EUR/USD Forecast: Bearish Potential Increases after FOMC Minutes

EUR/USD Forecast: Bearish Potential Increases after FOMC Minutes

The US dollar has appreciated sharply this week as FOMC latest meeting

minutes showed the Fed might raise rates as soon as June, while several

members stated that two to three rate hikes this year were still

possible.

According to the FOMC meeting minutes, several Fed officials would be in

favour of a rate increase in June if economic activity and inflation

continue to improve, although they warned about an uncertain outlook,

especially with the British EU referendum on June 23.

As for the Eurozone, ECB meeting accounts revealed the Draghi and Co.

want to leave absolutely clear of their strong commitment on reviving

inflation in the region, but stated now focus should be on how the

latest set of measures work.

Even though market expectations regarding the Fed funds rate have risen

noticeably, there is some uncertainty lingering, which could limit USD

bullish potential in the short-term.

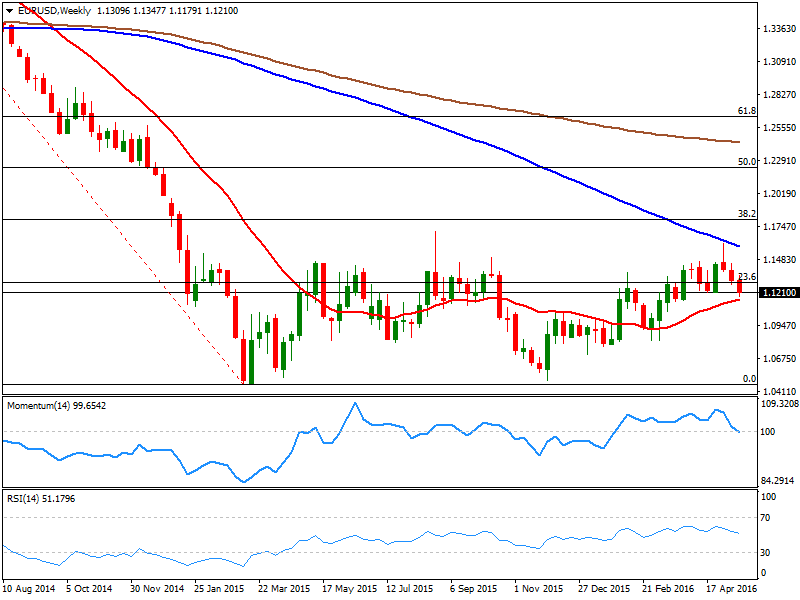

Having said this, EUR/USD outlook has turned bearish in the weekly

charts, with the pair posting its third weekly decline in a row after

being rejected from the 1.1615 zone, where the 100-week SMA capped the

upside. A break below 1.1160 (20-week SMA), would expose the 1.1060

support area en-route to March lows at 1.0820.

On the flip side, the pair need to regain the 1.1300 level to ease

immediate pressure with May high (1.1615) standing as a key bullish

target A break above this latter will re-shift short-term outlook and it

could pave the way towards the 1.1700 zone.

However, with next Fed meeting around the corner and Brexit fears

weighing on sentiment, downside breaks are likely to have more

potential.