XAU/USD: growing geopolitical tensions provoked purchases of gold

Increasing anxiety about possible geopolitical shocks again creates prerequisites for a rise in gold prices. On Saturday, US President Donald Trump again announced the possibility of a military solution to the conflict with North Korea. On Sunday, the US and Turkey mutually suspended the issuance of nonimmigrant visas. In addition, at the weekend in Barcelona, protest rallies were held regarding the outcome of the referendum in Catalonia. Today, the President of Catalonia Carles Puicdemont must speak in the regional parliament. It can proclaim the independence of the region, which can cause the volatility to increase in trading on financial markets and again increase the demand for gold.

On Monday, December gold futures for COMEX closed with an increase of 0.8%, at a level of 1285 US dollars per troy ounce. The spot price for gold at the beginning of today's European session was near the mark of 1290.00 dollars per ounce.

Meanwhile, traders continue to study the US labor market report published on Friday, which strengthened investors' expectations about the December rate hikes. In periods of rising interest rates, gold prospects deteriorate as gold can not compete with more profitable assets, such as treasury bonds, as the cost of acquiring and storing gold increases.

The Fed regularly reminds that it will not abandon its plan to gradually raise interest rates, and this is a negative factor for the price of gold.

Market participants will study the text of the minutes of the meeting of the US Federal Open Market Committee, which will be published on Wednesday (18:00 GMT) to understand how the Fed's FOMC members' rhetoric has changed about interest rate plans. According to the CME Group, the markets take into account the 85% chance of raising rates this year against 44% a month ago.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

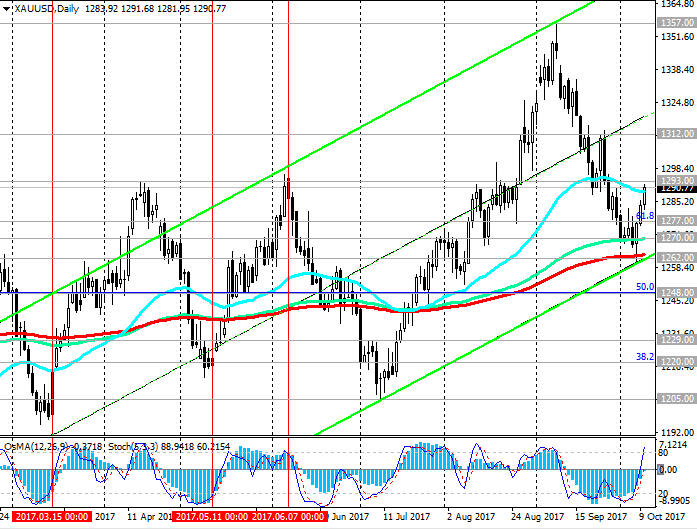

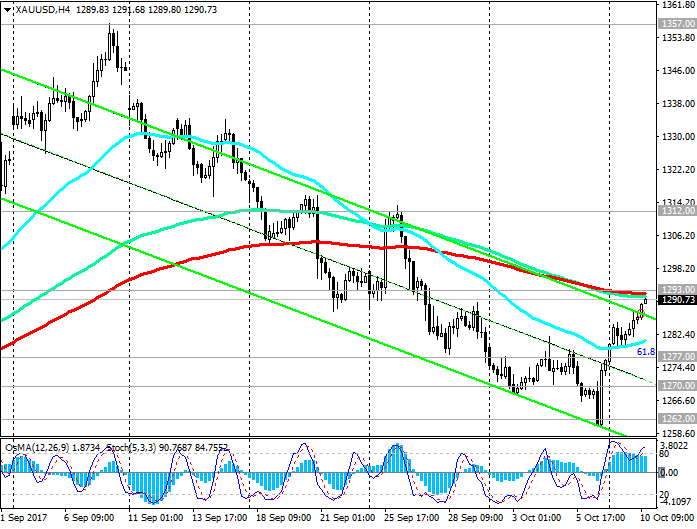

Since the opening of today, the XAU/USD is growing, and at the beginning of the European session is trading near the 1290.00 mark and the resistance level (EMA144 on the 4-hour chart).

The scenario for strengthening the XAU/USD is connected with the breakdown of the resistance level of 1290.00 and further growth with a long target of 1357.00 (annual highs).

The more distant goal is at the level of 1370.00 (the beginning of the wave of decline since July 2016 and the Fibonacci level of 100% and the upper limit of the rising channel on the weekly chart).

The reverse scenario will be associated with the breakdown of the support level 1277.00 (Fibonacci level 61.8% correction to the wave of decline since July 2016) and further decrease to the key support level of 1262.00 (EMA200 and the bottom line of the rising channel on the daily chart).

The breakdown of the support level of 1248.00 (50% Fibonacci level) will provoke further decline of the XAU/USD and its return to the downtrend.

The fundamental background (the tightening of monetary policy in the US) creates the prerequisites for the reduction of XAU/USD. However, the growth of geopolitical tensions in the world again brings buyers back to the gold market.

Support levels: 1277.00, 1270.00, 1262.00, 1248.00

Resistance levels: 1290.00, 1293.00, 1312.00, 1340.00, 1350.00, 1357.00

Trading Scenarios

Sell Stop 1284.00. Stop-Loss 1294.00. Take-Profit 1277.00, 1270.00, 1262.00, 1248.00

Buy Stop 1294.00. Stop-Loss 1284.00. Take-Profit 1300.00, 1312.00, 1340.00, 1350.00, 1357.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com