DXY Aims for Monthly Highs as Fed March Hike Odds Increase

DXY Aims for Monthly Highs as Fed March Hike Odds Increase

Talking Points:

- Fed's Mester, Harker both come out to leave door open for a March rate hike.

- Crude Oil prices turn higher as OPEC aims for more supply cuts; implications for USD/CAD.

- Keep an eye on short-term positioning shifts as traders turn against the US Dollar with the DailyFX Speculative Sentiment Index.

With the US economy at "full employment" and signs that inflation pressures are pushing through the Fed’s +2.0% medium-term target, Federal Reserve officials have publicly left the door open for a rate move in March. At least that's the message from the Fed's Mester and Harker, both of whom have come out over the past day and stated as such. While these two Fed presidents tend to lean hawkish, the growing chorus of policymakers suggesting that a rate hike could come next month has been a strong enough clue for markets to drive the US Dollar higher.

Over the past two weeks, Fed rate hike odds (per Fed funds futures contracts) have ebbed and flowed, but they are starting to trend higher: after hitting a low around 24% in early-February, the probability has increased to 36% today. While far below our 'line in the sand' of 60% - the Fed hasn't raised rates over the past 20-years unless traders have priced in at least a 60% probability in the front month contract - the shift in tone among US policymakers is something to be taken seriously.

Chart 1: GBP/USD 4-hour Timeframe (January 20 to February 21, 2017)

Concurrently, with short-term US yields pushing higher, and credit risk in Europe increasing thanks to Dutch and French elections on the horizon, EUR/USD finds itself within a stone's throw of the monthly lows; GBP/USD's symmetrical triangle may be ready to crack to the downside; and AUD/USD is threatening to break its daily 13-EMA, which it hasn't closed below since January 4. Add in USD/CAD's attempt to base and trigger its bullish falling wedge reversal, and you have a set of technical factors that all point to the US Dollar (via DXY Index) gearing up for a test of its monthly high in the coming sessions.

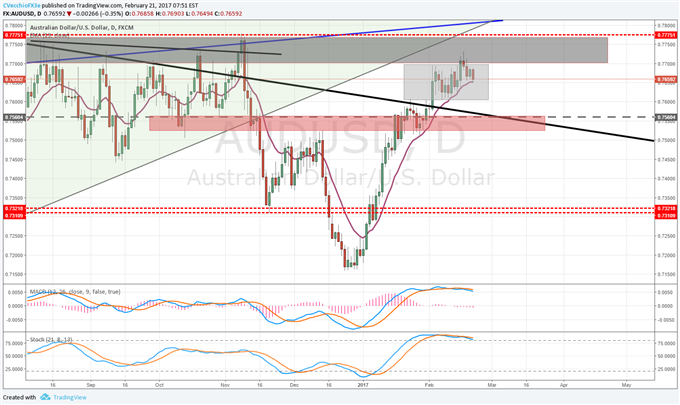

Chart 2: AUD/USD Daily Timeframe (August 2016 to February 2017)