax from companies to 20% from 35%. This victory of Republicans and the administration of Donald Trump promises to give a new impetus to the US economy and accelerate the growth of inflation, which will allow the Fed to tighten its monetary policy more confidently.

Despite disagreements between legislators, it is very likely that the final bill on tax reform will appear before the end of this year. And this, of course, is a strong fundamental factor for the growth of the dollar and the assets of the American stock market.

This, in turn, encourages investors to withdraw funds from safe assets, directing them to purchase higher-yield assets.

Today we are waiting for the publication at 13:30 (GMT) macro data from the United States. According to the US Department of Labor, the number of initial applications for unemployment benefits last week increased by 2,000 and amounted to 240,000. Despite the small increase, the number of unemployed has remained at the lowest level since 1973, and initial claims for benefits are kept below the mark in 300 000 for more than 2.5 years. This is the longest series since 1970. Employers will have to raise salaries to retain or attract employees, which will lead to an increase in personal incomes, correspondingly, expenditures and a gradual acceleration of inflation.

And this is a downgrade factor for gold prices, as in the case of rising inflation rates increase becomes more real event. The cost of acquiring and storing gold in this case will grow.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

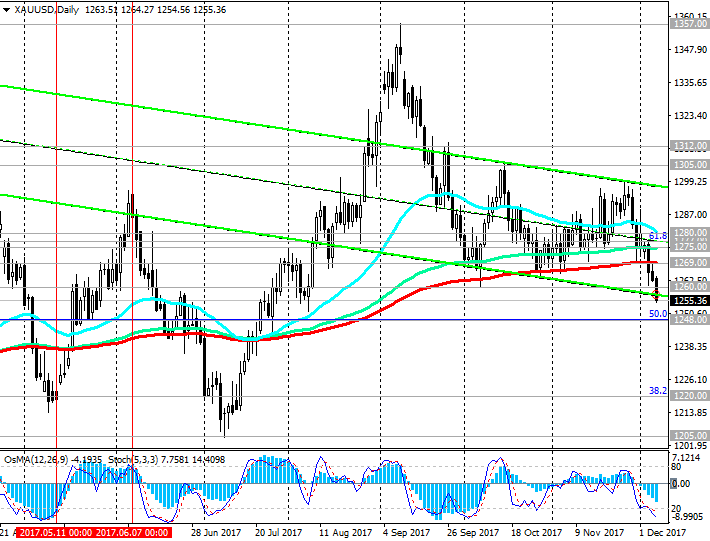

The XAU / USD declines for the third day in a row, breaking through the important support levels 1277.00 (Fibonacci level 61.8% correction to the wave of decline since July 2016), 1275.00 (EMA144 on the daily chart), 1269.00 (EMA200 on the daily chart). The next target of the decline will be the support level of 1248.00 (Fibonacci level of 50%).

A break of this level could provoke further weakening of the pair XAU / USD and a return to the global downtrend that began in October 2012.

An alternative scenario involves a weakening of the dollar and a return of XAU / USD to the zone above the resistance level of 1280.00 (EMA200 on the 4-hour chart, EMA50 on the daily chart).

Meanwhile, against the background of the strengthening of the dollar, negative dynamics of XAU/USD predominate.

Support levels: 1250.00, 1248.00

Resistance levels: 1260.00, 1269.00, 1275.00, 1277.00, 1280.00, 1290.00, 1300.00, 1305.00, 1312.00

Trading Scenarios

Sell in the market. Stop-Loss 1265.00. Take-Profit 1250.00, 1248.00, 1240.00

Buy Stop 1265.00. Stop-Loss 1255.00. Take-Profit 1269.00, 1275.00, 1277.00, 1280.00, 1290.00, 1300.00, 1305.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com