Generalized Forex Forecast for 29 February - 4 March 2016

First, a few words about the forecast for the previous week:

■ if we talk about the forecast for EUR/USD, seven days ago the vast majority of analysts and graphical analysis on D1, voted in favour of falling of the pair, which it did, "having lost weight" during the past week of more than 200 points;

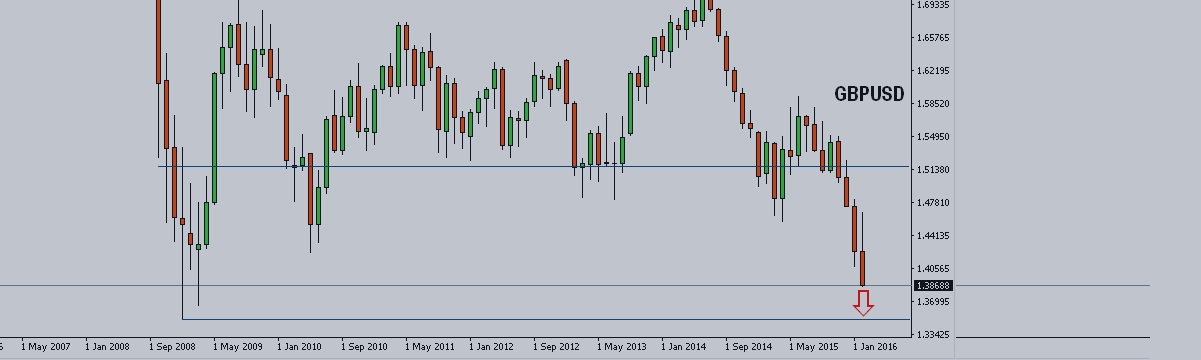

■ with regard to GBP/USD, the assumption of 40% of the experts, as well as graphical analysis that the pair should fight back down from the 1.4400 resistance turned out to be true. However, instead of the expected sideways trend, under the pressure of the announced referendum on the UK leaving the EU, the pair broke the support of 1.4200 easily and literally collapsed, being be the end of the week in the area of 2001 and 2009 lows;

■ the forecast for USD/JPY may be considered fulfilled by almost 100%. We should recall that we assumed that at first the pair would fall to the 110.70 support zone, and then make the jump up to the level of 112.55 and then even higher, placing the ultimate aim at the height of 115.00. In reality, the pair fell to the 111.04 mark, turned to the north, tried its power at the 112.55 resistance , broke it from the second attempt, turning it into a support, and soared to the height of 114.00;

■ but as for the future of USD/CHF, graphical analysis on the H4 and the indicators on H4 and D1 were right, which claimed that the pair would move in a sideways channel for some time, which, in general, is what happened. At the same time, following the general trend to regain position above the level of 1.0000, the pair attempted to break through the upper boundary of the corridor, and as a result, by Friday evening it was able to gain a foothold just above 0.9960.

***

Forecast for the coming week:

Summarizing the views of several dozen analysts from leading banks and brokerage firms, as well as the forecasts made basing on the different methods of technical and graphical analysis, we can say the following:

■ the forecast for EUR/USD for March has not changed and is as follows: first, it must break through the support of 1.0800, then 1.0700, and, reaching the bottom in the zone of 1.0500; try to win back losses, returning to the current level of 1.0930. 54% of experts, 90% of the indicators and graphical analysis on D1 agree with such a scenario. However, as far as the forecast for the coming week is concerned, 70% of analysts expect a rebound of the pair up and its temporary return to the zone of 1.1066 ÷ 1.1150. The remaining experts are divided in half: 15% - for the fall, 15% - for the sideways trend;

■ with regard to the future of GBP/USD, we do not have to talk about the indicators at all - 100% of them on H4 and D1 look down. Opinions of analysts are split almost equally, with some "bullish" sentiment prevailing: 50% vote for the growth of the pair, 40% - for its fall. As for the graphical analysis on H4 and D1, according to its forecast, in the next weeks the pair will still attempt to reach the minimum of 2009 at 1.3500, then it will return to the 1.4080 resistance. At this, the graphical analysis on H1 clarifies that before it starts its march to the south, the pair may grow up a bit, reaching the level of 1.3910;

■ in an attempt to predict the behaviour of the pair USD/JPY both experts and indicators have taken a relatively neutral position, with a certain predominance of "bullish" sentiment. Graphical analysis agrees with them, according to it the pair should first grow up to the height of 114.50 (or even higher - up to 115.00), and only then leave down to the support in the area of 112.55;

■ but as for the future of USD/CHF, 65% of the experts tend to believe that after reaching the key level of 1.0000, the pair will beat off a strong level of not less than 0.9800, and only then rush up again - to the zone of 1.0200 ÷ 1.0300. Indicators and graphical analysis, which, however, draws a support 100 points higher, - at the level of 0.9900 - agree with such a forecast.

Roman Butko, NordFX & Sergey Ershov