EUR/USD: Trading Recommendations to the week 19-23/10/2015

Check Trading Recommendations - HERE!

Overview and Dynamics

In anticipation of the key news from the Eurozone and the US, the EUR / USD will remain under pressure. October 22 held a press conference explaining the ECB's monetary policy and the prospects will decide on interest rates in the euro area. A meeting will be held on October 27-28 Fed.

After the representative of the ECB Nowotny on Thursday he said that "core inflation is clearly behind the target" of 2%, and further tools, including structural reforms to stimulate inflation in the Eurozone, the EUR / USD dropped sharply with progress maximums, almost with a mark of 1.1500. In the evening, the representative of the FOMC Meister said that the US economy is ready for higher short-term interest rates at or close to full employment and strong labor market should return to the 2% inflation over time. This slight increase in interest rates will not restrict economic growth in the United States.

The decline in production in the euro area and the weak close to zero inflation, as well as data on the trade balance in the euro area showed a decrease of almost 3 billion euros in August, could push the ECB to further easing of monetary policy that could provoke a decrease in pair EUR / USD.

Technical Analysis

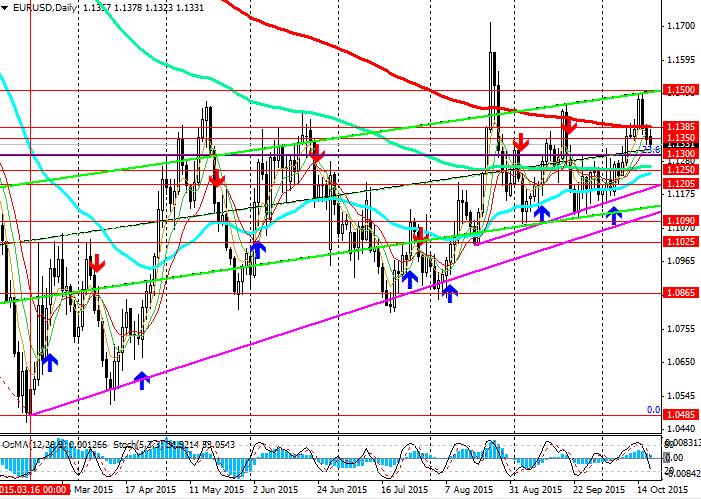

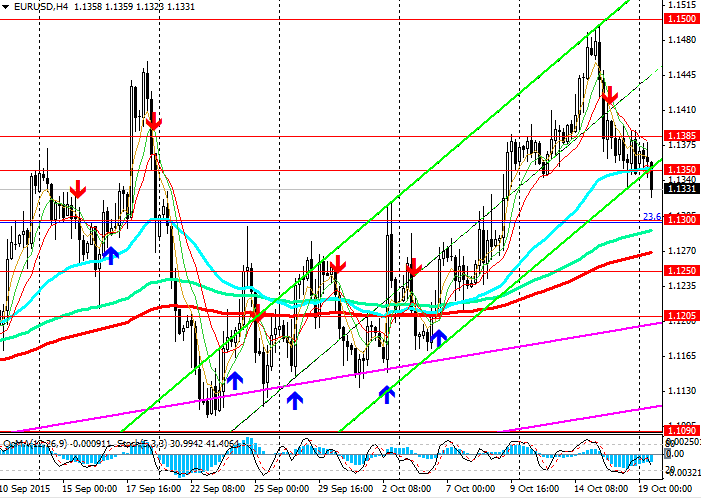

The EUR / USD back to 1.1380 range (EMA200) - 1.1255 (EMA144 on the daily chart). Resistance level 1.1500 (EMA50 Weekly chart) remained intact.

Also drawn tapering triangle on the daily chart with the bottom line at current levels 1.1210, 1.1110, which, together with the levels of 1.1285 (23.6% Fibonacci level), 1.1255 resistance zone is determined. It is possible that the price to 22 October, when will be a meeting of the ECB, will come close to this resistance zone, and a declaration of intention of the ECB to support the economy of the euro zone pair can break through the resistance zone and go to the July low at 1.0800. The decline can be slowed down by 28 October, when it will be held for the Fed meeting.

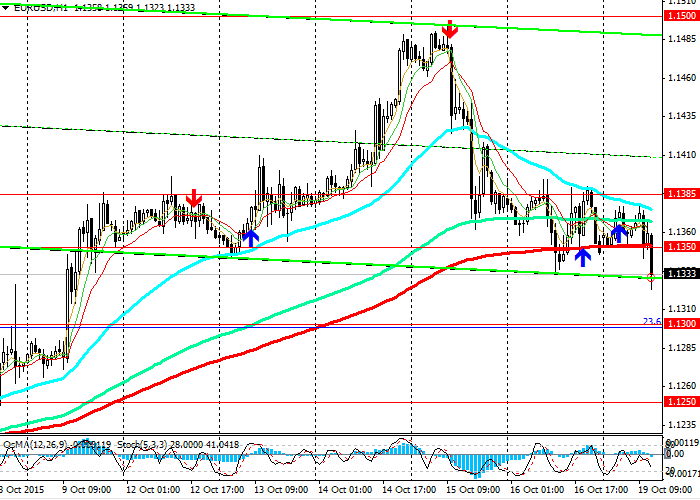

On the hourly, 4-hour and daily chart indicators OsMA and Stochastic recommend selling.