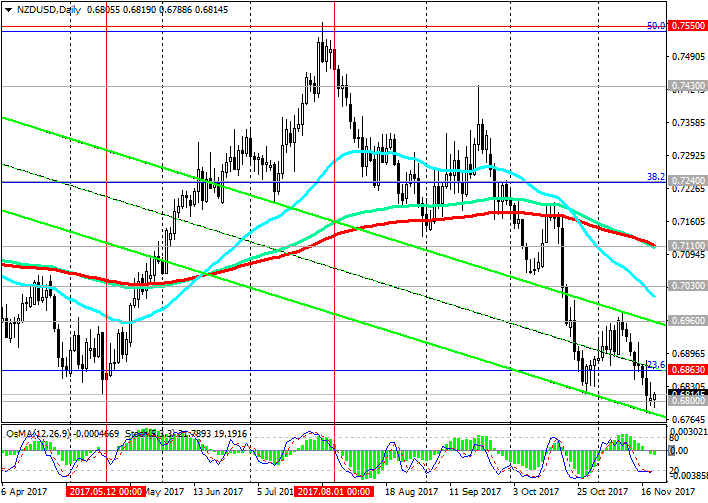

The large-scale decline in the New Zealand dollar, which began in August, continues. An additional downward impulse to the New Zealand currency was given by the general elections held in late September in New Zealand, as a result of which the ruling conservative party was defeated. The achievements of recent years in the growth of the country's economy belong to the former leadership of the country. First of all, this refers to the improvement of the situation on the labor market of the country. For example, unemployment in the 3rd quarter fell to the lowest level since the global financial crisis.

It is still too early to say what adjustments the new government will make to the earlier forecasts. Nevertheless, a survey of business circles conducted earlier this month in the country showed a sharp drop in confidence, and it turned out to be much lower than its average. The new government of New Zealand intends to reassess the RBNZ policy. Now the decision-making in the central bank will have to be carried out by the vote of the committee, whereas the role of the manager will go to the background. Further changes in the RBNZ policy will be discussed with the involvement of independent experts.

As a result of the meeting of the RB of New Zealand held in early November, the interest rate was maintained at the current level of 1.75%.

According to many economists, the RBNZ can return to consideration of the possibility of raising the rate in New Zealand not earlier than the second half of 2018.

Deputy Prime Minister Winston Peters has already hinted that a weakening of the New Zealand dollar could help the country's exporters.

On the other hand, the US dollar continues to strengthen in the foreign exchange market both the background of positive macroeconomic data coming from the US, and against expectations of a gradual increase in the rate of the Fed. According to some economists, the Fed can raise the rate not three, but four times in 2018.

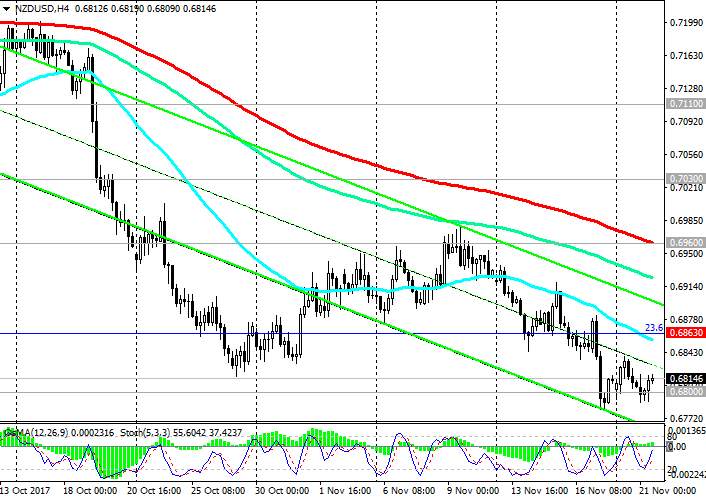

Fundamental factors support the further reduction of the NZD / USD pair.

From the news for today, we are waiting for the publication of the results of the dairy auction (in the period after 14:00 GMT). Two weeks ago, the price index for dairy products, prepared by Global Dairy Trade, came out with a value of -3.5% (against the previous value of -1.0%). Dairy products - one of the main exports of New Zealand, so the reduction in world prices for dairy products will harms the quotes of the New Zealand dollar.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support

levels: 0.6800, 0.6775

Resistance levels: 0.6863, 0.6900, 0.6960, 0.7030, 0.7075, 0.7110, 0.7200, 0.7240, 0.7270

Trading scenarios]

Sell in the market. Stop-Loss 0.6830. Take-Profit 0.6800, 0.6775, 0.6700

Buy Stop 0.6830. Stop-Loss 0.6790. Take-Profit 0.6863, 0.6900, 0.6960, 0.7030, 0.7075, 0.7100

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com