The U.S. non farm payrolls (NFP) report published on Friday revealed a slowdown of the headline jobs number. The American economy added 151,000 jobs in January coming under the market’s forecast of 190,000. In December the economy posted a massive 292,000 (now revised downward to 252,000) and a lower number was anticipated. Hourly wages rose in January by 0.5 percent. The unemployment rate also dropped to 4.9 percent given the strong pace of job gains in 2015. The current unemployment rate in the U.S. is the lowest since November 2007.

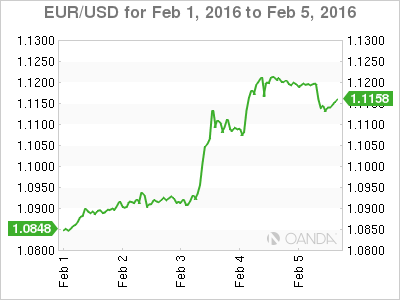

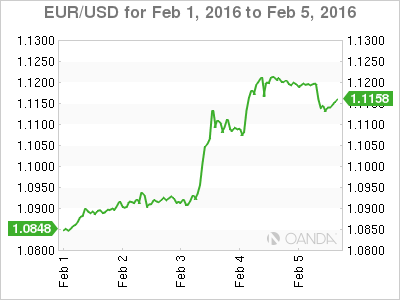

The effect of the miss on the headline NFP number is muted given the impact on an already improbable rate hike by the U.S. Federal Reserve in March. Macro economic conditions have shifted radically from December when the Fed announced its historic first rate hike in a decade. The follow up to that policy decision will not come in March if U.S. fundamentals continue to slowdown.

The economic calendar for next week is lighter than usual as most major central banks skip February. The highlight will be U.S. Federal Reserve Chair Janet Yellen’s testimony as part of her semi-annual Monetary Policy Report. Chair Yellen will face questions from the House Financial Services Committee on Wednesday, February 11 at 10:00 am EST and then from the Senate Banking Committee on Thursday, February 12 at 10:00 am EST. Investors will be on the lookout for comments on the next meeting of the Federal Open Market Committee (FOMC) on March 15 and 16.