AUD/USD: data on China supported the Australian dollar_17/04/2017

According to data published this morning, China's industrial production in March rose by 7.6% yoy (the previous value of 6.3%), retail sales in China in March grew by 10.9% in annual terms (the previous value of + 9.5%), China's GDP in the 1st quarter grew by 6.9% in annual terms (the previous value + 6.8%). Strong data on China contributed to the strengthening of the Australian dollar. China is the largest trade and economic partner and buyer of primary commodities in Australia, primarily coal, iron ore, liquefied gas. Therefore, strong macroeconomic indicators from China have a positive impact on the quotes of the Australian currency.

At the same time, the US dollar continues to win back weak data on retail sales in the US for March, which was published on Friday in closed trading on European and American exchanges. Retail sales in the US in March declined for the second month in a row, with a two-month dynamics was the worst for more than 2 years. The basic consumer price index also fell, which occurred for the first time since January 2010.

The weakening of inflationary pressures, after Donald Trump's negative comments on a strong dollar, can significantly reduce the enthusiasm of investors who are betting on the growth of the dollar. The rate of inflation, along with data on GDP and the labor market in the US are key factors for the Fed in terms of further interest rate increases.

Slowing down the pace of inflation could force the Fed to reconsider its tough stance on US monetary policy plans.

Tomorrow at 01:30 (GMT) the protocol will be published from the last April meeting of the RBA on Monetary Policy. As you know, at the beginning of the month the RBA kept the current interest rate at the same level of 1.5%. The fall in commodity prices in recent years, a fairly high level of unemployment in the country (the last 10 years, unemployment is close to 6.0%), a weak increase in wages of employees, which does not contribute to the growth of consumer spending, as well as weak, according to the RBA, GDP growth - these are the main risks for the Australian economy.

Most likely, the RBA protocol will become aware of the intention to continue to maintain a soft monetary policy in Australia.

If the protocols contain harsh rhetoric about monetary policy in the country, then the Australian dollar can be strengthened in the currency market at once and fairly sharply.

Support and resistance levels

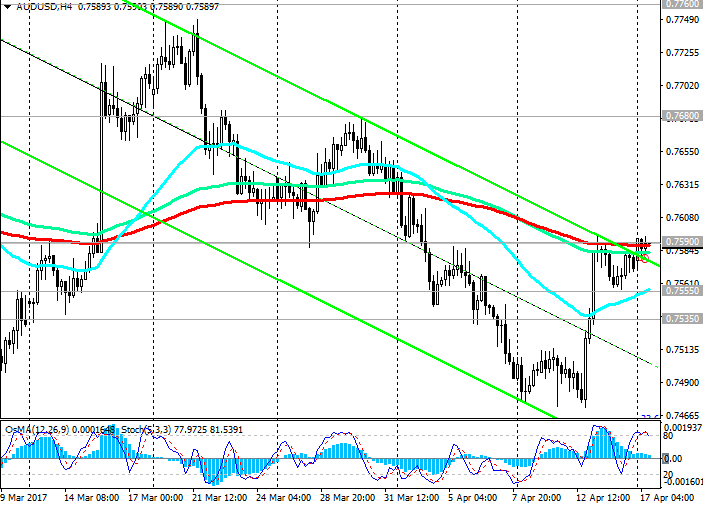

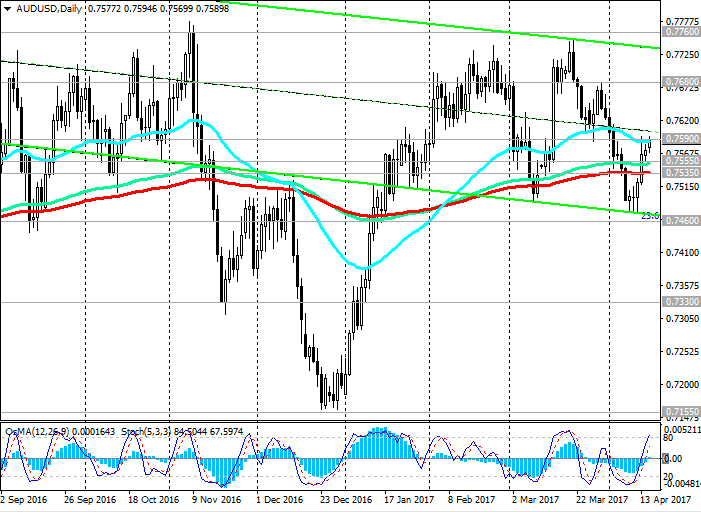

On the general weakening of the US dollar, the AUD / USD pair was able to grow and gain a foothold above the key levels of 0.7535 (EMA200), 0.7555 (EMA144 on the daily chart). At the moment, the pair AUD / USD is at a strong resistance level of 0.7590 (EMA50 on the day, EMA200 on the 4-hour chart).

Indicators OsMA and Stochastic draw a contradictory picture. If the indicators on the weekly chart are on the side of the sellers, then on the 4-hour and daily charts the indicators are turned to long positions.

The current level of 0.7590 is the key for guiding the further movement of the AUD / USD pair. In case of rebound from the level of 0.7590 and return below the short-term support level of 0.7550 (EMA200 on the 1-hour chart), the further decline of the AUD / USD pair is likely.

The fall in the pair AUD / USD under the level of 0.7535 will return it to a downtrend.

An alternative scenario is associated with a further weakening of the US dollar and breakdown of the resistance level at 0.7590. If this scenario is implemented, the pair AUD / USD with targets 0.7680, 0.7760, 0.7840 is likely to grow (Fibonacci level of 38.2% correction to the fall wave of the pair from July 2014 and EMA144 on the weekly chart).

The medium-term positive dynamics of the AUD / USD pair may remain as long as the pair is above the support level of 0.7535.

Support levels: 0.7555, 0.7535, 0.7460

Resistance levels: 0.7590, 0.7680, 0.7760, 0.7800, 0.7840

Trading Scenarios

Sell Stop 0.7575. Stop-Loss 0.7610. Take-Profit 0.7555, 0.7535, 0.7460, 0.7400

Buy Stop 0.7610. Stop-Loss 0.7575. Take-Profit 0.7635, 0.7650, 0.7680, 0.7740, 0.7760, 0.7800, 0.7840