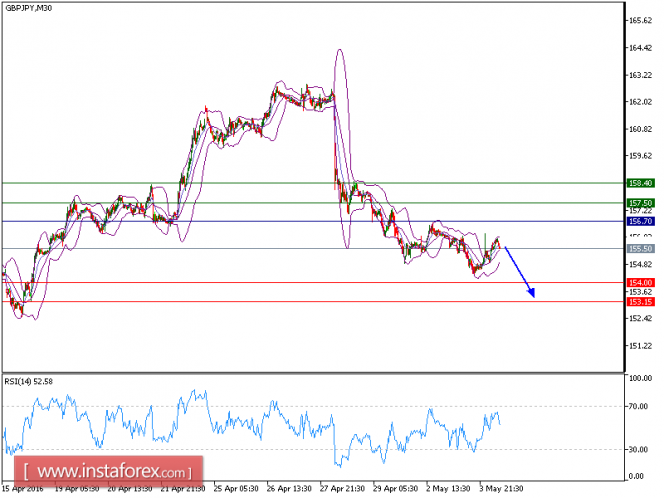

Technical Analysis of GBP/JPY for May 04, 2016

GBP/JPY is expected to trade in a lower range. The pair failed to post a sustainable rebound after its 2% plunge triggered by the Australian central bank's surprise move to cut interest rates by 25 basis points. Although it is currently off its low of 154, it is still far below the key resistance at 156.70 as well as the 50-period moving average. Crossing below the immediate support at 154 would suggest a further decline toward 153.15.

Trading Recommendations:

The pair is trading below its pivot point. It is likely to trade in a lower range as long as it remains below the pivot point. Short positions are recommended with the first target at 154. A break of this target will move the pair further downwards to 153.15. The pivot point stands at 156.70. In case the price moves in the opposite direction and bounces back from the support level, it will move above its pivot point. It is likely to move further to the upside. According to that scenario, long positions are recommended with the first target at 157.50 and the second target at 158.40.

Resistance levels: 157.50, 158.40, 159.10

Support levels: 154, 153.15, 152.20

The material has been provided by