In the focus of attention of traders today will be the meeting of the Bank of Canada and publication of the decision on the interest rate. Bank of Canada twice this year raised rates - in July and September. Inflation remains below the target level of 2%. The head of the Bank of Canada, Poloz noted earlier that the target range for inflation is 1% -3%, and said that the decline in the Canadian dollar will support exports. The Central Bank does not promise that the next step will be in favor of a rate hike, but the statement of the Bank of Canada says that it will closely monitor the level of household debt, and will decide in which direction the next change in monetary policy will be.

The decision to raise the rate was motivated by the desire to somewhat stabilize the monetary policy in the country against the background of rising oil prices after a series of lowering rates after the crisis in 2008.

It is widely expected that the rate will remain at the current level of 1.0%. The growth of the Canadian economy slowed in the second half of the year. In the third quarter, GDP grew only by 1.7% (after growth of 4.2% in 2Q). According to economists, the Bank of Canada will not change the interest rate until the second half of 2018 to wait for clearer signals about the economic recovery, despite the strong labor market in the country.

At the same time, the Fed intends to continue tightening monetary policy. The different focus of monetary policy in the US and Canada will be the most important factor in favor of the growth of the pair USD / CAD.

On the other hand, unexpected solutions are not excluded. As the recent events have shown, the Bank of Canada is able to surprise the markets. This applies, in particular, to unexpected increases in rates in July and September, despite the low inflation in Canada.

If today the rate is also raised, then the Canadian dollar will be sharply strengthened.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

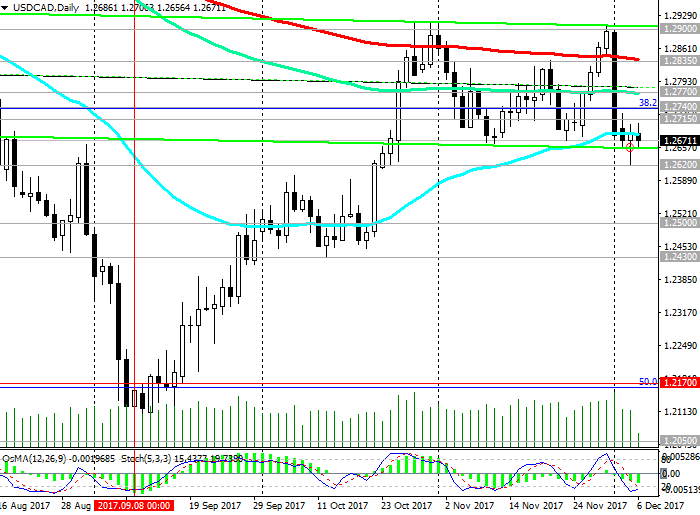

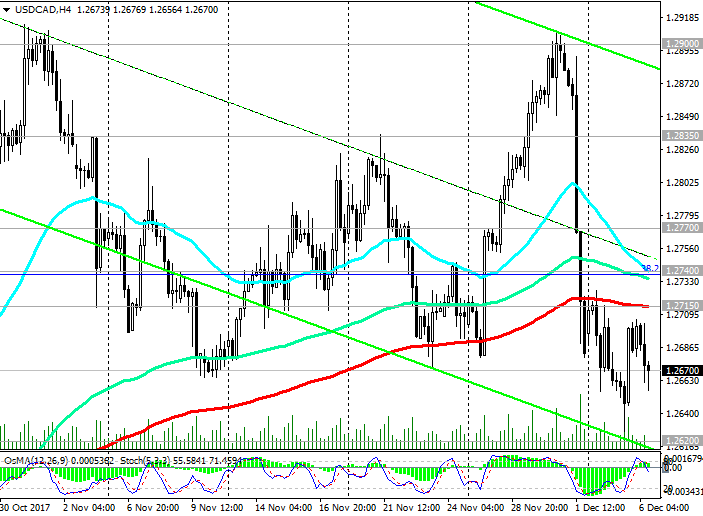

On strong data from the Canadian labor market published on Friday, the pair USD / CAD broke through the important support levels 1.2835 (EMA200), 1.2770 (EMA144 on the daily chart), 1.2740 (Fibonacci level 38.2% downward correction to the pair's growth in the global ascendant trend from September 2012 and 0.9700 mark), 1.2715 (EMA200 on the 4-hour chart) and again tries to return in to the descending channel on the weekly chart, trading just below its upper limit at the beginning of today's European session.

Indicators OsMA and Stochastics on the 4-hour, daily, weekly charts have deployed to short positions, signaling a possible resumption of the downtrend.

So far, the downward trend is prevailing.

In case of breakdown of the local support level 1.2620, the target for further reduction will be the support level 1.2500 (EMA200 on the weekly chart).

The breakdown of the support level at 1.2430 will completely return the USD / CAD pair to the downtrend and send it (within the downward channel on the weekly chart) to support levels 1.2170 (50% Fibonacci level), 1.2050 (2017 low).

The long-term goal of the decline is support level 1.1590 (Fibonacci level 61.8% and the bottom line of the descending channel on the weekly chart).

The signal for the resumption of growth will be the return of USD / CAD to the zone above the resistance level of 1.2740. A break of resistance level 1.2900 will return the pair USD / CAD to the upward global trend, which began in September 2012.

Support levels: 1.2620, 1.2500, 1.2430, 1.2300, 1.2170, 1.2100, 1.2050

Resistance levels: 1.2715, 1.2740, 1.2770, 1.2835, 1.2900

Trading Scenarios

Sell Stop 1.2650. Stop-Loss 1.2690. Take-Profit 1.2620, 1.2500, 1.2430, 1.2300, 1.2170, 1.2100, 1.2050

Buy Stop 1.2690. Stop-Loss 1.2650. Take-Profit 1.2715, 1.2740, 1.2770, 1.2835, 1.2900

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com