GBP: Are Brexit Risks Exaggerated: Where To Target? - BofA Merrill

It is hard to look beyond the EU Referendum for factors that will drive GBP. This is unfortunate as UK data momentum has improved in recent months but this is not being reflected in the UK rates market which remain reluctant to recalibrate their view on the timing of the first UK rate hike until the event risk of the Referendum is out of the way. The growing divergence between GBP and UK rate differentials versus its G10 counterparts is presenting a trading opportunity but only when the event risk has passed.

In our view, Brexit risks are exaggerated on the basis of previous UK voting patterns.

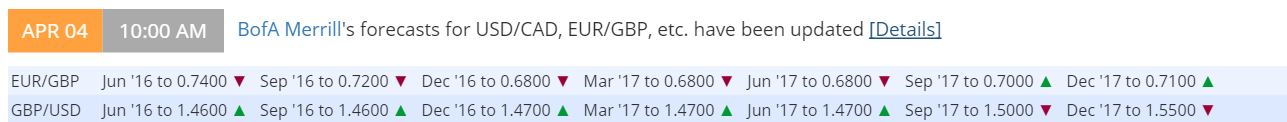

We therefore believe that GBP will stage a meaningful recovery following the Referendum and this is reflected in our revised FX forecasts. We look for GBP to recover by the end of Q2 2016 with EUR/GBP falling to 0.74 (-5% from current levels) and GBP/USD rising to 1.46.

The risks to our GBP/USD forecasts are, however, skewed to the upside.

Copy signals, Trade and Earn $ on Forex4you - https://www.share4you.com/en/?affid=0fd9105