British Pound to Dollar Rate Grossly Undervalued, According to BNP Paribas, Charts Confirm Tentative Reversal

Pound sterling is showing tentative signs that it might be slowing its decline, and possibly even preparing for a recovery rally.

French lender BNP Paribas argue the pound is undervalued according to their own in-house valuation model, called CLEER.

Whilst CLEER is saying the pound to dollar rate should be 1.4700 the market is pricing it at 1.4225; likewise, whilst CLEER is indicating euro-to-pound should be at 0.7000 , the spot rate at the time of writing sits at 0.7715.

Sterling’s Brexit premium is the main reason why the currency is so undervalued.

BNP Paribas argue that with such an excessive short position already built into the rate, the probabilities now favour a snap back towards fair value as calculated by CLEER:

“We stress that, as the market has built such a significant short GBP exposure, we believe sterling is more likely to rally on news that diminishes EU membership uncertainty, as opposed to selling off on news that increases this uncertainty.”

The suggestion that the pound is undervalued is one echoed right across the institutional community.

Most recently we have reported that Lloyds Bank are forecasting steady climbs in the rate, while the consensus forecasts fromthe world's leading analysts say 1.40 is a level the rate is unlikely to go below for extended periods of time.

Bank of England Supports Cameron Deal

The pound may have gained some stability as a result of support from the Bank of England (BOE) for David Cameron’s deal to stay in the E.U, as well general benefits of remaining within the trading bloc.

In a recent testimony to the Parliamentary Committee on Brexit the BOE governor Mark Carney and his deputy Sir Jon Cunliffe, argued Cameron’s new deal addressed the Bank’s previous concerns on financial stability if the U.K remained in the E.U.

In a broader endorsement of membership Carney also remarked that membership had brought growth and prosperity to the United Kingdom, and that leaving would definitely have a negative impact on the British financial sector, or the ‘City’.

The news that the Queen of England had taken the unusual step of making a complaint to the Press Complaint Commission over a story in the Sun newspaper which portrayed her as a euro-sceptic, was a sign that her majesty wanted to distance herself from the euro-sceptic camp, and actually another possible blow to the ‘leave’ campaign despite the sun arguing it had reliable sources.

The pound weakened over 2.0% after the news that the popular mayor of London Boris Johnsson had joined the out campaign, but since then has lost momentum and this may be reflected in the pound’s recent recovery.

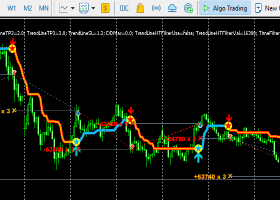

Chart Showing Tentative Signs of Reversal

Technical signs of a possible reversal in the fortunes of the pound are also showing on a chart of GBP/USD, which has put in a two-bar reversal on the weekly timeframe.

This consists of a long down candle followed by a long up candle which is of a similar length and occurs immediately after (circled on chart below).

Whilst it is too early to say for sure, situated at the end of a concerted down-trend as it is on cable, this signals a potential change in trend.

There is a lot of resistance above which is likely to prevent easy progress higher, such as the R1 monthly pivot at 1.4440, however, a clear break above the 1.4667 highs would provide the confirmation for a bullish continuation to the trend-line and R2 at roughly the 1.4950 level.

Pound to Aussie Also Showing Signs..

The GBP/AUD rate has fallen sharply from the 1.98s to the current 1.89s in only a matter of weeks.

Yet now it has reached a major support level provided by the S1 monthly pivot at 1.8940.

Monthly pivots are levels of support or resistance calculated using the previous months high, low, close and open.

Traders use them as levels where they predict increased demand or supply and where price pause, bounces and sometimes reverses.

The chart is also showing ADX at an extreme high of 50.50, signalling the down-trend may be due a correction.

ADX is short for Average Directional Index and measures how ‘trending’ the market is. When it goes over 50 it is often a sign the trend is overextended.

RSI in the bottom pane is a momentum indicator, which has fallen below 30, and is a sign that the pair is oversold.

An oversold signal indicates no more short-positions should be opened.

PS: Copy signals, Trade and Earn on Forex4you - https://www.share4you.com/en/?affid=0fd9105