It was quite a surprise when the US Federal Open Market Committee released its statement following the 15 June monetary policy meeting: “…Information received since the Federal Open Market Committee met in April indicates that the pace of improvement in the labor market has slowed… …Although the unemployment rate has declined, job gains have diminished…”

It should be noted that maximum employment is a primary Fed mandate. It is stated in every policy meeting statement: “…Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability…” So by specifically referring to the seeming contradiction of a lower unemployment rate along with diminishing job gains, the FOMC may have been indicating it has perceived a change in hiring momentum. In a nutshell, if the number of people seeking employment goes uncounted, the unemployed rate declines. It must be noted that the Fed uses other measures as well. Also, reiterated at several past policy meetings “…Market-based measures of inflation compensation declined; most survey-based measures of longer-term inflation expectations are little changed, on balance, in recent months…”

Guest post by Mike Scrive of Accendo Markets

The big question is whether employment gains had reached an inflection point. Over the past several years the employment situation has improved remarkably, by the numbers, but the quality of the new jobs created, for example, in terms of wage compensation, hours worked and skills required, has been mediocre at best. New statements are compared against previous statements for indications of a policy change. One particular sentence in the 15 June statement stood out: “…The Committee expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run…” Keep in mind that just a month or two ago, four 2016 increases were expected. Still, analyst raised the question whether this was a ‘one-off’. At this point one must consider how much the referendum outcome will weigh on the Fed’s mind.

US Fed officials are considered the top economist in the nation and as such are often invited as guest speakers. This creates a platform for the Fed to, perhaps, give ‘hints’ about the mindset of the FOMC. About 10 days before the policy statement, Chair Yellen, referring to the 3 June employment report, had remarked that “…the overall labor market situation has been quite positive. In that context, this past Friday’s labor market report was disappointing… …while the unemployment rate was reported to have fallen further in May, that decline occurred not because more people had jobs but because fewer people reported that they were actively seeking work. A broader measure of labor market slack that includes workers marginally attached to the workforce and those working part-time who would prefer full-time work was unchanged…”

At the semiannual policy report to the House of Representatives’ Committee on Financial Services, Chair Yellen noted in her introductory remarks that “… the pace of improvement in the labor market appears to have slowed more recently, suggesting that our cautious approach to adjusting monetary policy remains appropriate… …A broader measure of labor market slack that includes workers marginally attached to the workforce and those working part-time who would prefer full-time work was unchanged in May and remains above its level prior to the recession… …considerable uncertainty about the economic outlook remains. The latest readings on the labor market and the weak pace of investment illustrate one downside risk–that domestic demand might falter…”

The whole point of the matter is that although the surprisingly disappointing 3 June jobs report has been considered by many as a ‘one-off’ it seems that the Fed had been concerned before and was still concerned after the 15 June meeting adjourned. Now, with the increasing potential of a sudden accelerating slowdown in the global economy, the Fed will be even more cautious.

What does this mean for the US Dollar safe haven reserve currency? Unless there’s a very intense and sudden surge in US economic activity, the expectations are for at the very best, one rate increase.

