Official Communication Channels

MQL5 Profile:

https://www.mql5.com/en/users/sucsesseful

Direct Message:

For personalized configuration guidance, setup instructions, and risk management consultations, please use private messages on the MQL5 platform.

Live Audit (Real Trading Signal):

https://www.mql5.com/en/signals/2358645

The engineering integrity of the system is maintained through direct communication between the developer and the investor.

Quantix Core is not just an algorithm.

It is a supported system with transparent architecture and professional guidance.

Chapter 0. The Engineering Group Manifesto: Redefining the Algorithmic Environment

The Quantix Core project did not emerge in a vacuum; it was born as a direct response to the systemic crisis within the field of automated trading. Our analytical group — a collective of specialists in quantum mathematics, systems engineering, and data science — set out with a fundamental objective: to deconstruct the chaos of the gold market (XAUUSD) and transform it into a manageable data structure.

A Paradigm Shift: From Linearity to Multilayering

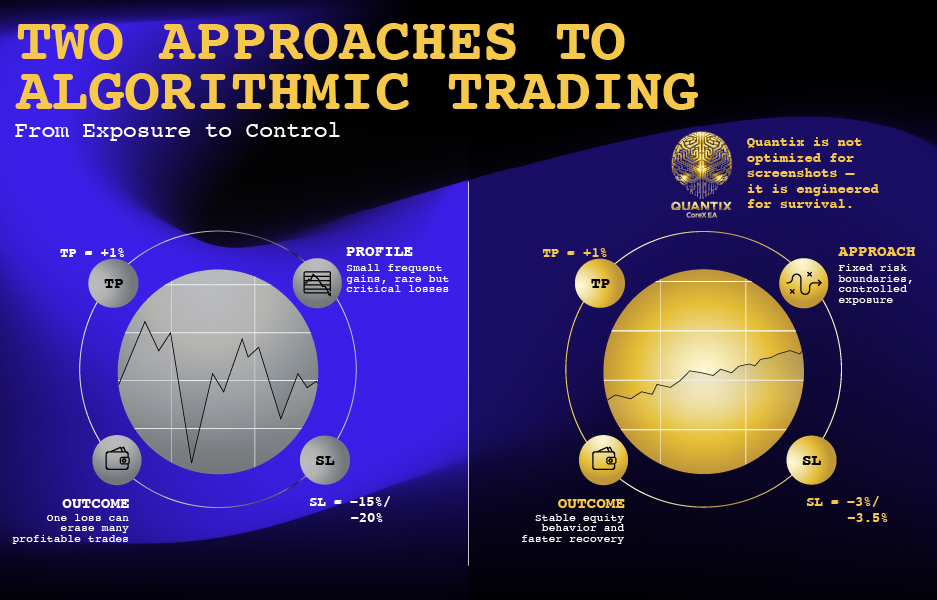

The majority of existing market solutions are monolithic structures, critically dependent on the stability of a specific market phase. Our experience, backed by thousands of hours of simulations, demonstrated that such architectures inevitably lead to degradation when market contexts shift. We realized that to not just survive, but to dominate the M5 timeframe, a system must possess more than mere intelligence — it requires a comprehensive immune defense and distributed decision-making logic.

The Ensemble Philosophy — Five-Core Architecture

Rather than relying on a single universal algorithm, we integrated five autonomous computational cores (Core 1–5) into the system's architecture. Each core is a specialized protocol that has undergone extreme stress testing:

Structural Cores analyze price morphology, separating fundamental impulses from informational noise.

Liquidity Cores identify zones of interest belonging to major institutional players.

Protection Cores continuously monitor capital integrity, ensuring equity stability even during periods of anomalous volatility.

Engineering Ethics and Real Capital

We fundamentally distance ourselves from concepts based on theoretical zero-loss scenarios. For our team, trading is the management of mathematical expectation, where risk is a strictly deterministic variable. This is why every node of Quantix Core has been verified on our own live accounts. We do not seek easy paths — we build mechanisms capable of withstanding the pressure of the real market.

This blog will serve as the official channel of our laboratory, where we will step-by-step reveal the technical nuances of the Protocol's operation.

Welcome to the world of high-precision systems engineering.

Chapter 1. Genesis of the Five Cores: Modular Isolation and Synergy

At the foundation of every perfect mechanism lies the principle of separation of concerns. In Chapter 1, we reveal the internal architecture of Quantix Core—a system that functions not as a single script, but as a synchronized ensemble of five independent computational cores (Core 1–5).

