EURUSD dipped before closing last week.

Most of our users are setting levels at 1.13 - http://www.calvl.co/oOQmdmOV/

Will GBPUSD rise back to 1.54? - http://www.calvl.co/zJq42qO1/

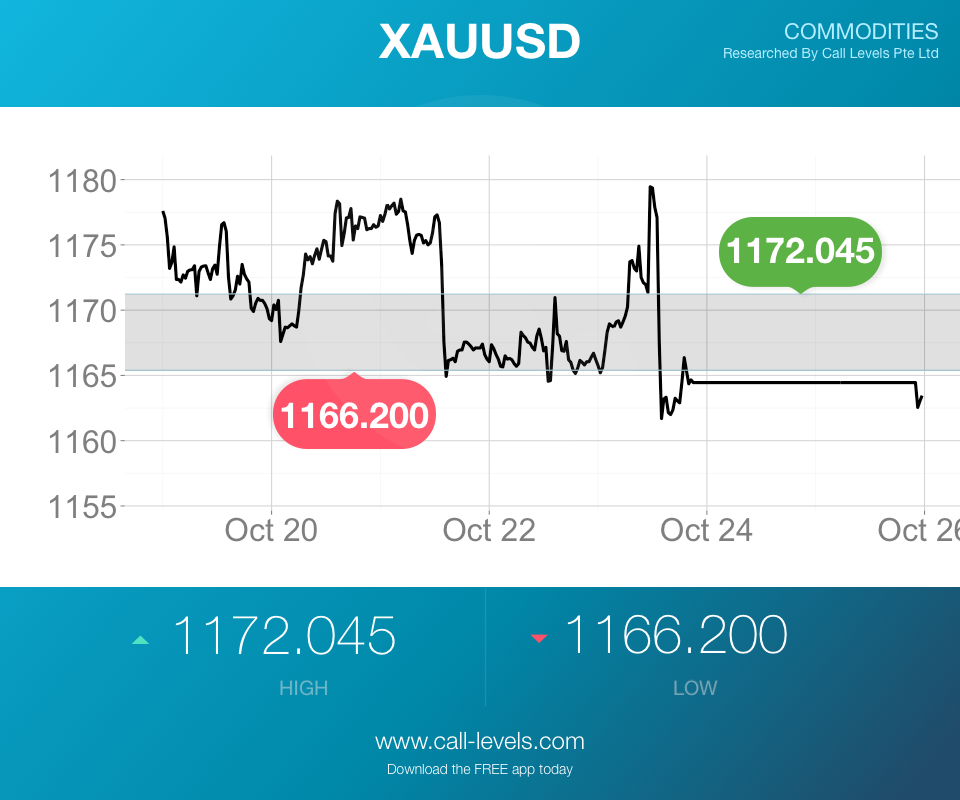

Prices of Gold fluctuated wildly last week. Will it rise past 1172? - http://www.calvl.co/4J0Q4bGD/

Trading Updates

U.S. Stocks traded more or less sideways as markets await the FOMC meeting decision outcome. Earnings so far for the Index have been mixed, though revenue has definitely been on the disappointing side. Currently, no change in the Fed funds rate is expected with no change expected to the follow on statement.

For now, a consolidation for the Index continues to be on the cards making the green path still the most likely path in the week ahead in our opinion. However, as previously stated a break of the 1940/50 level would automatically mean the red path is playing out, and the really bearish scenario would play out over the course of the next few weeks, so this coming pullback is very crucial to the S&P 500 with the 1940/1950 a key level to watch on the downside.

We have included a longer term picture for your reference to see where the red and green path are likely to end depending on which is playing out, to help better understand the longer term implications of the next move down.

Stock Pick of the Week

This Bullish flag on the Daily time frame would suggest a continuation of the Bullish move and so a move above the $74.22 price would definitely break the contraction phase and my conservative trigger above the 6/4 MA High Line (Blue MA line) is now in play. A Stop Buy Order around $74.25 would therefore be a good entry for this potential Long Position for the Stock Pick of the week, TWX-NYSE, as seen on the chart below. Target Price would be $82.00.

Conversely we cannot ignore that the overall and long term trend for this stock is Bearish and the Resistance level below the $70.50 price could hold to confirm the Wave 4 pullback on the potential 5 wave Bearish move. More confirmation is need for a Short trade so a close below my conservative 6/4 MA Low line would be needed (Red MA line). So a conservative entry would be a Stop Sell Order around the $70.47 with a potential Target price of $61.00.

Target Price at $61.00 - http://www.calvl.co/zO6ay3Xy/

[Originally adapted from http://blog.call-levels.com/recommended-call-levels-for-this-week-26102015/. Reproduced with permission.]