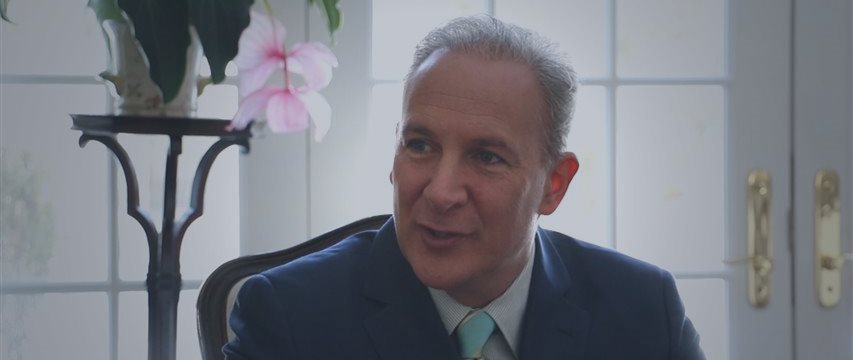

Peter Schiff: Fed is playing a dangerous game with stock-market investors

Peter Schiff, the chief executive of Euro Pacific Capital, said in a recent interview with CNBC that the U.S. Federal Reserve is playing a "dangerous game" with

benchmark interest rates that is likely to leave stock-market

investors suffering.

"I think it is a very dangerous game the Fed is playing because the I do think the economy is already decelerating…and the Fed still has rates at zero," Schiff said during the interview.

His remarks came after minutes from the Fed’s October policy-setting meeting offered the strongest signs yet that the U.S. regulator is close to ending a nearly decade-long period of ultrasoft monetary policy.

Schiff said he is not convinced that the Fed is ready for that, although various Wall Street surveys signaled traders have priced in 60% to over 80% possibility of a rate increase next month. The Fed’s talk about the hike is a pretence to mollify investors, Schiff argued.

The analyst offered one explanation for a Wednesday’s curious rally in stocks: the terrorist attacks in Paris make it likely that there will be more quantitative easing in Europe and

thus maybe the Fed won’t move to raise rates, Schiff said.

"I think it is still the easy money that is propping up the market…It’s all about cheap money and QE and if we lose that the market’s are going down," he noted.

Previous signs that the Fed would normalize rates have resulted in

tantrums and selloffs in a market some argue has been buoyed by

record-low interest rates.

A day earlier, the Dow Jones Industrial Average soared nearly 250 points. The bulk of its gains came in the last two hours of trading after the Fed’s meeting minutes were released at 2 p.m. Eastern.

Schiff’s persistent but prophetical calls ahead of the 2008 financial crisis earned him applause on Wall Street as one of the few able to see a global economic crisis looming. Today he’s having a similar oracle-like effect on market players.

His latest remarks largely repeat a series of earlier attacks against the Fed, which he has criticized for mismanaging monetary policy.