Yellen May Emulate Taper Template and Raise Rates in December.

18 September 2015, 14:35

0

225

- September deferral echoes Bernanke's alert in abating QE.

- Sustained at the end of the day confronting abroad dangers and government shutdown.

Central bank Chair Janet Yellen hints at taking a page out of her antecedent's approach playbook as she creeps toward the national bank's first premium rate increment in nine years: Delay activity in September just to move in December.

While the Fed on Thursday picked to keep rates stuck close to zero for the time being, Yellen told a question and answer session that most strategy creators still hope to raise rates this year. She highlighted the quality of the U.S. economy, binds the choice to postpone liftoff to new instability about the standpoint abroad and to monetary business sector turbulence over the previous month.

"I would prefer not to exaggerate the ramifications of these late advancements, which have not on a very basic level adjusted our standpoint," she said. "The economy has been performing admirably, and we anticipate that it will keep on doing as such."

Yellen's methodology has parallels to the technique that previous Fed Chairman Ben S. Bernanke sought after in 2013 as authorities faced off regarding whether to begin downsizing bond buys. Refering to vulnerabilities to the viewpoint, Bernanke put off a move to start decreasing in September before choosing to proceed in December.

Much the same as today, a significant part of the Fed's starting reservations about acting in 2013 focused on advancements in developing markets, which had been shaken by Bernanke's proposal a couple of months prior that a decrease was en route. Approaching out of sight then, as it is currently, was the risk of a U.S. government shutdown.

At that point and Now

Today's circumstance "lines up in such a large number of courses" with that of 2013, said Aneta Markowska, boss U.S. financial expert at Societe Generale in New York, indicating the up and coming monetary standoff and developing business sector concerns. "On the off chance that the greater part of that is determined by December, my desire is that the information will certainly bolster a trek."

Financial specialists may get more hints to Yellen's reasoning when she talks on Sept. 24 in Amherst, Massachusetts.

Merchants in the government stores prospects business sector denoted the possibilities of a December rate ascend to beneath 50 percent taking after news of the choice, contrasted and 64 percent on Wednesday. That is taking into account the supposition that the powerful bolstered stores rate will normal 0.375 percent after liftoff.

"When they didn't go then, I think there was an extremely solid sense that they would go in December," said Michael Feroli, boss U.S. business analyst at JPMorgan Chase & Co. in New York, alluding to Bernanke's decrease. "Presently, individuals are notwithstanding having questions about whether they will even go this year." Feroli himself estimates a December move.

Yellen said the Federal Open Market Committee examined the likelihood of raising rates at the current week's meeting, however chose not to in light of the uplifted instabilities abroad and the marginally lower expected way for expansion.

Keep a watch out

"The Committee passed judgment on it fitting to sit tight for more confirmation, incorporating some further change in the work business sector, to support its certainty that swelling will ascend to 2 percent in the medium term," she said.

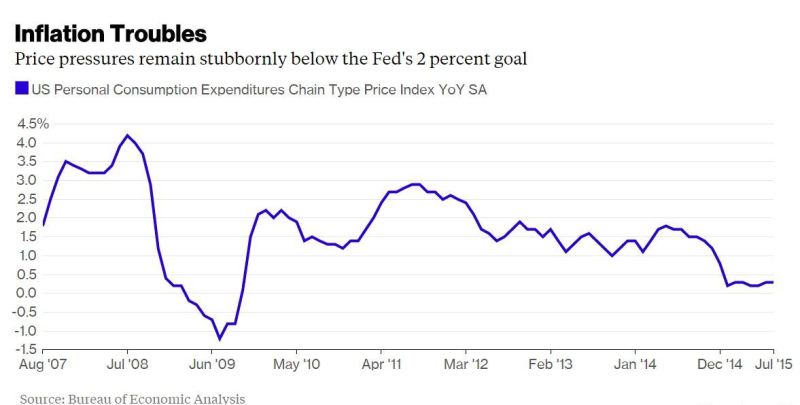

Moderating development in China has undulated over the world, hitting item delivering nations hard. Locally, Fed authorities are additionally thinking about an expansion rate that remaining parts too low, rising only 0.3 percent for the 12 months finished July, as indicated by the Fed's favored measure of value weights.

"They unmistakably are a bit hazard disinclined," said Luke Tilley, boss financial analyst at Wilmington Trust in Wilmington, Delaware, which oversees $77 billion. "They are at last searching for that certainty for expansion to return up."

Tilley said Fed authorities will be looking for some adjustment in product costs and a firming in business sector based measures of swelling desires.

Expansion Expectations

Yellen said the FOMC "has observed" late decreases in those measures and would "keep on monitorring swelling improvements precisely."

"I think our believability relies on shielding our swelling target from dangers that it transcends, as well as that we not have, over the medium-term, that we need to see expansion return to 2 percent," she said.

She additionally over and again highlighted the significance of proceeded with upgrades in the occupations business sector to help support her certainty that swelling at last will ascend back to the Fed's 2 percent objective. In Yellen's perspective of the world, pay increments - and expansion - ought to begin to quicken as unemployment falls further and further.

The economy made 2.92 million occupations in the year finished in August, pushing the jobless rate down to 5.1 percent, around the level that numerous Fed strategy creators consider full livelihood.

The work business sector isn't the main thing permeating. Shopper spending, which Yellen said was the primary driver of the economy, climbed 3.2 percent in the 12 months through July, among the greatest year-over-year readings of the ebb and flow development. Also, the turmoil in money related markets didn't discourage families in August, with vehicle deals moving to their most abnormal amount subsequent to 2005.

Noteworthy Performance

"We are taking a gander at, as I accentuated, a U.S. economy that has been performing great and inspiring us by the pace at which it is making employments and the quality of local interest," Yellen said.

While she held out the likelihood of the Fed raising rates at its next meeting in October, business analysts and merchants weren't purchasing it. The chances of a move one month from now are just around one in five, as indicated by dealings in the fed stores prospects market.

Chris Rupkey, boss money related financial specialist at Bank of Tokyo-Mitsubishi UFJ Ltd. in New York, said it may even be intense for Yellen to completely persuade speculators that the Fed is proceeding proceed with a rate rise this year.

"It will be difficult to change market brain research," he said. "Brokers feel the chances support extra postpone on Yellen's part."

"My estimate is December, however I would not stake my life on it," he included.https://www.mql5.com/en/signals/111434#!tab=history