Weaker U.S. Dollar Ahead Of FOMC On Speculation Of Less-Hawkish Statement

Dear Traders,

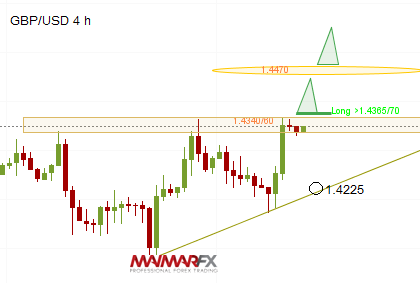

Instead of showing a sustained break below the 1.42-mark the British pound bounced off the 1.4170 level and surged to a high of 1.4366. While there could be some upside room before GBP approaches technical resistance levels at 1.44 and 1.4470, we generally favor a bearish stance in the GBP/USD. As long as the Brexit uncertainty persists, the risk is to the downside. Moreover, BoE governor Carney has taken a cautious tone at a hearing Tuesday, saying that policy makers "have to see a continued firming of core inflation" in order to raise rates. Economists are forecasting no change to interest rates in 2016.

The euro ended the day unchanged against the U.S. dollar and it looked as if the EUR/USD was waiting for today's FOMC statement to determine direction.

All eyes will be on the Federal Reserve's policy statement at 19:00 GMT.

The Fed holds its first monetary policy meeting in 2016 and while the Fed is widely expected to leave interest rates unchanged this month, the focus will be on the central bank's statement. Market participants will be looking for clues about the Fed's forward guidance and whether policy makers are backing away from the path of four rate hikes this year. Speculation are the Fed will signal a more cautious approach to raising interest rates this year, taking a less hawkish monetary policy stance. In case of a less-hawkish bias the U.S. dollar could weaken in the short-term, driving the euro and pound sterling sharply higher. The expectations are high and if the FOMC statement will be left essentially unchanged, maintaining a steady stance, market participants could be disappointed and refrain from adding to their positions. With no new insights into the Fed's monetary policy path the statement could thus turn out to be a non-event for traders.

We will wait and see and focus on the technical side.

EUR/USD

Based on an ascending triangle in the 4-hour chart the odds are currently in favor of upcoming bullish momentum. We will focus on an upside break of 1.0875, driving the pair towards 1.0920 and 1.0955. Upward movements could be limited until the resistance line which is currently at 1.0955/60. The ascending-triangle-pattern shall become void if the euro declines below 1.0830. How the currency pair will trades within the next 12 hours will mainly hinge on the outcome of the FOMC announcement but in case of a possible sell-off, traders should set their targets at 1.0780 and 1.0735.

GBP/USD

The currency pair is pointing upwards and now it will be interesting whether the cable is able to break above 1.4370 and head towards higher levels at 1.4420 and 1.4470. On the bottom side bearish movements could be limited until 1.4225/20.

Daily Forex signals:

View our daily signal alerts http://www.maimar.co/category/daily-signals/

We wish you good trades and many pips!

Any and all liability of the author is excluded.