The "Safety Island" Architecture

Traditional algorithms often suffer from the "domino effect": a failure in one logical chain paralyzes the entire system. Our engineering group solved this problem through modular isolation. Each of the five Quantix Core modules operates in its own dedicated data stream, responding to specific market anomalies.

Functional Distribution of Protocols:

-

Core 1 & 2: Impulse Determination. These cores focus on identifying zones of explosive volatility. They ignore 90% of market movements, activating only when the mathematical probability of a directional impulse on XAUUSD exceeds a critical threshold.

-

Core 3: Neural Structural Filtration. A module responsible for separating market "noise" from true trend phases. Using recursive analysis methods, Core 3 verifies the signals from the impulse cores, acting as an intellectual censor.

-

Core 4: Institutional Liquidity Protocol. This core analyzes the M5 micro-structure for hidden accumulations. It "sees" the footprints of institutional players where standard indicators see a void.

-

Core 5: Sentinel (Capital Integrity). The highest hierarchical level. Core 5 does not look for entry points. Its sole task is the continuous audit of system operations and risk limit control. If market conditions exceed the boundaries of allowed models, the Sentinel blocks execution, preserving the core capital.

Synergy vs. Chaos

The uniqueness of Quantix Core lies not in the strength of an individual core, but in their interaction. We developed a consensus system: a trade is initiated only when independent protocols confirm the identity of a market pattern. This eliminates subjectivity and accidental triggers, turning trading into a disciplined data-processing event.

It is this multi-layered approach that allows us to confidently state: Quantix Core is engineered to operate under conditions of uncertainty where conventional systems fail.

