Current trend

At the beginning of the week, the price of gold is not changing significantly as market participants are waiting for the publication of key macroeconomic statistics from the US, where the Federal Reserve holds its meeting this Thursday.

The price remains under pressure but some analysts think that it may turn up after the Fed's meeting and if macroeconomic statistics come in worse than expected.

Support and resistance

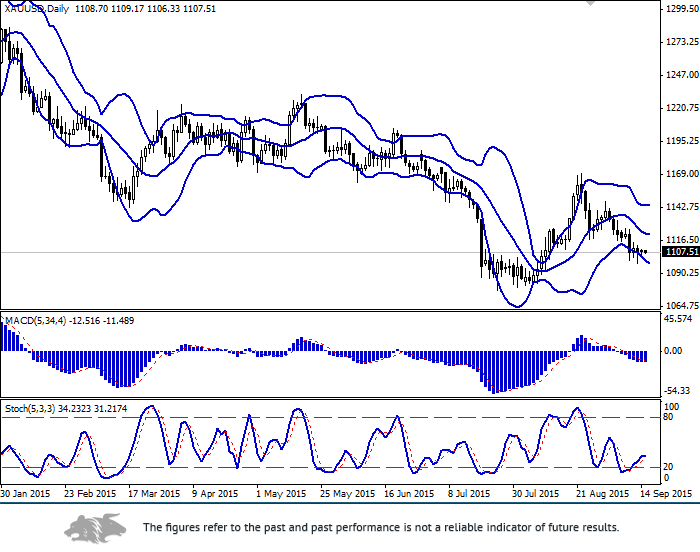

Bollinger Bands on the daily chart is trying to turn horizontally, while the price range is widening at the bottom. At the same time, the indicator recommends opening long positions during a correction, as the price has left the range. MACD is keeping a sell signal and trying to turn up. Stochastic is turning horizontally.

The indicators recommend waiting for a clear signal before opening new positions.

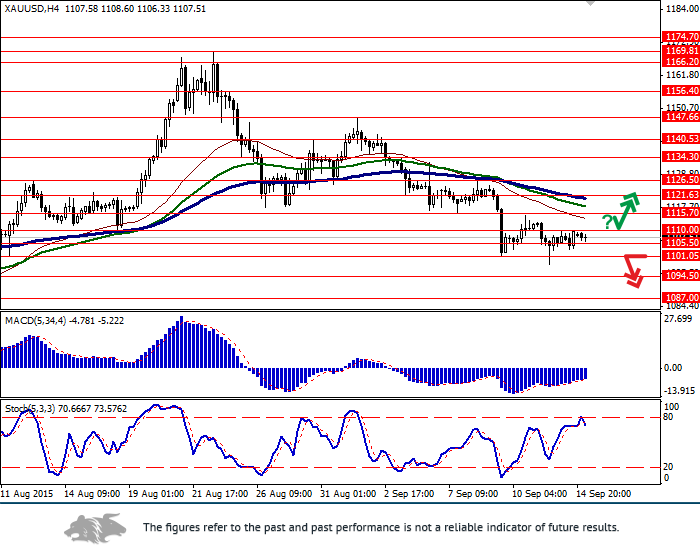

Support levels: 1105.50, 1101.05 (9 September local low), 1094.50, 1087.00.

Resistance levels: 1110.00, 1115.70, 1121.63, 1126.50 (near 8 September local high), 1134.30, 1140.53, 1147.66 (1 September high), 1156.40, 1166.20, 1169.91 (24 August high).

Trading tips

Long positions can be opened after the breakout and consolidation above the level of 1110.00 (with appropriate indicators signals) with targets at 1121.63, 1126.50 and stop-loss at 1101.05.

Short positions can be opened after the breakdown of the level of 1101.05 with the target at 1087.00 and stop-loss at 1110.00.