Goldman Warns Markets Unprepared for Fed as Treasuries Seesaw.

16 September 2015, 18:19

0

255

- `Are we in the storm's eye at this moment?': BMO's Collins.

- Treasuries bounce back in the wake of tumbling Tuesday in the midst of Fed open deliberation.

Goldman Sachs Group Inc. says money related markets are powerless on the grounds that no one can concede to what the Federal Reserve will do. Treasuries whipped around in the midst of the level headed discussion.

Fleeting Treasuries rose Wednesday, bouncing back from a selloff a day prior when retail-deals information expanded theory the Fed would raise premium rates this week. Goldman Sachs Chief Economist Jan Hatzius said the national bank most likely won't act until December, or even until 2016.

There's an absence of accord among arrangement producers which is a purpose behind them to hold off when they complete their meeting Thursday, he said.

"There will be some worry that the market's not arranged," Hatzius said Tuesday in a Bloomberg Television meeting. "There's a danger of an unfriendly market response." Goldman Sachs is one of the 22 essential merchants that exchange specifically with the national bank.

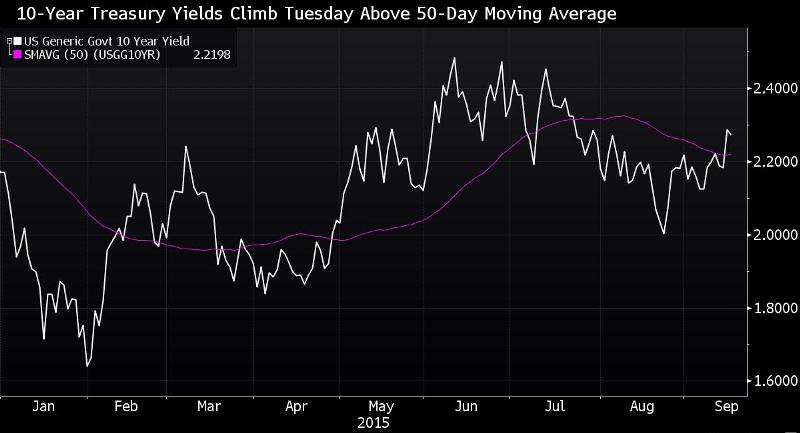

Treasury 10-year note yields fell one premise point to 2.28 percent starting 9:27 a.m. in New York, in view of Bloomberg Bond Trader information. The 2's cost percent security due in August 2025 rose 1/32, or $0.31 per $1,000 face worth, to 97 1/2.

Yields hopped 10 premise focuses Tuesday, the most in just about three weeks.The move left the Bloomberg U.S. Treasury Bond Index down 0.3 percent this month through Tuesday and clinging to a 0.5 percent pick up for 2015.

Two-year note yields fell two premise focuses to 0.78 percent in the wake of rising Tuesday to the most elevated subsequent to 2011.

No Consensus

"Are we in the storm's eye at this time?" said Craig Collins, overseeing executive of rates exchanging at Bank of Montreal in London. "It all that much has that vibe to it. It was an, extremely feverish day yesterday. What the Fed offers on Thursday is presumably going to have an emotional impact too. It's all that much a moving target."

Costs paid by American family units fell in August as less expensive fuel helped keep expansion beneath the Fed's target, Labor Department figures indicated Wednesday. The purchaser value list dropped 0.1 percent, the first decrease following January, subsequent to rising 0.1 percent in July.

"I don't know the amount it'll effect Fed desires given that the meeting is beginning today," said Gennadiy Goldberg, a New York-based U.S. rates strategist with TD Securities. "There's not an in number conviction coming from this specific number."

Late unpredictability in worldwide value markets has made further questions about the Fed's eagerness to raise rates. David Keeble, the New York-based head of altered salary methodology at Credit Agricole SA, said there's no agreement on how much the Fed will consider "worldwide advancements we've seen of late, or whether they imagine that the local numbers will be good to the point that they can begin to be pre-emptive."

Rate Bets

Prospects demonstrate there's a 30 percent possibility of the Fed raising rates Thursday, as indicated by information ordered by Bloomberg. The count is in view of the supposition that the benchmark rate will normal 0.375 percent after the first increment, versus the present focus of zero to 0.25 percent.

The moderately low likelihood the business doles out to a rate increment "will deter the Fed from climbing" this week, Morgan Stanley strategists wrote in a note Sept. 15. They said an increment in rates "would propose the Fed overlooked the lessons gained from 1994," when monetary conditions fixed altogether after national bank authorities raised rates.

They think the market's likelihood for a rate ascend in October or December could "crevice higher" as the Fed signals an increment is coming soon. In 1999 and 2004, "there was a propensity for the Fed to flag the top notch climb at the FOMC meeting," they said.