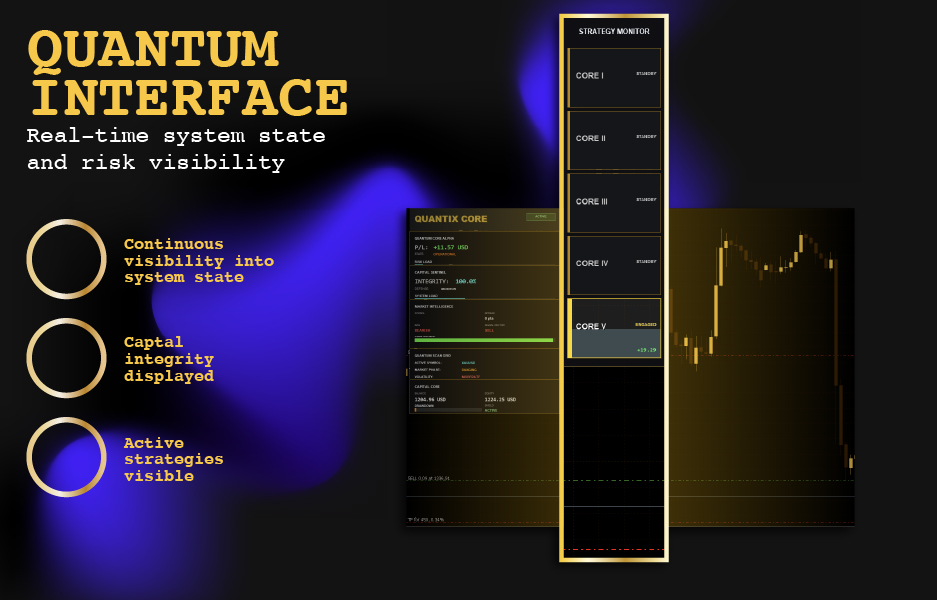

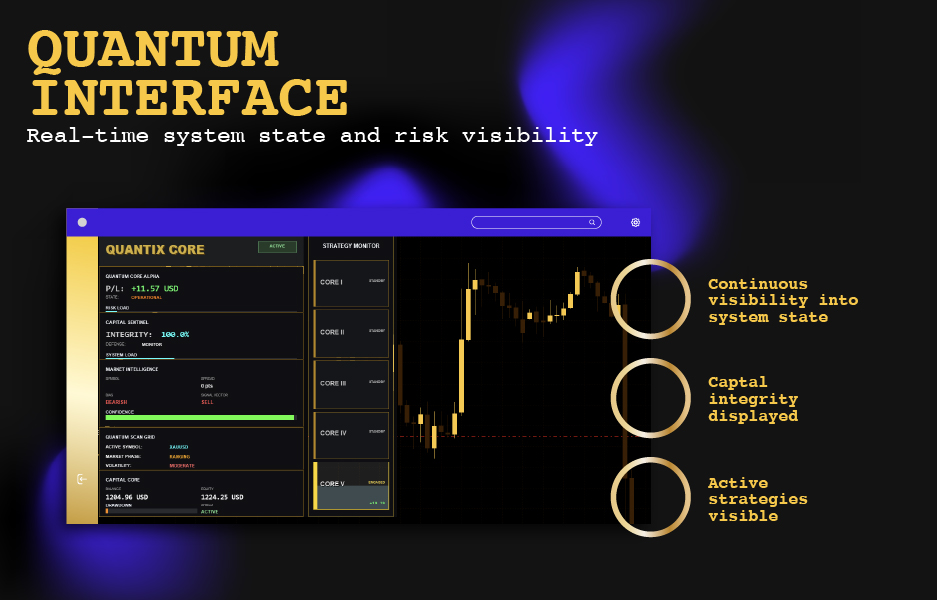

Chapter 2. Quantum Interface: The "Capital Sentinel" Philosophy

The interface of a professional tool must be an extension of its logic, not just a collection of numbers. In Chapter 2, we break down how our engineering group embodied the principles of transparency and control in the Quantum Interface — the command center of Quantix Core.

Visualization of Integrity (Integrity Monitoring)

Most trading panels only show profit. We took a different path. The central element of our interface is the Integrity indicator.

-

For our team, this parameter is more important than current equity. It displays how well market conditions align with the embedded mathematical models.

-

If the "Capital Sentinel" detects an anomalous volatility spike or a breach in liquidity structure, the integrity status changes, signaling the system's transition into high-protection mode.

Control Panel Architecture

We developed an interface that allows the investor to see the operation of all five cores in real-time:

-

Core Status Matrix: You always know which core is currently holding a position and which is in monitoring mode. This eliminates the "black box" effect.

-

Risk Sentinel: A limit management block that operates at the system interrupt level. It controls not only the current lot but the overall account exposure.

-

Adaptive Metrics: Instead of standard points, we display dynamic data regarding the current state of the IPRC protocol, showing how effectively the system is managing balance recovery.

High-Tech Aesthetics

The "gold on black" design is not merely an aesthetic choice. It is a tribute to the XAUUSD asset we operate with and a reflection of our philosophy: trading is a serious engineering discipline that demands focus and exceptional precision.

Chapter 3. IPRC Protocol: Intelligent Capital Recovery Control

In the world of professional trading, the recovery phase following a drawdown is the most critical moment. Most systems utilize primitive lot-increase methods that often lead to catastrophic consequences. In Chapter 3, we present one of our laboratory's most proprietary developments — the IPRC Protocol (Intelligent Precision Recovery Control).

Abandoning "Blind" Geometry

The IPRC Protocol is an intelligent alternative to classic Martingale. Our analytical group developed an algorithm that focuses not on the result of an individual trade, but on the High Watermark (the maximum recorded account balance). The system transforms the yield curve into a dynamic sensor, adapting the load based on the depth of the drawdown.

The Mathematics of Two Modes:

-

IPRC Automatic (Arithmetic Regression): Our safety standard. The system calculates a "soft" lot increment based on the strategy's profit factor. The primary innovation is recursive decrement: if a trade yields profit but the balance maximum has not yet been refreshed, the system reduces the lot size, "locking in" part of the profit and minimizing risks during the recovery phase.

-

IPRC Manual (Exponential Exposure): A mode designed for precision recovery from statistical outliers. We implemented a 1.5 coefficient, which our research identified as the "golden ratio" for XAUUSD liquidity. This mode maintains the calculated load until the High Watermark is fully refreshed, ensuring the maximum speed of equity recovery.

Deterministic Calculation

The CalcSemiMart function is integrated directly into the order execution core. It performs position volume calculations in a nanosecond interval prior to entry. This ensures that every order is mathematically justified and fully aligned with the current state of your capital.

