EURUSD Multi-timeframe Analysis – Downtrending after Distribution

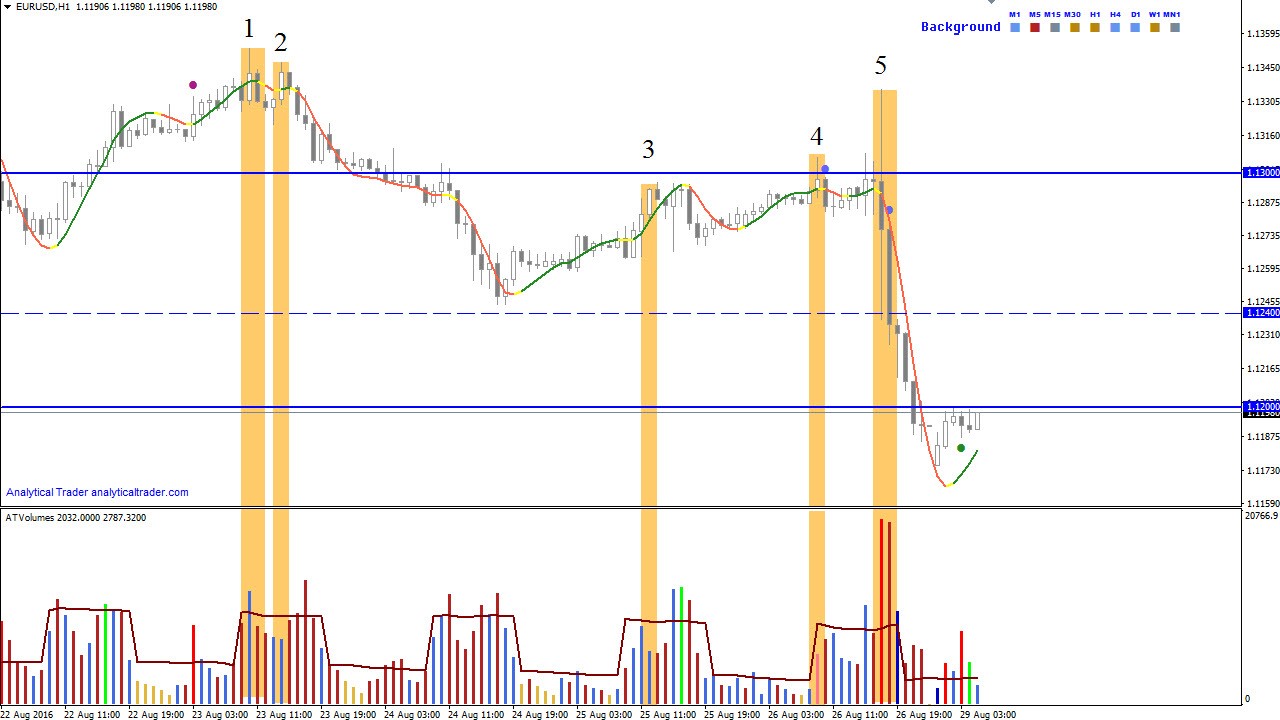

According with the previous analysis, the volume’s “type” changed from demand to supply. Also, according with the previous analysis, on the level of the breakdown of 1.124 it was a great opportunity for sell on TF M15 with ratio risk: profit of 1:4.

In point 1 there was a combination of turning bars, which together can be seen as “Up-Thrust”. This is a significant signal of the weakness. At point 2 – the successful “No Demand”.

In point 3 and 4 these were successful “No Demand ” again, which confirmed the weak character of the market. In point 4, the signal can also be regarded as “Up-Thrust”. The low volume and narrow spreads suggest that supply has overcome demand.

In point 5 – two bars, one of which looks like an”Up-Thrust”, and the second – the breakdown of the support level of 1.124.

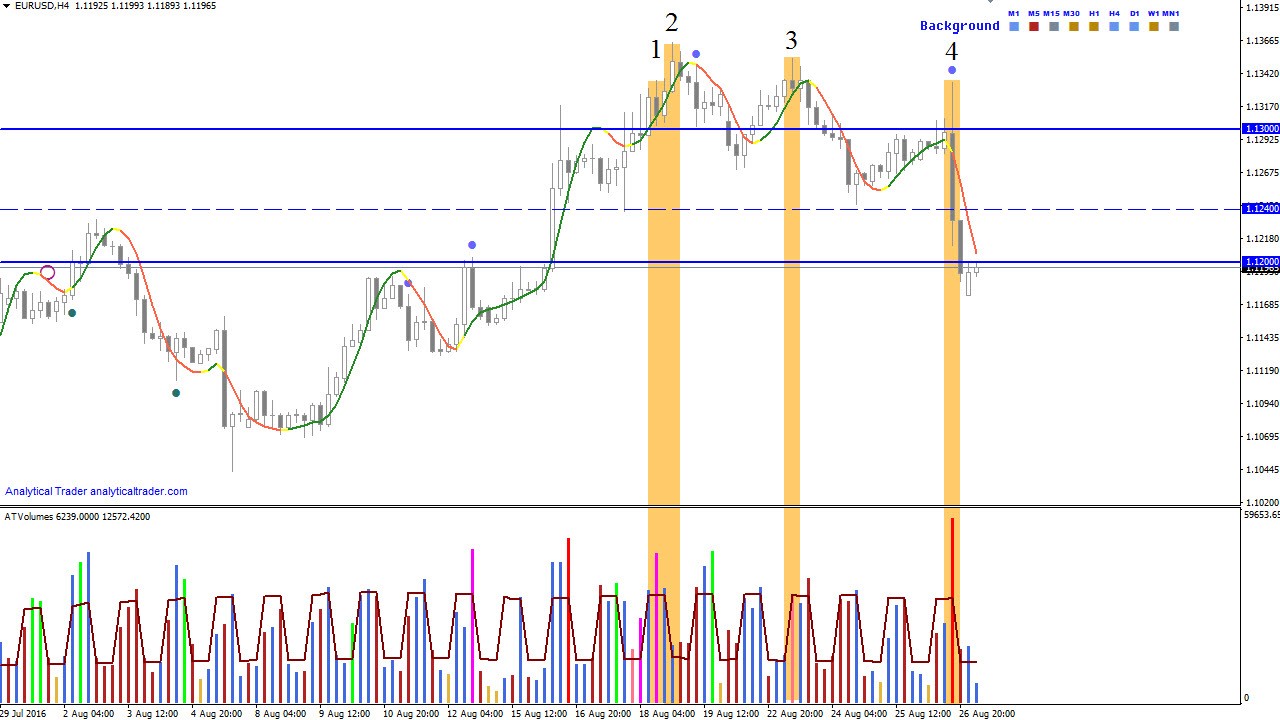

In addition, the weakness of the market confirmed the signals from TF H4: down bar with high volume in point 1, “No Demand” in point 2, followed by a decrease in prices, “Up-Thrust” in point 3 and the breakdown level of 1.124 in point 4.

Suggested Strategies

Consider only sell if the price will approach to the level of 1.124 and «No Demand» bar appears. Also, consider sell if the price breakdown the last low and «No Demand» bar appears. These should be searched in a lower timeframe.