Trading recommendations

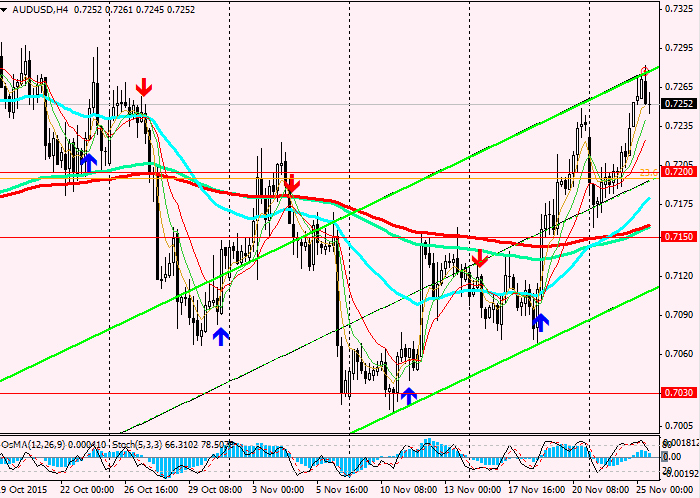

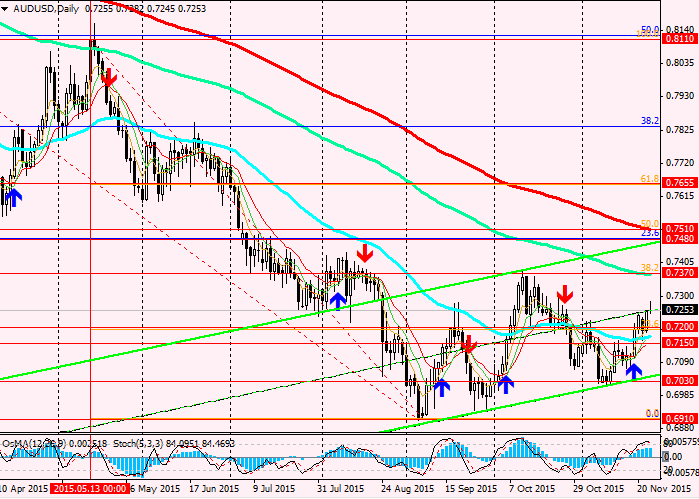

Sell Stop 0.7240. Stop Loss 0.7270. Take-Profit 0.7110, 0.7090, 0.7030, 0.6950, 0.6910

Buy Stop 0.7285. Stop-Loss 0.7250. Take-Profit 0.7300, 0.7370

Technical analysis

The OsMA and Stochastic on the weekly and daily charts are on the buyers side, but in the 4 hours chart signals came up for sale.

Reaching the month's maximum of near 0.7280, AUD/USD down today followed other dollar pairs.

The previously breached resistance levels 0.7200, 0.7150 (EMA200 on 4-hour chart and EMA50 on the daily chart) are the levels of support. Their break will return the pair in downtrend.

Strong levels of resistance 0.7370 (EMA144 on the daily chart), 0.7500 (the Fibonacci correction level 23.6 per cent, the upper line of the ascending correctional channel and EMA200 on the daily chart) remains valid. The main downward trend has continued. Breakdown of the level 0.7030 (the November lows and the lower line of the rising corrective channel on the daily chart) will return a pair of downward momentum with the short-term goal 0.6950, 0.6910 (lows).

AUD/USD continues its move to the lows of 2008 at the level of 0.6000, despite the rather strong decline for the year (1,700 points or 20%).

Overview and dynamics

In his speech yesterday, the RBA Governor Glenn Stevens said nothing new. He noted that employment growth in Australia has increased markedly and that there is an opportunity for lowering interest rates if necessary. About the same thing regarding the interest rate hike in Australia he spoke on previous occasions. He also noted a slight improvement outside the mining industry. An unexpected drop in the unemployment rate to 5.9% in October from 6.2% in September, was due, most likely, with the active growth of the construction sector of Australia. However, compared to other issues of the economy and the downturn in the mining industry unemployment could grow back. Mining companies continue to reduce their investments. On the world market of raw materials is observed months-long price decline.

Since may, when the RBA lowered its key interest rate to a record low of 2.0%, the rates remain the same. In conditions of rising unemployment, falling rate of inflation, the slowdown of the Chinese economy and reduce the level of Chinese imports of Australian raw materials reduction of interest rates is almost inevitable. Limiting factor so far is the expectation of higher interest rates in the US in mid-December.

However, two fundamental factors – the gradual tightening of monetary policy in the U.S. and the need for continued soft monetary policy in Australia – will exert downward pressure on AUD/USD in the medium term.