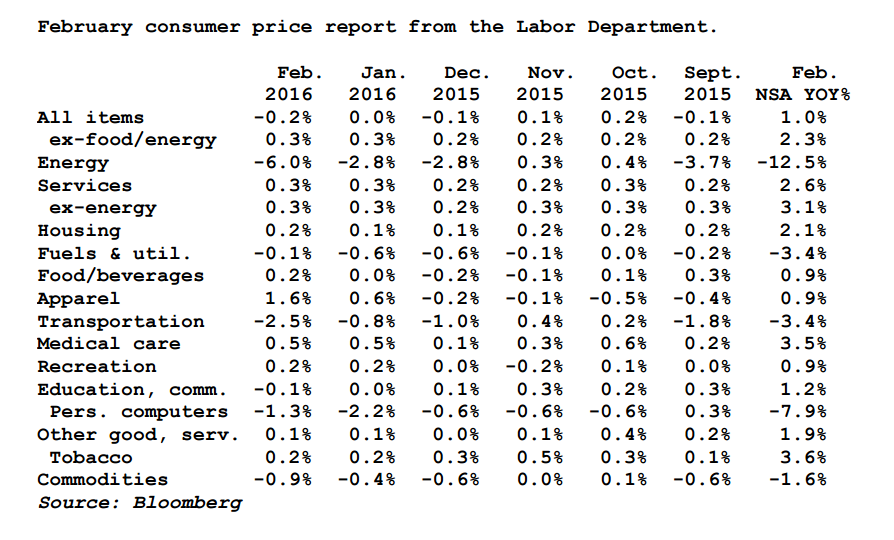

The Fed’s first rate hike relied on the theoretical link between strong employment and accelerating inflation, but now that prices seem to actually be heating up, policymakers can point to early signs of actual progress on the inflation front. Despite headline prices being restrained again by weak energy prices, core inflation in February reached its highest level since mid-2012.

Implications & Actions

Re: Economic Forecast — Despite some softness in wage increases, the gains in core prices should give Fed officials enough confidence that inflation is approaching its target to resume their rate hike cycle in June. Moreover, with the labour market continuing chew through remaining slack, wages should accelerate later in the year, thus providing more meaningful support for prices.

Re: Markets — A second month in a row where core prices increased 0.3% on the back of broad based gains, should see markets continue to re-establish bets that the Fed will raise rates later this year. As a result, the data is positive for the US dollar and negative for fixed income.

PS: Copy signals, Trade and Earn on Forex4you - https://www.share4you.com/en/?affid=0fd9105