Nonfarm Payrolls: Expect the Unexpected

The US economy is expected to have added roughly 200,000 new jobs in April, way too optimistic, given these last few day's macroeconomic releases. Adding

to a quite disappointing US growth in the first quarter, as the

advanced GDP reading came in a 0.5%, was a relatively soft ADP survey,

showing that the private sector added just 156,000 new jobs in April,

below the 200K expected. The backdrop in GDP, was largely attributed to

softening consumer spending. Also, US productivity fell again in

Q1 after declining by the end of 2015, with the hourly output per worker

down by a 1.% annual rate. Late April, the Commerce Department reported

that personal consumption expenditures (PCE) price index, excluding the

volatile food and energy components, edged up 0.1% in March after an

upwardly revised 0.2% increase in February. Personal income rose

modestly but spending fell below expected, suggesting consumption will

remain subdued, as salaries are not growing enough. A

positive note came from the ISM non-manufacturing PMI employment

sub-component, up in April 2.7 percentage points to 53, from the March

reading of 50.3 percent and indicates growth for the second consecutive

month. Overall, the US economy is clearly in trouble, and even if

the April employment report beats expectations, speculative interest

will be watching how wages performed before rushing into buying the

greenback. If wages remain low there's no chance of up

ticking inflatio. This will take a June rate hike out of the table and

therefore send the dollar back south. The unemployment rate is

expected to remain steady at 5.0% while average hourly earnings are

expected to have advanced 0.3% monthly basis. A reading above 0.5%,

alongside with a steady unemployment rate and in-line with expected jobs

creation, could boost the latest recovery of the greenback,

particularly against the EUR and commodity related currencies. A

conflicting release on the other hand will see the market spiking up and

down to initial headlines to finally go accordingly to salaries'

results.

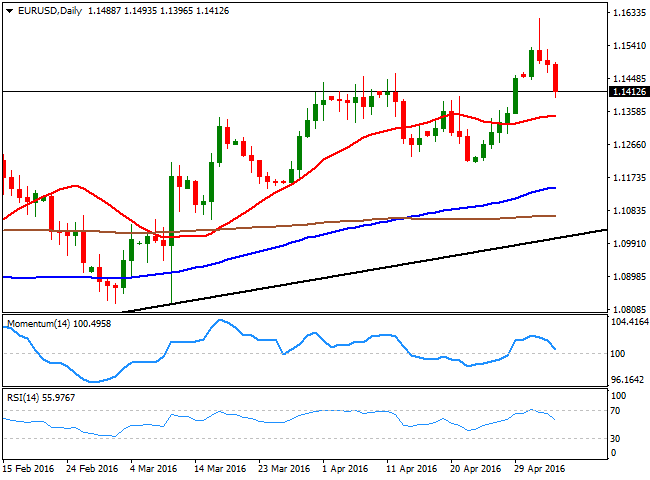

EUR/USD levels to watch

The EUR/USD pair erased all of its weekly

gains ahead of the NFP release and stands a few pips above the 1.1400

level, losing its upward potential according to the daily chart, as the

pair shed over 200 pips pretty much straight after topping at 1.1615

mid-week. The pair is quite close to a major support in the 1.1370/80

region and a break below can see the pair down towards the 1.1300 price

zone, en route to 1.1260. The report should be an extreme positive

surprise in all of its sub-components to see the pair reaching this

last.

The 1.1460 price zone has become once again the immediate

resistance, followed by the 1.1530 level. Should the advance extend

beyond this one, the pair is then expected to continue beyond the

mentioned 1.1615 high and advance towards the 1.1710 level next week.

USD/JPY levels to watch

The USD/JPY pair will probably see large

movements after Payrolls, particularly after Japanese markets will

resume activity after a three-day holiday this Friday and investors will

be eagerly ready to play with it.

Dollar's demand has helped the

pair bounce from a multi-year low of 105.54, but the technical stance

is still bearish in the daily chart, as the Momentum indicator has

resumed its decline within negative territory. The price is far below

its 100 and 200 SMAs and it seems unlikely that even with a strong

Nonfarm Payroll report the pair can recover up to the shortest,

currently at 113.20.

Anyway, the main support is now 106.60,

followed by 106.00, and the mentioned low at 105.54. A decline down to

this last one is possible on a poor employment report. A steady advance

above the 107.60/80 region, where the pair has several daily lows from

late March/early April, could see the recovery extending towards the

109.00 price zone on a positive surprise.