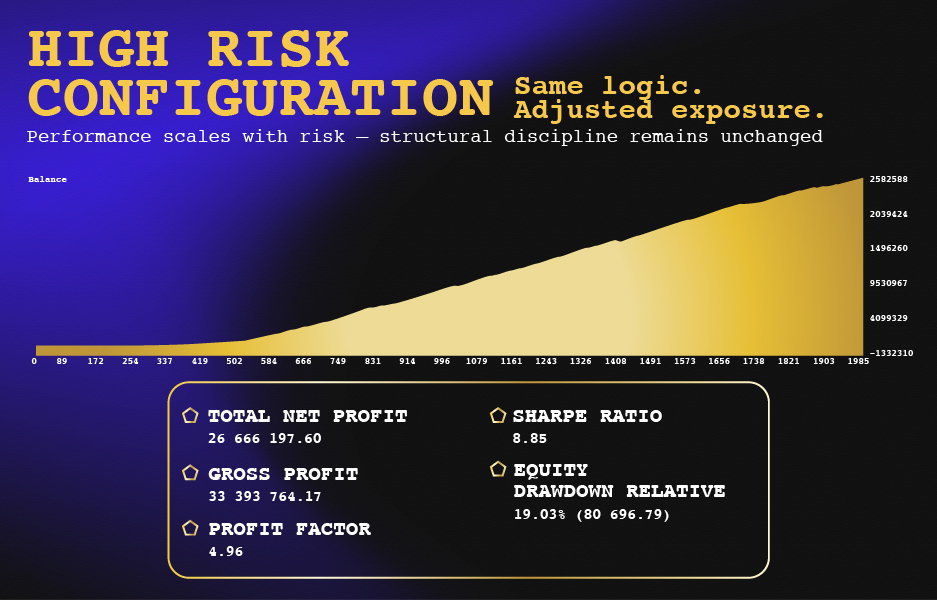

Chapter 4. Field Trials: Verification by Reality

Engineering ethics within our group exclude the use of demo accounts for final validation. Every algorithmic node of Quantix Core has undergone rigorous verification on real capital. We intentionally subjected the system to stress tests with increased loads to find the perfect balance between profitability and risk.

The Philosophy of Real Exposure We believe that an algorithm's true character is only revealed when real equity is at stake. During our internal testing phase, we observed how the five-core architecture handles slippage, execution delays, and real-time spread widening on the XAUUSD market. This "Live Alpha" stage allowed us to fine-tune the IPRC protocols, ensuring they operate with surgical precision.

Transparency of Results The fact that we risk our own balance before offering a solution to you is our primary guarantee of quality. We do not hide the reality of the market: we show the recovery phases and the controlled drawdowns. In our laboratory, a drawdown is not a failure — it is a calculated mathematical state that the system is engineered to overcome.

Full transparency of our operational activity is available through our independent real-time audit: https://www.mql5.com/en/signals/2358645

Chapter 5. The Gold Standard: Why XAUUSD?

Gold is not just an asset; it is the most complex and structured financial instrument in the world. Our engineering group chose XAUUSD as the primary testing ground because its unique volatility profile is ideal for quantum analysis.

Harnessing Volatility Many systems fear the aggressive nature of the gold market. We, however, view this volatility as a source of energy. The Quantix Core protocols are specifically calibrated to detect "micro-bursts" of liquidity on the M5 timeframe—structural shifts that are often invisible to the human eye. We have tuned our five cores to transform the rapid price movements of gold into a disciplined and steady equity growth curve.

A Specialized Ecosystem The gold market requires a specialized approach. By focusing exclusively on XAUUSD, our team was able to integrate specific filters that account for the fundamental behavior of metals, such as news-driven spikes and institutional stop-runs. Quantix Core doesn't just trade gold; it understands its morphology, turning market uncertainty into a calculated engineering advantage.

Chapter 6. The Final Frontier: The Future of Algorithmic Engineering

The release of Quantix Core is not a final destination, but the beginning of a new era in systematic trading. Our engineering group views this protocol as a living organism, designed to evolve alongside the ever-shifting dynamics of the global financial markets.

Evolution of the Protocol We are already looking beyond today’s achievements. Our laboratory continues to conduct research into advanced neural-filtration methods and non-linear data analysis to further enhance the sensitivity of our five cores. The Quantix ecosystem is built on a foundation of continuous improvement—where every market cycle provides fresh data to refine our mathematical models.

Our Vision for Professionals Our goal is to establish a new standard where algorithmic trading ceases to be a game of chance and becomes a disciplined, engineered process of capital growth. We invite you to be part of this journey—a journey where uncertainty is managed, risk is quantified, and every trade is backed by the collective intelligence of a global team. The future of trading belongs to those who prioritize engineering integrity over market noise.

Official Communication Channels

MQL5 Profile:

https://www.mql5.com/en/users/sucsesseful

Direct Message:

For personalized configuration guidance, setup instructions, and risk management consultations, please use private messages on the MQL5 platform.

Live Audit (Real Trading Signal):

https://www.mql5.com/en/signals/2358645

The engineering integrity of the system is maintained through direct communication between the developer and the investor.

Quantix Core is not just an algorithm.

It is a supported system with transparent architecture and professional guidance.