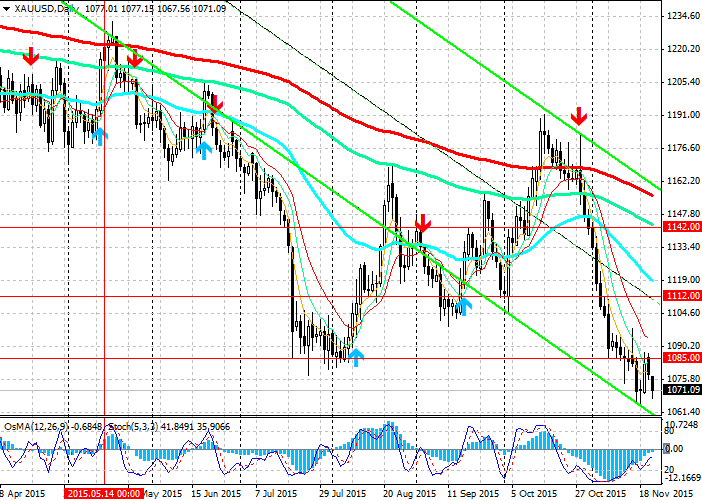

XAU/USD: decline will continue at least until December 15

Trading recommendations and Technical Analysis – HERE!

In anticipation of the December fed meeting increasingly on the markets growing confidence in higher interest rates in the US. In response to these growing expectations, the dollar, and declining prices for precious metals, including gold.

The fed is very close to the beginning of monetary policy tightening in the United States. Other Central banks of major economies are considering the possibility of easing monetary policy in their countries.

Because the US economy is on the path of stable recovery, as the labor market shows almost full employment, with constant increase of new jobs, despite low inflation, most fed officials support the possibility of higher interest rates in the US in December. Despite doubts expressed by some leaders of the fed, as reflected in the minutes from the last FOMC meeting, market participants are waiting for the first over the last few years an increase in interest rates in the US. Even if further tightening of monetary policy will be slow, as can be seen from the protocols, the demand for the dollar among investors will increase. In conditions of rising interest rates the price of gold will decline, because the cost of borrowing for purchases of the precious metal and its storage will grow.

According to the results of the last trading session on COMEX, the December futures quotes on gold moved lower by $ 1.60, or 0.1%. Other precious metals also fell. December futures for silver declined by 12.6 per cent, the January futures for platinum – by 2.20 dollars, the December futures of palladium – on-17,90 USD.

Strongly declining EUR/USD is having correlation with the pair XAU/USD is about 92%, drags and quotes for gold.

Although in the European session the pair XAU/USD has stalled, the price of gold will be under pressure until the end of the month and the 15th of December, when the fed meeting.

See also review and trading recommendations for DJIA!