Trading recommendations

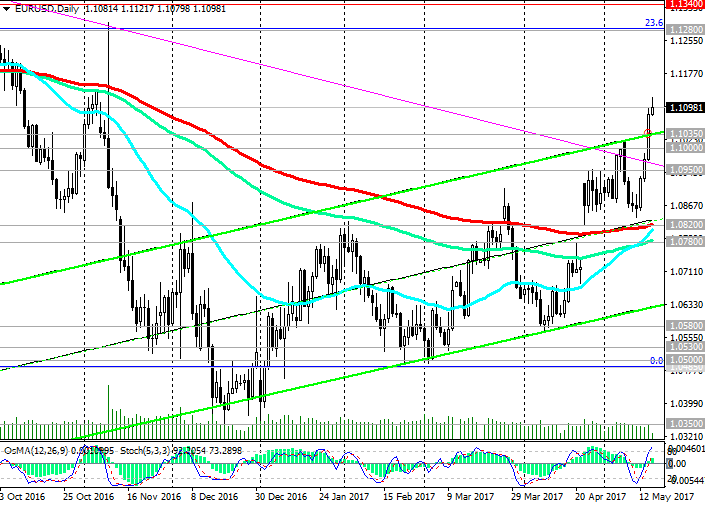

Sell Stop 1.1080. Stop-Loss 1.1125. Objectives 1.1035, 1.1000, 1.0950, 1.0900, 1.0875, 1.0820, 1.0800

Buy Stop 1.1125. Stop-Loss 1.1080. Objectives 1.1200, 1.1280. 1.1340

Despite the rapid dynamics of the euro in recent days, many economists believe that the growth of the euro is not supported by strong fundamental factors. For the most part, the growth of the euro is related to the stabilization of the political situation in Europe after the presidential elections in France. The growth of the EUR / USD is also affected by the weakening of the dollar on the back of political uncertainty in the US and due to weak economic data coming from the USA recently.

On Tuesday, the dollar fell to a 7-month low. The ICE dollar index, which reflects the value of the US dollar against 6 major currencies, fell by 0.7% (to 98.21 - the minimum level since early November). After Monday night reports that Trump had reported important secret data to the Russian government and after Trump had fired the FBI director James Komi last week, political uncertainty in the United States had intensified. A number of contradictory factors may hamper the process of tax cuts and increased infrastructure spending promised by US President Donald Trump during his election campaign.

Weaker than expected data on the US housing market, published on Tuesday, also put pressure on the dollar. The fall in the number of bookmarks for new homes has been observed for the third time in four months. Inflationary indicators, weaker than expected, reduced the optimism of investors, who put on the growth of the dollar before the June Fed meeting. According to the CME Group, investors now estimate the likelihood of an increase in Fed rates in June at 69%, against yesterday's 74% and 83% earlier.

Despite the growth that continued today at the beginning of the trading day, the pair EUR / USD is declining at the beginning of today's European session.

At 07:00 (GMT), the ECB meeting began. As is known, and as the leaders have repeatedly stated, the ECB stands for maintaining the current extra soft monetary policy in the Eurozone. In order to accelerate the growth of inflation and support the economy of the Eurozone, the ECB has consistently lowered the basic interest rate (the refinancing rate for commercial banks) from 4.25% in 2008 to a record low current level (-0.4%). In addition, the ECB continues the QE (quantitative easing) program in the euro area, which is extended until the end of 2017, and since April is 60 billion euros per month. Until now, according to the ECB, this has not led to the desired improvement in macroeconomic indicators and increased inflation. "It is still necessary to maintain the current significant monetary stimulus," ECB President Mario Draghi said recently. In his opinion, the growth of the economy and inflation in the Eurozone is still very weak.

The pair EUR / USD updated its annual highs near the level of 1.1120 today, however, at the beginning of the European session the pair EUR / USD is declining. Technical indicators (OsMA and Stochastic) on a 1-hour time frame were deployed to short positions, signaling an overdue downward correction.

In case the EUR / USD pair returns to the zone below the support level 1.1035 (the upper line of the rising channel on the daily chart), the fall in the EUR / USD pair may accelerate into the channel. Strong levels of support are also the levels of 1.1000, 1.0950. However, the key support levels are 1.0820 (EMA200), 1.0780 (EMA144 on the daily chart). As long as the pair EUR / USD is above these levels, its medium-term positive dynamics remains. In the case of renewed growth, the targets will be levels 1.1280 (Fibonacci retracement of 23.8% of corrective growth from the lows reached in February 2015 in the last wave of global decline from 1.3900), 1.1340 (EMA144 on the weekly chart).

Support levels: 1.1080, 1.1035, 1.1000, 1.0950, 1.0900, 1.0875, 1.0820, 1.0800, 1.0780

Resistance levels: 1.1120, 1.1200, 1.1280, 1.1340

Author signals - https://www.mql5.com/en/signals/author/edayprofit

*)presented material expresses the personal views of the author and is not a direct guide to conduct trading operations.