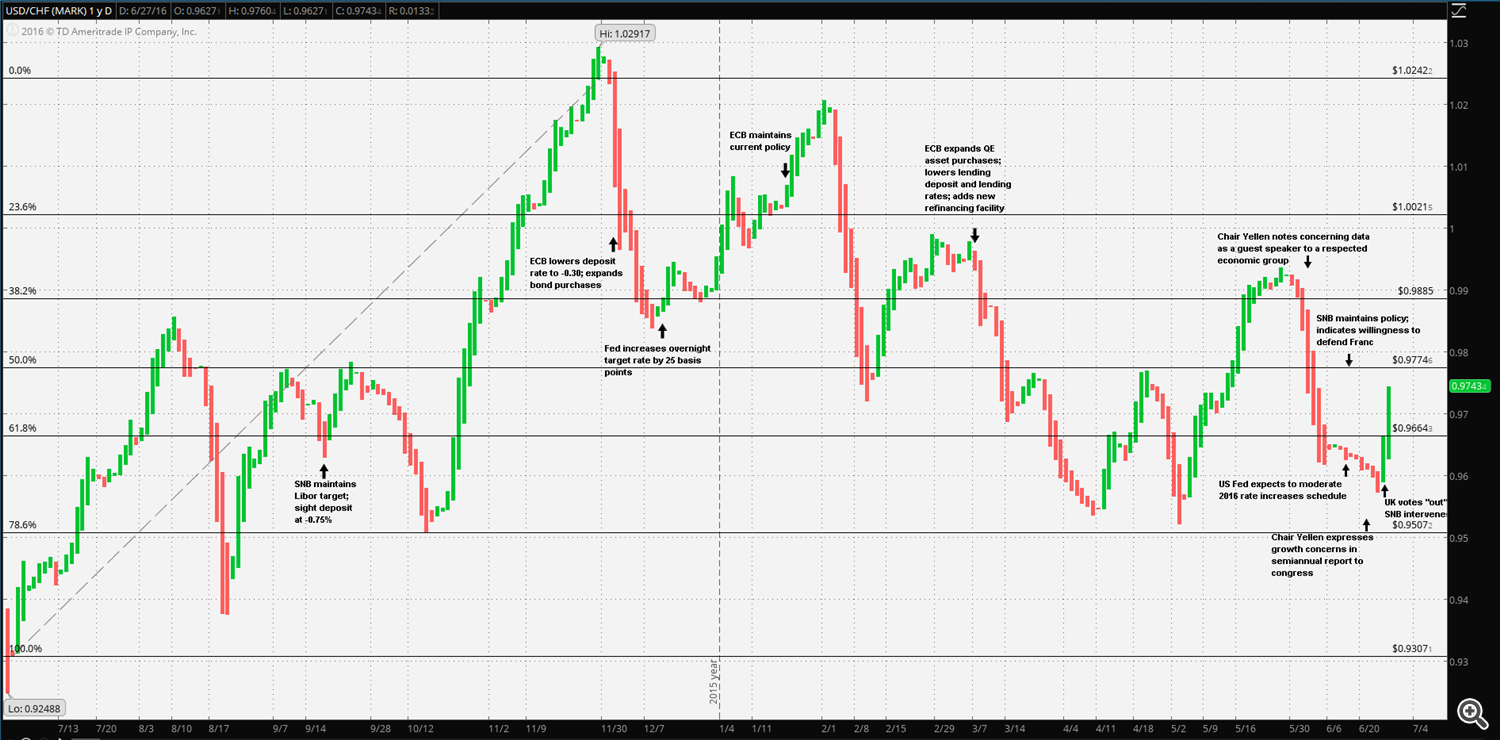

The Swiss Franc is by all accounts the ‘go-to’ European safe haven in times of uncertainty, to the frustration of the SNB. In the press release following the scheduled Monetary Policy Assessment of 16 June the SNB maintained its negative rate policy and again noted the “...SNB’s willingness to intervene in the foreign exchange market are intended to make Swiss franc investments less attractive, thereby easing pressure on the currency…” Indeed, shortly after the UK referendum outcome was certain, the SNB confirmed intervention. The important difference to keep in mind is that US, by far, is a consumer economy; it imports far more than it exports. Hence a stronger dollar benefits its major trade partners. Switzerland, on the other hand is heavily dependent on exports; what’s more, a large portion of Swiss exports are destined for Asia, i.e. to a weakening economic region. The SNB statement specifically noted, hopefully, that “…The moderate recovery in the global economy continues. It is particularly well advanced in the US, which is on the cusp of full employment…” Surely, that optimism has faded.

The SNB was hopeful for a Fed which would remain on track towards a stronger US Dollar, thus relieving pressure from the Franc. A key pressure relief valve for the Franc may now remain closed for longer than expected. Lastly, the SNB noted that “…the imminent UK referendum on whether to stay in the European Union may cause uncertainty and turbulence to increase…”

Once the dust settles, the SNB will likely regain its footing, albeit with a significantly overvalued Franc. However, the Fed may have turned completely neutral, and if a global recession results, the Fed may have to go back to the 0% to 0.25% target.

“CFDs, spread betting and FX can result in

losses exceeding your initial deposit. They are not suitable for

everyone, so please ensure you understand the risks. Seek independent

financial advice if necessary. Nothing in this article should be

considered a personal recommendation. It does not account for your

personal circumstances or appetite for risk.”