Brent: despite the decline, the upward trend is prevailing

Last week in Vienna, OPEC, Russia and a number of other major oil-producing countries agreed to further reduce oil production by about 1.8 million barrels a day, or about 2% of global oil production.

The deal was extended until the end of 2018. The task of rebalancing the market has not yet been fulfilled, according to representatives of the countries participating in the meeting, which together control about 60% of world oil production.

"We need to wait for the exact rate of reduction (stocks) in the second quarter, and we will consider them at the June meeting. We expect that unless something unexpected happens, we will not change our course in the second half of the year", Saudi Energy Minister Khaled Al-Falih said in Riyadh today.

At the same time, American oil companies will make their own decisions, Al-Falih said. The US can work in the existing parameters, according to Al-Falih.

Nevertheless, the proposal from the United States and other countries not participating in the deal will continue to grow. Now that the OPEC agreement on production cuts has been extended, the market will become dependent on oil production data, as well as sensitive to the dynamics of the dollar.

So, today in Asia quotations of oil futures fell against the background of the strengthening of the dollar. Prices lost some of the positions won at the end of last week.

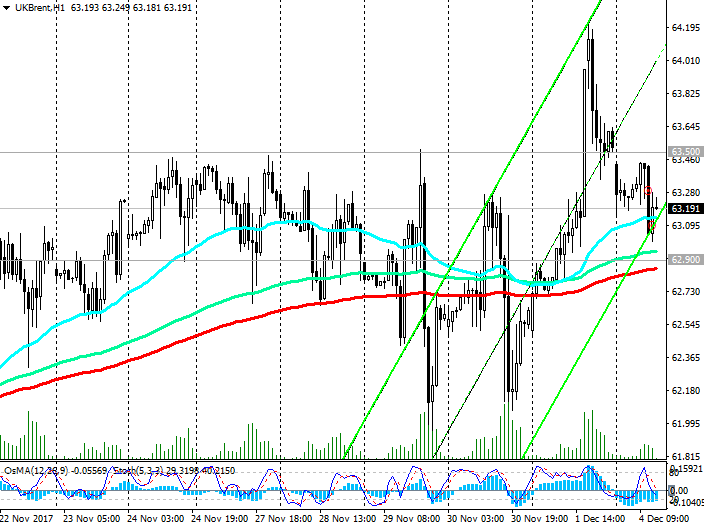

February futures for Brent crude oil fell 0.47%, to 63.43 dollars per barrel. The spot price for Brent crude at the beginning of the European session is close to the level of 63.20, which is $ 0.3 per barrel less than the opening price of today's trading day.

The dollar received good support today after it became known on Saturday about the adoption of the US Senate tax bill. It provides for a reduction of the tax from companies to 20% from 35%, which should stimulate the growth of the US economy and the dollar in the long term.

Some pressure on oil prices was also provided by a report on Friday from the American oil service company Baker Hughes that the number of oil drilling rigs in the US increased by 2 units last week to 749 units after growing 9 units earlier two weeks ago. The maximum number of active drilling in this year was recorded in August (768 units). US oil producers still have a significant prospect for the production growth. Especially, the growth of oil production in the US will be stimulated by the extended OPEC deal and high oil prices. This, along with the growth of the dollar, will become one of the main constraints to the growth of oil prices.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and Resistance levels

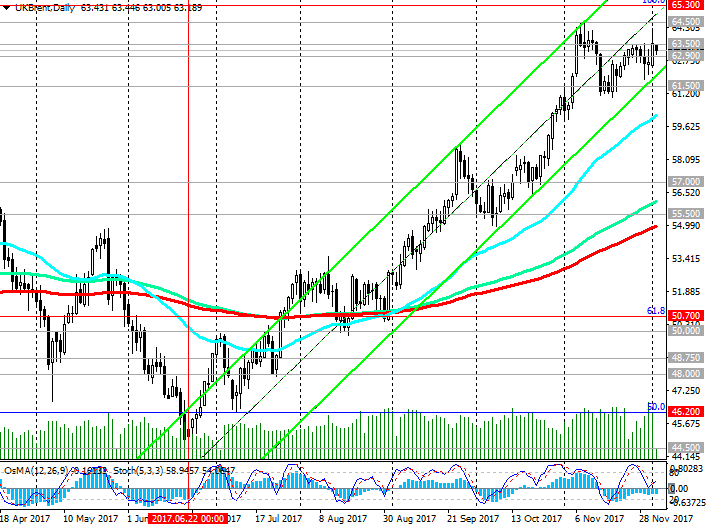

From the end of June, Brent crude oil is traded in the upward channel on the daily chart, the upper limit of which runs near the 67.00 dollars per barrel mark.

The price remains above the key support level of 62.90 (EMA200 on the monthly chart), and in case of resumption of growth the nearest target will be a local resistance level of 64.50 (November highs). Growth above the level of 65.00 will indicate a full recovery in prices after falling from the level of 65.00 in June 2015 to the absolute minimums of 2016 near the mark of 27.00. According to optimistic forecasts, the price may soon overcome the $ 65.00 mark and rise to the area of $ 70.00.

Support levels: 62.90, 62.00, 61.50, 61.00, 60.00, 59.00, 58.80, 58.00, 57.00, 56.20, 55.50, 55.00, 54.00, 53.50, 52.20, 50.70, 50.00

Resistance levels: 63.50, 64.00, 64.50, 65.00, 65.30, 66.00, 67.00

Trading Scenarios

Sell Stop 62.80. Stop-Loss 63.60. Take-Profit 62.60, 61.50, 61.00, 60.00, 59.85, 58.80, 58.00, 57.00, 56.20, 55.50

Buy Stop 63.60. Stop-Loss 62.80. Take-Profit 64.00, 64.50, 65.00, 65.30, 66.00, 67.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com